[William Peterson was the 2006 Schlarbaum laureate, and here is his acceptance speech, delivered October 8, 2005.] Gary Schlarbaum, I thank you for this award and high honor from your grand legacy in loving memory of a genius in our time, Ludwig von Mises (1881–1973). But let me say up front, fellow Miseseans, meet me, Mr. Serendipity, Bill Peterson, here by a fluke, a child of fickle fate. For frankly I had never heard of the famous Mises when I took his course for...

Read More »Teilt Binance Nutzerdaten mit Russland?

Reuters hat gegen Ende der Woche gemeldet, dass die weltweit größte Crypto-Börse Binance Nutzerdaten mit staatlichen russischen Instituten teilen würde. Laut Reuters wurden diese Daten vor allem vom russischen Sicherheitsdienst genutzt, um Kriminalität im eigenen Land zu bekämpfen. Doch Binance verneinte diese Anschuldigungen nun. Crypto News: Teilt Binance Nutzerdaten mit Russland?In einem konkreten Fall ging es um finanzielle Unterstützung des Kreml Kritikers...

Read More »AKA Part I

Thanks for all of those great questions you submitted! Make sure you follow us on Twitter, Facebook and LinkedIn and are subscribed to our YouTube Channel so you can submit question and check out all of our audio articles, media appearances, podcasts episodes and more. A Gold Mine of Show Notes Ukraine and inflation Famous Buyer and Seller Fallacy Monetary Metals fundamental gold price World Gold Council estimates on amount of gold mined The Dawn of Gold by Philip...

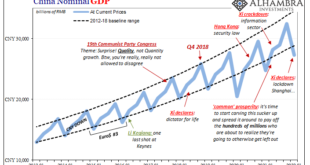

Read More »Shanghai’s Current Plight Began in 2017

The first chapters to China’s new story now playing out in Shanghai were written down in October 2017. Planning for them had begun years earlier, their author Xi Jinping requiring more research before committing them to paper. Communist authorities there had grown increasingly concerned about the lack of growth potential for its political system by then utterly dependent for a quarter-century on the economy growing. So long as other places around the world wanted...

Read More »To Fight Russia, Europe’s Regimes Risk Impoverishment and Recession for Europe

European politicians are eager to be seen as “doing something” to oppose the Russian regime following Moscow’s invasion of Ukraine. Most European regimes have wisely concluded—Polish and Baltic recklessness notwithstanding—that provoking a military conflict with nuclear-armed Russia is not a good idea. So, “doing something” consists primarily of trying to punish Moscow by cutting Europeans off from much-needed Russian oil and gas. The problem is this tactic doesn’t...

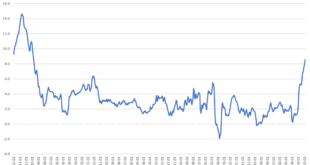

Read More »Real Wages Fall Again as Inflation Surges and the Fed Plays the Blame Game

Money printing may bring rising wages, but it also brings rising prices for goods and services. And those increases are outpacing the wage increases. Original Article: “Real Wages Fall Again as Inflation Surges and the Fed Plays the Blame Game” According to a new report released Wednesday by the US Bureau of Labor Statistics, the Consumer Price Index increased in March by 8.6 percent, measured year over year (YOY). This is the largest increase in more than forty...

Read More »Energy prices: government considers measures to help households

The issue of rising energy and fuel prices is ‘on the government’s radar’, according to Energy Minister Simonetta Sommaruga © Keystone / Christian Beutler The Swiss government has set up a working group to examine whether measures are needed to relieve the burden on households caused by rising energy prices. “[The government] is observing the development very closely in order to clarify whether support is needed to cushion hardship cases,” said Energy Minister...

Read More »Palestra Copywriting Bill Bonner e Mark Ford

Bill Bonner e Mark Ford

Read More »Swiss trade unions sound alarm about rising cost of living

Prices in Switzerland are on the rise, albeit less drastically than in the EU and the US. © Keystone / Christian Beutler Trade unions say middle- and lower-income workers in Switzerland are facing a “shock” in 2022, with wages unable to offset rising inflation and health insurance costs. With inflation currently over 2% in Switzerland, the cost of living is going up, and workers need a salary boost to offset this, said the country’s biggest trade union group on...

Read More »China, Japan, And The Relative Pre-March Euro$ Calm In February

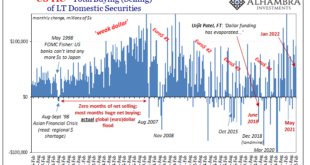

The month of February 2022, the calm before the latest storm. Russians went into Ukraine toward the month’s end, collateral shortage became scarcity, maybe a run right at February’s final day, and then serious escalations all throughout March – right down to pure US Treasury yield curve inversion. Given that setup, it was unsurprising to find Treasury’s February TIC data mostly unremarkable. Top to bottom, there wasn’t really much that changed. No huge negatives,...

Read More » SNB & CHF

SNB & CHF