Overview: Ahead of the much-anticipated speech by Federal Reserve Chair Powell, the Fed funds futures are pricing in about a 70% chance of a 75 bp hike next month. The US 10-year yield is up nearly five basis points today to 3.07% and the two-year yield is firm at 3.38%. Asia Pacific equities were mostly higher, with China the main exception among the large markets, after US equities rallied yesterday. Europe’s Stoxx 600 is off about 0.3% to bring this week’s...

Read More »Novartis job cuts to heavily impact management roles

Under construction: the new Novartis Pavilion in Basel. Keystone / Georgios Kefalas Of the 1,400 job cuts announced by the pharma giant in Switzerland, up to half of them will involve staff in leadership positions, the company said on Monday. For these executive roles, the consultation process has been finalised, and the first individuals concerned will be informed “in the coming weeks”, said the head of Novartis Switzerland Matthias Leuenberger at a media event in...

Read More »What’s Worse Than Inflation? Depression + Inflation

If “markets” controlled by the rich are allowed to distribute essentials, the result will be civil disorder and the overthrow of regimes. What’s worse than inflation? Depression + Inflation. And that’s where we’re heading. As I explained yesterday in The Fed Can’t Stop Supply-Side Inflation, central banks are trying to reduce inflation by crushing demand. This works in eras of abundance, but not in eras of scarcity in which supply constraints drive inflation. If the...

Read More »Number of businesses and jobs fell in 2020 for the first time since 2011

25.08.2022 – In 2020, the Swiss economy had almost 617 000 businesses and just under 5.3 million jobs. After uninterrupted growth since the start of the statistical series in 2011, the number of businesses and jobs has declined for the first time. Compared with 2019, around 900 fewer units and 33 000 fewer workplaces were recorded, a decline of 0.1% and 0.6% respectively. Food and beverage service activities and the accommodation sector were particularly affected,...

Read More »Ukraine beschlagnahmt Cryptocoin Wallets mit Verbindungen zu Russland

Schon beim Freedom Convoy in Kanada wurden Inhalte von Crypto-Wallets staatlich beschlagnahmt. Auf diversen Plattformen wurden Wallets blockiert und die darin befindlichen Cryptocoins konfisziert, sofern diese in Verbindung mit den regierungskritischen Protesten standen. In der Ukraine wird nun dieselbe Strategie verfolgt. Bitcoin News: Ukraine beschlagnahmt Cryptocoin Wallets mit Verbindungen zu RusslandIn der Ukraine sind es offenbar die Crypto-Plattformen selbst,...

Read More »Treasury Bills: Never Miss an Opportunity to Miss an Opportunity [Ep. 280, Eurodollar University]

The Treasury Bill is the most liquid capital market asset of the monetary system. Now the Federal Reserve's 'quantitative' 'tightening' could liquify the dehydrated system (making Bills market-available). But are they treating it as a monetary vulnerability that needs to be addressed? Pfft. ****EP. 279 REFERENCES**** The Bill for QT: http://www.marketsinsiderpro.com/ RealClear Markets Essays: https://bit.ly/38tL5a7 Epoch Times Columns: https://bit.ly/39ESkRf ****THE EPISODES****...

Read More »Dollar Longs Pared as Jackson Hole Gathering is set to Start

Overview: It seems that many market participants had the same thing in mind, cut dollar longs before the Jackson Hole gathering. The Antipodeans lead the majors move, encouraged perhaps by China’s new economic measures, with around a 1% gain. The euro and sterling are up about 0.35% and are the laggards. Emerging market currencies are higher as well, with the notable exception of India and Turkey, which are nursing small losses. Equities are having a good day. All...

Read More »Zurich airport bounces back to profit after pandemic

Retail and hospitality infrastructure helped drive revenues at Zurich airport. © Keystone / Christian Beutler Switzerland’s busiest airport has posted a CHF55 million ($57 million) net profit for the first six months of the year as post-pandemic air travel picks up. By comparison, Zurich airport made a CHF45 million loss in the corresponding period of 2021, but the newly reported profits still fall well short of the CHF143 million booked in the first six months of...

Read More »Switzerland banks on hydropower reserve to combat energy crunch

Hydropower accounts for around 60% of total Swiss electricity production. Keystone / Gian Ehrenzeller The Swiss Federal Electricity Commission (Elcom) has laid out plans to hold back hydropower reserves to help compensate for anticipated energy shortages this winter. Elcom wants hydropower operators to hold back up to 666 gigawatt hours of electricity that would normally be sold on the open market. That’s enough to power 150,000 households for a year. The reserves...

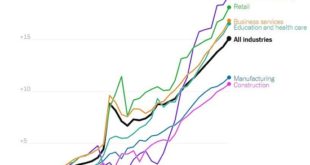

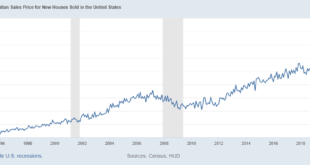

Read More »Rate Hikes Are Working

New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%. Obviously, the fall this year is related to rising mortgage rates but that can’t be the reason sales have been falling for nearly two years....

Read More » SNB & CHF

SNB & CHF