Last weekend, when we reported that Germany’s Raiffeisenbank Gmund am Tegernsee – a community bank in southern Germany – said it would start charging retail clients a fee of 0.4% on deposits of more than €100,000 we said that “now that a German banks has finally breached the retail depositor NIRP barrier, expect many more banks to follow.” Not even a week later, not one but two large banks have done just that....

Read More »The World’s Dominant Gold Refineries

There are many precious metals refineries throughout the world, some local to their domestic markets, and some international, even global in scale. Many but by no means all of these refineries are on the Good Delivery Lists of gold and/or silver. These lists are maintained by the London Bullion Market Association (LBMA) and they identify accredited refineries of large (wholesale) gold and silver bars that continue to...

Read More »Emerging Markets: What has Changed

China unveiled a second equity link that will allow foreign investors to buy local stocks with fewer restrictions. Saudi Arabia will allow qualified foreign investors to subscribe to local IPOs starting this January. South Africa’s two main opposition parties agreed to informally band together in local governments. The Brazilian central bank decreased the daily intervention amount to 10,000 reverse swap contracts...

Read More »Swiss market lower this week as US stocks reach new record highs

SMI The Swiss Market Index is set to close lower this week underperforming global equities as US stocks reached new record highs and emerging markets outperformed on a weaker dollar. Click to enlarge. Oil also made further gains this week as investors bet that talks between OPEC members and other producers may result in action to stabilise the market in the coming weeks. Click to enlarge. Japan The week began with...

Read More »Toward Stagflation

Norway Real House Price Per M2 We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades. The road toward such outsized gains in property is not paved...

Read More »Gold and Silver Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Famous Buffett Quote The prices of the metals didn’t change much this week. We thought we would take this opportunity to quote Warren Buffet. A comment he made at Harvard in 1998 earned him the scorn of the gold community. “Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another...

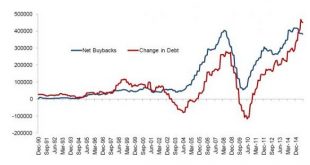

Read More »What the Fed Hasn’t Fixed (and Actually Made Worse)

The Fed has not only failed to fix what’s broken in the U.S. economy–it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don’t hurt yourself patting your own backs, Fed governors past and present: it’s bad enough that the Fed can’t fix the economy’s real problems–its policies actively make them...

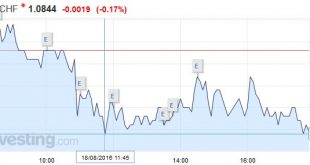

Read More »FX Daily, August 18: US Dollar Pushed Lower, but Do FOMC Minutes Really Trump Dudley?

Swiss Franc A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. Click to enlarge. FX Rates It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting. The...

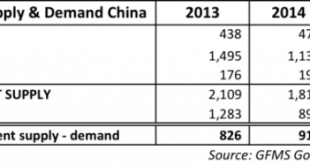

Read More »Spectacular Chinese Gold Demand Fully Denied By GFMS And Mainstream Media

Submitted by Koos Jansen of BullionStar In the Gold Survey 2016 report by GFMS that covers the global gold market for calendar year 2015 Chinese gold consumption was assessed at 867 tonnes. As Chinese wholesale demand, measured by withdrawals from Shanghai Gold Exchange designated vaults, accounted for 2,596 tonnes in 2015 the difference reached an extraordinary peak for the year. In an attempt to explain the 1,729...

Read More »Swiss theatre group makes waves

The Swiss theatre group, Karls Kühne Gassenschau, is still managing to pull the crowds, after 32 years in the business. It's latest show predicts a dark future, but the story is told with high dives, punk rock and gags. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or...

Read More » SNB & CHF

SNB & CHF