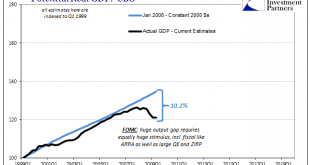

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great...

Read More »FX Weekly Review, February 13 – 18: Why still long the dollar?

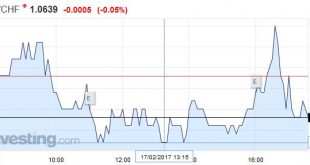

Swiss Franc Currency Index The Swiss Franc index was mostly unchanged against the U.S. Dollar Index in the last week. One word about Marc Chandler’s argumentation below: Three types of investors are long the dollar: FX investors/speculators are long the dollar because of the difference in monetary policy (e.g. higher US rates). Cash investors, for example rich people from China and other Emerging Markets, currently...

Read More »If It Didn’t Abandon The Gold Standard, U.S. Empire Would Have Collapsed…

The U.S. will never go back on a gold standard. The notion that a U.S. Dollar backed by gold would solve our financial problems is pure folly. Why? Because, if the U.S. Empire didn’t abandon the gold standard in 1971, it would have collapsed decades ago. Unfortunately, some of the top experts in the precious metals community continue to suggest that revaluing gold much higher, to say…. $15,000-$50,000 an ounce, would...

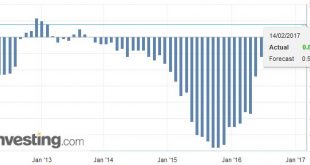

Read More »Swiss Producer and Import Price Index in January 2017: +0.4 percent

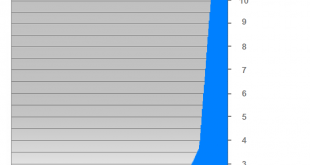

The Producer Price Index (PPI) or officially named "Producer and Import Price Index" describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »The Consensus Narrative does not Appreciate the Resilience of the System

Summary: The system of checks and balances is working. Populism-nationalism is not sweeping across the world. Even in US and UK, populist agenda was appropriated by the main-center right party. The attack on the body politics is activating the immune system in ways that the consensus narrative does not recognize. The high level of anxiety among investors is masked by the rise of equities. As political issues...

Read More »Emerging Markets: What has Changed

Summary Head of Samsung Group Jay Y. Lee was formally arrested on allegations of bribery, perjury, and embezzlement. The assassination of Kim Jong Un’s half-brother suggests the political situation in North Korea may be heating up. The Polish central bank is tilting more hawkish. The Turkish central bank said it will allow domestic companies to use liras to repay export loans. Nigerian President Buhari may...

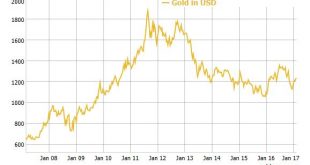

Read More »Gold Is Undervalued Say Leading Money Managers

Gold is undervalued according to a record number of fund managers Last time gold was considered undervalued, the price surged BAML surveyed 175 money managers with $543 billion in assets under management 34% of investors believe protectionism is the biggest threat to markets Gold viewed as the best protectionist investment by a third of investors Gold in USD – 10 Years - Click to enlarge For the third time in a...

Read More »Why Aren’t Oil Prices $50 Ahead?

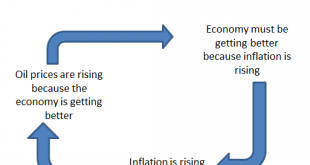

Right now there are two conventional propositions behind the “reflation” trade, and in many ways both are highly related if not fully intertwined. The first is that interest rates have nowhere to go but up. The Fed is raising rates again and seems more confident in doing more this year than it wanted to last year. With nominal rates already rising in the last half of 2016, and with more (surveyed) optimism than even...

Read More »FX Daily, February 17: Greenback Stabilizes Ahead of the Weekend

Swiss Franc EUR/CHF - Euro Swiss Franc, February 17(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is finishing the week on a steady to firmer note against the major currencies but the Japanese yen. The softer yields and weaker equity markets often are associated with a stronger yen. For the week as a whole, the dollar is mostly lower, though net-net it has held its own against sterling,...

Read More »Uncertainty and concern follow voter rejection of Switzerland’s company tax reform

Speaking to Tribune de Genève, Serge Dal Busco, Geneva’s minister of finance, voiced his concerns about last Sunday’s rejection of Switzerland’s planned company tax reform. At the same time he remains optimistic about the chances of a new federal corporate tax reform project. His biggest concern is that Bern might backtrack on its promise to help the cantons replace the lost tax revenue created by lowering standard tax...

Read More » SNB & CHF

SNB & CHF