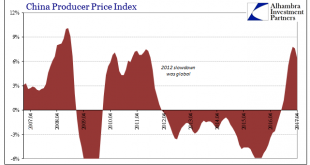

We can add China to the list of locations where the near euphoria about inflation rates is rapidly falling apart. This is an important blow, as the Chinese economy has been counted on to lead the world out of this slump if through nothing other than its own sheer recklessness. “Stimulus” was all the rage one year ago, and for a time it seemed to be producing all the right effects. This was “reflation”, after all....

Read More »How to Stick It to Your Banker, the Federal Reserve, and the Whole Doggone Fiat Money System

Bernanke Redux Somehow, former Federal Reserve Chairman Ben Bernanke found time from his busy hedge fund advisory duties last week to tell his ex-employer how to do its job. Namely, he recommended to his former cohorts at the Fed how much they should reduce the Fed’s balance sheet by. In other words, he told them how to go about cleaning up his mess. Praise the Lord! The Hero is back to tell us what to do! Why, oh...

Read More »Swiss National Bank releases updated banknote app

Discover new 20 and 50-franc notes on mobile devices The Swiss National Bank (SNB) is releasing an app for mobile devices, designed to help the public familiarise themselves with the new banknotes. The app – an updated version of the ‘50-franc’ app launched last year to accompany the issue of the new 50-franc note – is now called ‘Swiss Banknotes’ and can be downloaded free of charge from the Apple (itunes.apple.com)...

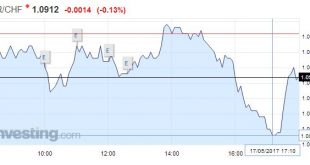

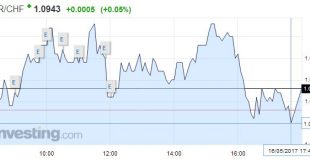

Read More »FX Daily, May 17: Drama In Washington Adds To Dollar Woes

Swiss Franc EUR/CHF - Euro Swiss Franc, May 17(see more posts on EUR/CHF, ). GBP/CHF Inflation data weakens Sterling. Yesterday saw the release of Consumer Price Index (CPI) data. CPI is a measure of inflation and yesterday we saw a rise from 2.3% to 2.7% month on month. Usually a rise in inflation is deemed as good for an economy, but on this occasion it is a worrying sign. The rapid rise is a direct result of the...

Read More »Cool Video: Oil, US Inflation

I was on Bloomberg’s Day Break with the team and guest Anne Lester from JP Morgan discussing oil and inflation. Oil prices had bounced back at the end of last week and were lifted further on news that Saudi Arabia and Russia were inclined to support extending output cuts not just until the end of the year, but through Q1 18. I make two points. First, that US yields seem to be largely decoupled from the oil prices. This...

Read More »Swiss export products banned as toxic at home

UN experts estimate pesticides cause 200,000 deaths a year, 99% of which occur in developing countries (Keystone) In the wake of a Chinese takeover of the Swiss agribusiness group Syngenta, a Swiss advocacy group raises concerns about Switzerland’s regulatory role. Switzerland exports two powerful herbicides, atrazine and paraquat, to developing countries. However, these products, manufactured by Basel giant Syngenta,...

Read More »Rising Oil Prices Don’t Cause Inflation

Correlation vs. Causation A very good visual correlation between the yearly percentage change in the consumer price index (CPI) and the yearly percentage change in the price of oil seems to provide support to the popular thinking that future changes in price inflation in the US are likely to be set by the yearly growth rate in the price of oil (see first chart below). Gushing forth… a Union Oil Co. oil well sometime...

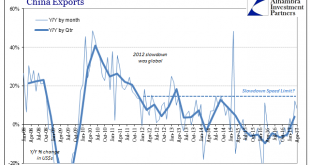

Read More »Lackluster Trade, China April Edition

China’s trade statistics for April 2017 uniformly disappointed. They only did so, however, because expectations are being calibrated as if the current economy is actually different. It is instead merely swinging between bouts of contraction and low-grade growth, but so low-grade it really doesn’t qualify as growth. Positive numbers do get the mind racing, but since the end of 2011 there is almost a speed limit on how...

Read More »Charles Hugh Smith On How Financial Repression Is Affecting Millennial Generation Values

Today’s topic is the millennial generation and how financial repression has resulted in asset bubbles that ultimately have affected the millennials in terms of their values and how they view the economy and life. As well as what they’re facing in terms of the housing market and the job situation. Click here for the full summary with all the supporting graphs/charts: http://financialrepressionauthority.com/2017/05/13/charles-hugh-smith-millennial-housing-summary/

Read More »FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

Swiss Franc EUR/CHF - Euro Swiss Franc, May 16(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday’s activity. It appeared to have been trying to stabilize yesterday in the North American session. News that President Trump may have shared...

Read More » SNB & CHF

SNB & CHF