Economic forecasts by the Federal Government’s Expert Group – autumn 2017* – Because of the weak performance in the first half of the year, the Federal Government’s Expert Group anticipates only moderate GDP growth of 0.9% in 2017. Over the coming quarters, though, solid momentum in the global economy is set to support the export sector, while the domestic sector is also expected to gather pace. Sizeable GDP growth of 2.0% is therefore expected for 2018. Accelerating growth will bring a marked increase in employment and a further decline in the unemployment rate. Positive and negative risks to the outlook are more balanced than in previous quarters. International economy The Swiss economy is only gradually

Topics:

SECO considers the following as important: Featured, newsletter, Swiss, Swiss economy, Swiss Macro, Switzerland SECO Forecast

This could be interesting, too:

investrends.ch writes Lufthansa will zentralisieren – Swiss betont ihre Stärke

investrends.ch writes Swiss erwartet weiteren Druck auf den Gewinn

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Economic forecasts by the Federal Government’s Expert Group – autumn 2017* – Because of the weak performance in the first half of the year, the Federal Government’s Expert Group anticipates only moderate GDP growth of 0.9% in 2017. Over the coming quarters, though, solid momentum in the global economy is set to support the export sector, while the domestic sector is also expected to gather pace. Sizeable GDP growth of 2.0% is therefore expected for 2018. Accelerating growth will bring a marked increase in employment and a further decline in the unemployment rate. Positive and negative risks to the outlook are more balanced than in previous quarters.

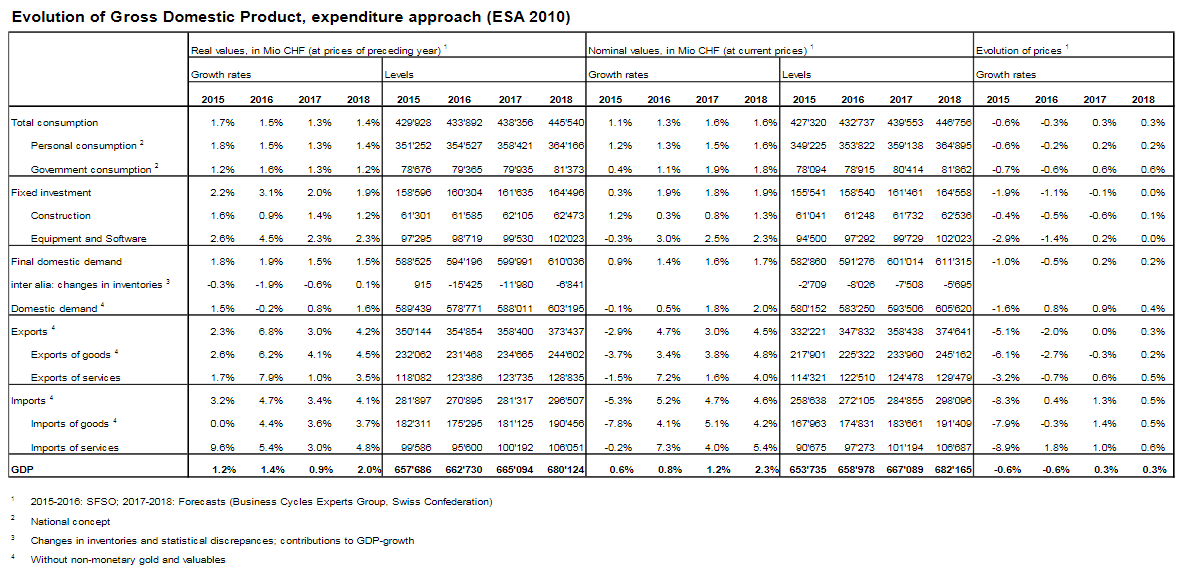

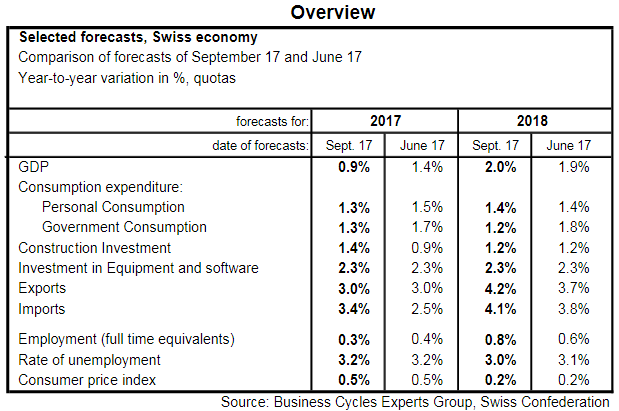

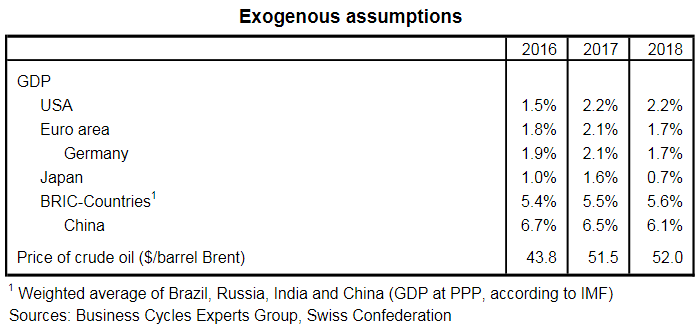

International economyThe Swiss economy is only gradually resuming a stronger growth trajectory. In the first half of 2017, GDP growth fell again short of expectations, following even a slight decrease in the final quarter of 2016. Although in both manufacturing and the hotel and catering industry the recovery from the slump of the last few years continued, this recovery was offset by sluggish growth in most other service sectors. The downturn in GDP growth at the turn of 2017 was further exacerbated by a special effect of the “entertainment and other services” sector, which pushes down the revised GDP figures at the turn of the year.** Aside from this, GDP figures still indicate that the Swiss economy is continuing its moderate recovery. The Federal Government’s Expert Group is lowering its GDP forecast for 2017 from 1.4% (June forecast) to 0.9% due to the mentioned base effect and the unexpectedly soft 2nd quarter of 2017. Leading indicators (consumer sentiment, PMI for the service sector and industry, and the KOF barometer) still point to a marked acceleration in growth in the near future, underpinned in particular by the solid momentum of the global economy: the major industrial countries (in particular the USA and the eurozone including Germany) and most emerging markets (especially China) have posted robust growth recently, and world trade has continued to rise. With slightly better growth prospects for the global economy compared to the previous forecast, the Expert Group expects economic activity in Switzerland to gather pace over the coming quarters, anticipating solid GDP growth of 2.0% in 2018 (June forecast: 1.9%). The Swiss export sector is benefiting from the healthy global economy, and will do so all the more if the Swiss franc, which has depreciated in the summer, maintains its new level. A moderate yet broad-based upward trend in exports is expected in the forecast period: in addition to the chemical and pharmaceutical industry, the machinery, electronics and metal industry as well as the watch industry and the tourism sector are also set to contribute a greater share to export growth. Consequently, the trade balance is expected to contribute positively to GDP growth over both forecast years. |

Comparison of Forecasts of September 17 and June 17 Source: news.admin.ch - Click to enlarge |

Economic situation and forecasts for SwitzerlandDomestic demand is also expected to gain momentum. Private consumption looks set to achieve moderate growth, as sustained population growth and a recovering job market (see below) counteract the adverse effect of muted real wage growth. While government consumption will grow at rates slightly below-average, investment in equipment could gather considerable pace in view of the brighter global economic conditions and the recent increase in capacity utilisation. With interest rates low, investment in construction is also expected to ac-celerate to a certain extent. |

Source: news.admin.ch - Click to enlarge |

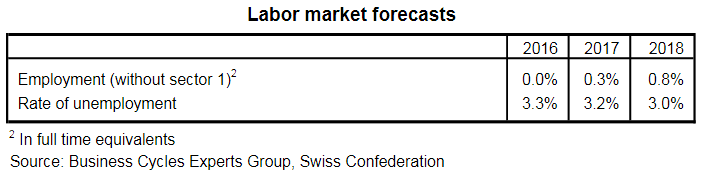

| Thanks to rising GDP growth, prospects on the job market will improve during the forecast period. The Expert Group forecasts a marked increase in employment following several quarters of very sluggish growth, anticipating a 0.3% rise in employment for 2017 which will step up further to 0.8% in 2018. At the same time, unemployment is set to decline further, with an anticipated unemployment rate of 3.2% for 2017 and 3.0% for 2018 (annual average in each case).

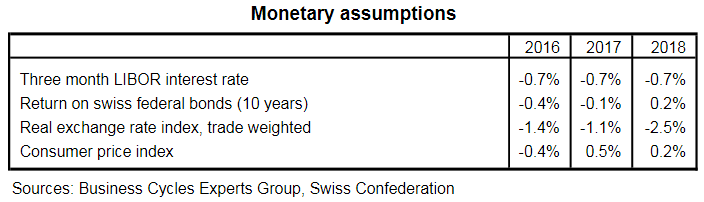

Inflation normalises in 2017, helped by the higher oil price, reaching an anticipated annual average of 0.5%. In 2018, the most recent drop in the reference interest rate will put down-ward pressure on rents, reducing inflation to 0.2%. |

|

Economic risksFor the global economic outlook, risks have become more balanced over the past few months. With leading indicators at elevated levels, global growth could prove more robust than projected in the forecast, which in turn would give the Swiss economy a further boost. What is more, the risks associated with government debt and the banking system in Europe (particularly in Italy) have decreased in the short term thanks to the economic recovery. By contrast, there is still a significant degree of uncertainty related to international politics. The implementation of the Brexit decision and the potential economic consequences remain unclear, while the various protectionist measures being announced could restrain global trade and thus harm Switzerland’s export industry. An escalation in the conflict surrounding North Korea would imply substantial disruptions of the economic recovery. For the domestic economy, there are also various economic risks. In the light of rising vacancy rates, ongoing robust construction investment could possibly result in a marked downturn in the construction sector. With various structural developments under way, there is also a risk that growth in the Swiss services sector could prove weaker than expected, for instance in the trade and finance sectors, which would restrict the domestic economy. If the international risks mentioned were to escalate, this could push the Swiss franc up further and at least partially reverse the global economy’s positive impact on the export sector. *The Federal Government’s Expert Group publishes its forecasts for Switzerland’s economic development four times a year. More detailed information can be found in the quarterly publication “Konjunkturtendenzen” (Economic Trends), which is available online (www.seco.admin.ch/konjunkturtendenzen) and in printed form as a supplement to the political economics magazine “Die Volkswirtschaft” (www.dievolkswirtschaft.ch). |

Source: news.admin.ch - Click to enlarge |

Tags: Featured,newsletter,swiss,Swiss economy,Switzerland SECO Forecast