Links between parliamentarians in Bern and lobby groups have grown steadily in recent years, according to a study by the Universities of Lausanne and Geneva. Between 2007 and 2015, these sorts of ties between interest groups and politicians increased by 20%. Links between parliamentarians and interest groups grew by 20% between 2007 and 2015. - Click to enlarge The academic research, featured in Swiss newspaper Le...

Read More »New Gold Pool at the BIS Basle, Switzerland: Part 1

“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.” 13 December 1979 – Kit McMahon to Gordon Richardson, Bank of England Introduction A central bank Gold Pool which many people will be familiar with operated in the...

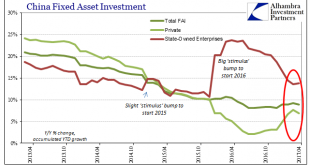

Read More »Trying To Reconcile Accounts; China

Chinese economic data for April 2017 has been uniformly disappointing. External trade numbers resembled too much commodity prices, leaving an emphasis on them rather than actual economic forces. The latest figures for the Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment, unfortunately also remained true to the pattern. Industrial Production had seemingly accelerated in March, rising to a 7.6%...

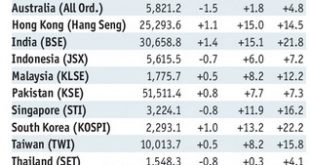

Read More »“Sell in May”: Good Advice – But Is There a Better Way?

Selling in May, With Precision If you “sell in May and go away”, you are definitely on the right side of the trend from a statistical perspective: While gains were achieved in the summer months in three of the eleven largest stock markets in the world, they amounted to less than one percent on average. In six countries stocks even exhibited losses! Only in two countries would an investment represent an interesting...

Read More »Emerging Markets: What Has Changed

Summary China’s government approved the creation of a bond link between Hong Kong and the mainland. S&P upgraded Indonesia one notch to investment grade BBB- with stable. Fitch revised the outlook on Vietnam’s BB- rating from stable to positive. Egypt will announce a package of social spending soon. Moody’s changed the outlook on Poland’s A2 rating from negative to stable. Brazil press reported that meat-packing...

Read More »6 Swiss regions in Europe’s 10 most prosperous

Zurich – © Europhotos | Dreamstime.com Six Swiss regions make the top ten most prosperous regions of Europe measured in terms of GDP per person, according to an analysis by the University of Lausanne. The six Swiss regions are Zurich (3rd), Ticino (4th), Basel (5th), the region around Zug (6th), Bern-Solothurn (7th) and Suisse romande, Switzerland French-speaking region (8th). The only regions ranked higher were...

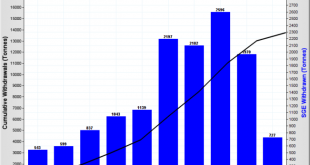

Read More »An update on SGE Vault Withdrawals and SGE Price Premiums

In 2016, withdrawals of gold from the Shanghai Gold Exchange totalled 1970 tonnes, the 4th highest annual total on record. This was 24% less than SGE gold withdrawals recorded in 2015, which reached a cumulative 2596 tonnes (See Koos Jansen’s 6 January 2017 blog at BullionStar “How The West Has Been Selling Gold Into A Black Hole” for more details of the 2016 withdrawals). SGE gold withdrawals are an important metric...

Read More »Markozy, Merde, and now Meron

Second, and ultimately, Maron’s success will depend on his ability to revive the French economy. The French economy has been a lagged for several years. The unemployment rate is near 10%, more than twice the UK and US rate. The German unemployment rate is below 6%, and the lowest since unification. Macron will likely emphasize labor market reforms and tax cuts. France Unemployment Rate, Q1 2017(see more posts on...

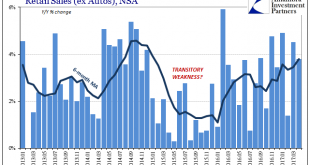

Read More »Reasonable Retail (Therefore Consumer) Expectations

Retail sales estimates are not adjusted for inflation, but even so whenever they get down toward the 3% growth level you can be sure there is serious economic trouble. The 6-month average for overall retail sales dropped below 3% in March 2001, the month that marked the start of the official dot-com recession (though that is not the official name for the cyclical peak, it probably should be). They would remain near or...

Read More »FX Daily, May 19: Markets Trying to Stabilize Ahead of Weekend

Judging from investors’ reactions, the only thing worse that than the low volatility environment is when volatility spikes higher, as it did yesterday. Higher volatility is associated with weakening equity markets, falling interest rates, pressure on emerging markets, a strengthening yen and, sometimes, as was the case yesterday, heavier gold prices. A fragile stability has enveloped the markets after US equities...

Read More » SNB & CHF

SNB & CHF