Happy 2nd Birthday Bail-in Tool! We Suggest Gold As The Perfect Gift – Two years since bail-in rules officially entered EU regulations– EU bail-in rules have wiped out billions for savers and and businesses, with more at risk– Future of many failing banks now rests on depositors who may no longer be protected by deposit insurance– Physical gold enables savers to stay out of banking system and reduce exposure to...

Read More »Industrial production: The Chinese Appear To Be Rushed

While the Western world was off for Christmas and New Year’s, the Chinese appeared to have taken advantage of what was a pretty clear buildup of “dollars” in Hong Kong. Going back to early November, HKD had resumed its downward trend indicative of (strained) funding moving again in that direction (if it was more normal funding, HKD wouldn’t move let alone as much as it has). China’s currency, however, was curiously...

Read More »Several Simple Suppositions and Suspicions for 2018

A New Year of Symbiotic Disharmony The New Year is nearly here. The slate’s been wiped clean. New hopes, new dreams, and new fantasies, are all within reach. Today is the day to make a double-fisted grab for them. Without question, 2018 will be the year in which everything happens exactly as it should. Some things you will be able to control, others will be well beyond your control. Certainly, your ability to stop...

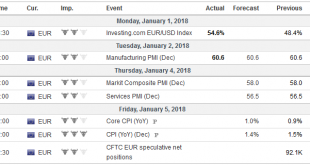

Read More »FX Daily, January 03: Dollar Stabilizes, but Sees Little Recovery

Swiss Franc The Euro has risen by 0.37% to 1.1755 CHF. EUR/CHF and USD/CHF, January 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is stabilizing but the tone remains fragile. The euro, which has advanced for five consecutive sessions coming into today is slightly lower. The euro had stalled yesterday as it approached last year’s high set in September...

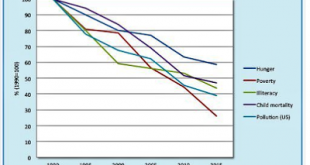

Read More »Great Graphic: Progress

The world looks like a mess. While the economy appears to be doing better, disparity of wealth and income has grown. Debt levels are rising. Protectionism appears on the rise. Global flash points, like Korea, Middle East, Pakistan, Venezuela are unaddressed. At the same time, this Great Graphic tweeted by @DinaPomeranz, with a hat tip to @bill_easterly is a helpful corrective. The clear decline in hunger, poverty,...

Read More »Great Graphic: Progress

The world looks like a mess. While the economy appears to be doing better, disparity of wealth and income has grown. Debt levels are rising. Protectionism appears on the rise. Global flash points, like Korea, Middle East, Pakistan, Venezuela are unaddressed. At the same time, this Great Graphic tweeted by @DinaPomeranz, with a hat tip to @bill_easterly is a helpful corrective. The clear decline in hunger, poverty,...

Read More »Digitalisation will reverse offshoring trends, says ABB head

Are robots replacing jobs or helping to bring them back home? (Keystone) - Click to enlarge Thanks to advances in robotics and digitalisation, the trend towards the offshoring of manufacturing jobs to cheaper countries is set to be reversed, according to the president of Zurich-based industry giant ABB group. In an interview published Sunday in the NZZ am Sonntag newspaper, Peter Voser said that digital...

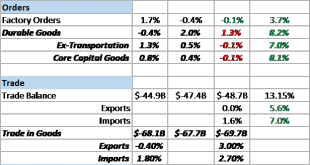

Read More »Bi-Weekly Economic Review: Housing Market Accelerates

The economy ended 2017 with current growth just slightly above trend. In general the reports of the last two weeks of the year were pretty good with housing a standout performer going into the new year. We are still trying to get past the impact – positive and negative – from the hurricanes a few months ago though so it is probably prudent to wait for more evidence before making any definitive pronouncements about the...

Read More »98,750,067,000,000 Reasons to Buy Gold in 2018

98,750,067,000,000 Reasons to Buy Gold in 2018 – World equity index market capitalization touching distance of $100 trillion dollars at beginning of December – Key indicators across global financial markets are looking decidedly bubble-like – Little indication that we are through the worst of the financial crisis that started in 2007 – Apparent lack of concern regarding the over-heated and overpriced markets – Since...

Read More »The Past is Not Passed: 2017 Spills into 2018

The New Year may have begun in fact, but in practice, full participation may return only after the release of US employment data on January 5. The macroeconomic and policy tables have been set, though interpolating from the Overnight Index Swaps market, there is 45% chance the Bank of Canada hikes rates at its policy meeting near the middle of the month. In the currency markets, sentiment appears to be as uniformly...

Read More » SNB & CHF

SNB & CHF