USD/CHF The USDCHF pair shows some bullish bias to approach retesting the previously broken support that turns into key resistance now at 0.9418, noticing that stochastic loses its bullish momentum clearly to reach the overbought areas, while the EMA50 forms continuous negative pressure against the price. Therefore, our bearish overview will remain active for today unless breaching 0.9418 level and holding above it,...

Read More »Swiss continue to rent rather than buy houses

Some 59% of Swiss households were rentals in 2015, according to the most recent figures. The average monthly rent across the country came in at just over CHF1,300 ($1,395). The numbers were released on Monday by the Federal Statistical Office and reflect the situation at the end of 2015, when 2.1 million rented accommodations were recorded. The regions with the highest proportion of renting were the urban cantons of...

Read More »Bi-Weekly Economic Review: Markets At Extremes

Economic Reports Production Production ended the year on a strong note but early readings from January are not as positive. The December industrial production report headline was strong at a 0.9% gain but a lot of that strength was in the mining (oil drilling) and utility sectors. Mining has actually led the way the last year as rig count has risen with drilling activity. I’d love to see our economy less dependent on...

Read More »FX Daily, January 29: A Brief Word

Swiss Franc The Euro has fallen by 0.33% to 1.1559 CHF. EUR/CHF and USD/CHF, January 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is modestly firmer, but nothing to suggest a outright correction rather than consolidation. However, have a dramatic drop over the past month, much more than we think is justified by macroeconomic developments and interest...

Read More »Swiss fact: nearly half of Swiss rental properties owned by individuals

If you rent a home in Switzerland it is more likely to belong to an individual than a big real estate company or pension fund. © Kevkhiev Yury | Dreamstime.com - Click to enlarge In 2017, 49% of residential rental properties in Switzerland were owned by individuals, according to Statistics published by the Swiss Federal Statistical Office. The highest rate of rental home ownership by individuals was in the...

Read More »Silver Bullion: Once and Future Money

Silver Bullion: Once and Future Money – “Silver is as much a monetary metal as gold” – Rickards – U.S. following footsteps of Roman Empire which collapsed due to currency debasement (must see table) – Silver bullion is set to rally due to a combination of supply/demand fundamentals, geopolitical pressures creating safe haven demand, and increasing inflation expectations as confidence in central banking and fiat money...

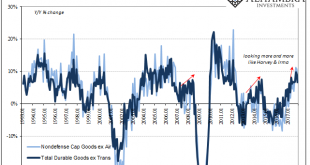

Read More »December Durable Goods

Durable and capital goods orders and shipments all increased in December by growth rates consistent with those registered in the months leading up to the big storms Harvey and Irma. We continue to find evidence that accelerated growth in October and November was nothing more than the anticipated after-effects cleaning up after those hurricanes. New orders for durable goods (excluding transportation orders) had...

Read More »FX Weekly Preview: Market Confusion and New Inputs

Many investors are confused, and the official communication only fanned the confusion. Before turning to next week’s key events and data, let’s first spend some time, working through some of the confusion. There was no change in policy last week. The US did not suddenly become protectionist. It did put tariffs on solar panels and washing machines. At the end of last week, unexpectedly the US International Trade...

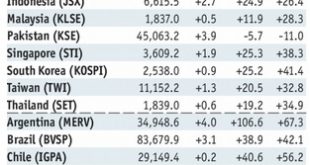

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX closed Friday on a mixed note, but still posted solid gains for the week as a whole. Best performers last week were ZAR, PLN, and CZK while the worst were ARS, PHP, and IDR. The bearish dollar environment remains intact and so we see further gains for EM FX this week. However, we continue to warn that divergences within EM are likely to assert themselves. Stock Markets Emerging Markets, January 27...

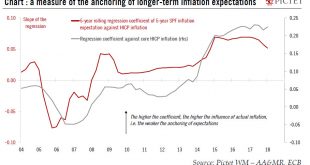

Read More »Europe chart of the week – The beginning of the ‘re-anchoring’

Professional Forecasters survey shows a substantial improvement in economic growth and employment, consistent with the ECB’s own assessment. The ECB will be pleased by its latest Survey of Professional Forecasters (SPF). The headlines are unambiguously positive, fuelled by the uninterrupted improvement in economic data, with expectations of GDP growth and HICP inflation revised higher for the next couple of years,...

Read More » SNB & CHF

SNB & CHF