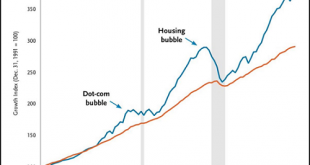

The illusion that risk can be limited delivered three asset bubbles in less than 20 years. Has anything actually changed in the past two weeks? The conventional bullish answer is no, nothing’s changed; the global economy is growing virtually everywhere, inflation is near-zero, credit is abundant, commodities will remain cheap for the foreseeable future, assets are not in bubbles, and the global financial system is in a...

Read More »Seasonality of Individual Stocks – an Update

Well Known Seasonal Trends Readers are very likely aware of the “Halloween effect” or the Santa Claus rally. The former term refers to the fact that stocks on average tend to perform significantly worse in the summer months than in the winter months, the latter term describes the typically very strong advance in stocks just before the turn of the year. Both phenomena apply to the broad stock market, this is to say, to...

Read More »SNB-Jordan verkündet Kommunistisches – und lädt zum Gratis-Buffet

- Click to enlarge Es geht um die Sache und Institution – nicht um eine Person. Die Schweizerische Nationalbank (SNB) und ihr Chef Thomas Jordan sind aber mittlerweile dermassen eng miteinander verflochten, dass eine getrennte Beurteilung gar nicht mehr möglich ist. Thomas Jordan ist zum Gesicht der SNB und diese eine „One-Man-Show“ geworden. Man kann Thomas Jordan sogar zum Gesicht der Schweiz erküren. Er...

Read More »Europe chart of the week – Italian productivity

With less than 30 days to go, the Italian general election remains highly unpredictable. The new electoral system and the fact that 37% of seats are to be allocated on a ‘first-past-the-post’ system make projecting seats from voting intentions particularly hard. Importantly, Italy is going into this election with an economy that is performing relatively strongly relative to recent history. However, cyclical strength is...

Read More »FX Daily, February 14: Investors Remain Uneasy even as Equities Stabilize

Swiss Franc The Euro has fallen by 0.08% to 1.1533 CHF. EUR/CHF and USD/CHF, February 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There is an unease that continues to hang over the market. It is as if a shoe fell last week, and most investors seem to be waiting for the other shoe to drop. It is hard to imagine the kind of body blow that the equities took last week...

Read More »Great Graphic: Stocks and Bonds

Summary: The relationship between stocks and bonds does not appear to have changed much. It is difficult to eyeball correlations. Question the meaning of a chart that has two time series and two scales and. This Great Graphic comes from Bloomberg. It is a more complicated look at the relationship between the US stocks and bonds. In particular, we are looking at the S&P 500 and the 10-year US generic...

Read More »Swiss businesses in China upbeat after record export year

Swiss Centers China is a non-profit organisation aimed at lowering market entry barriers of Swiss companies in Asia. (GFAC) - Click to enlarge According to a survey, 72% of Swiss business leaders in China expect “higher” or “substantially higher” sales of goods from Switzerland to China and Hong Kong in 2018 than in 2017, when exports reached a record CHF16.7 billion ($17.9 billion). Just 5% of business...

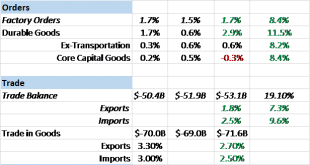

Read More »Bi-Weekly Economic Review

Economic Reports Economic Growth & Income Personal income for December was better than expected at up 0.4% on the month and 4.11% year over year. Wages and salaries were up 0.5%. Unfortunately, that rate of rise is not even up to the lower end of the range we’ve seen in past expansions when 5% income growth was a precursor to recession. Still, it is, sadly, about average for this expansion. Two items in this...

Read More »Currency swap agreement between the Swiss National Bank and the Bank of Korea

- Click to enlarge The Swiss National Bank (SNB) and the Bank of Korea (BOK) will enter into a bilateral swap agreement. The agreement will be signed on 20 February 2018 in Zurich by the Chairman of the SNB Governing Board, Thomas Jordan, and the Governor of the BOK, Juyeol Lee. The swap agreement enables Korean won and Swiss francs to be purchased and repurchased between the two central banks, up to a limit of KRW...

Read More »Switzerland: inflation edged lower in January

According to the Swiss Federal Statistical Office (FSO), the headline consumer price index (CPI) inflation eased to 0.7% y-o-y in January from 0.8% y-o-y in December, in line with consensus and our own expectations. Core inflation (CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) also eased, from 0.7 % y-o-y in December to 0.5% y-o-y in January (see Chart 1), back to the level of October...

Read More » SNB & CHF

SNB & CHF