U.S. withdraws from Iran nuclear deal

Oil jumps past $70

Argentina hikes interest rates to 40%

S. 10 year disparity

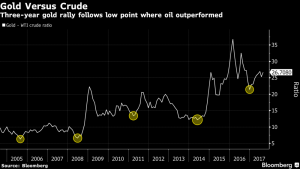

Western buying returns to gold

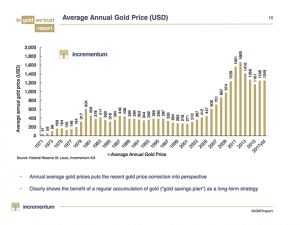

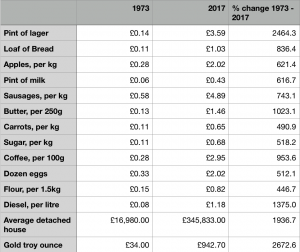

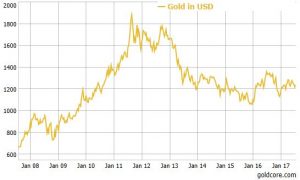

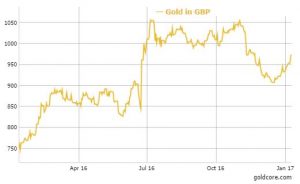

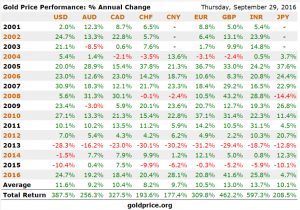

Gold and silver both ended slightly up in a week dominated by heightening geopolitical news, weakening inflation data, and emerging market concerns.With gold closing the week at $1,318 (up 0.28%), €1,104 (0.37%), and £973 (0.2%).

In sterling, gold was up strongly on Thursday following the BOE’s decision not to raise rates, and from the weaker than expected industrial production data.

Gold Price in GBP, May 2018(see more posts on Gold prices, ) – Click to enlarge

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

– Click to enlarge

On Tuesday the