Swiss Franc EUR/CHF - Euro Swiss Franc, May 12(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc rate has broken 1.30 this week as sterling has risen and investors confidence over the outlook for politics in the Eurozone increased. The election of Emmanuel Macron has removed the uncertainty over the increase in Europe of right-wing parties which could have threatened the government. The overall belief is that we are in a much better position for the Swiss Franc as confidence increases over the global The market is now looking towards the French regional elections in June as trigger points to further volatility on safe haven currencies like the Swiss Franc. The Franc as a safe haven currency has been much stronger as investors believe the market favours political uncertainty. With Brexit and Trump causing the Franc to strengthen at times the outcome of the French election was crucial. If you have a transfer to make then understanding the market in advance is key to making the most of the volatility. If you are looking to buy or sell currency in the future then making some plans in advance, the shock movements on sterling yesterday highlight how unpredictable the currency markets can be.

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Eurozone Industrial Production, Featured, FX Daily, FX Trends, GBP, GBP/CHF, Germany Consumer Price Index, Germany Gross Domestic Product, JPY, newslettersent, Options, U.S. Consumer Price index, U.S. Michigan Consumer Sentiment, U.S. Retail Sales, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, May 12(see more posts on EUR/CHF, ) |

GBP/CHFThe pound to Swiss Franc rate has broken 1.30 this week as sterling has risen and investors confidence over the outlook for politics in the Eurozone increased. The election of Emmanuel Macron has removed the uncertainty over the increase in Europe of right-wing parties which could have threatened the government. The overall belief is that we are in a much better position for the Swiss Franc as confidence increases over the global The market is now looking towards the French regional elections in June as trigger points to further volatility on safe haven currencies like the Swiss Franc. The Franc as a safe haven currency has been much stronger as investors believe the market favours political uncertainty. With Brexit and Trump causing the Franc to strengthen at times the outcome of the French election was crucial. If you have a transfer to make then understanding the market in advance is key to making the most of the volatility. If you are looking to buy or sell currency in the future then making some plans in advance, the shock movements on sterling yesterday highlight how unpredictable the currency markets can be. Yesterday sterling was poised to improve but ended up slipping as all of the data disappointed and the Bank of England announced that they would be cutting growth forecasts as they expect Inflation to really bite this year. All in all the GBCHF rate is at some of the best in 2017 to buy Francs. If you have a transfer the coming weeks will be very interesting as we get further news on the UK election, French regional election and also international concerns. |

GBP/CHF - British Pound Swiss Franc, May 12(see more posts on GBP/CHF, ) |

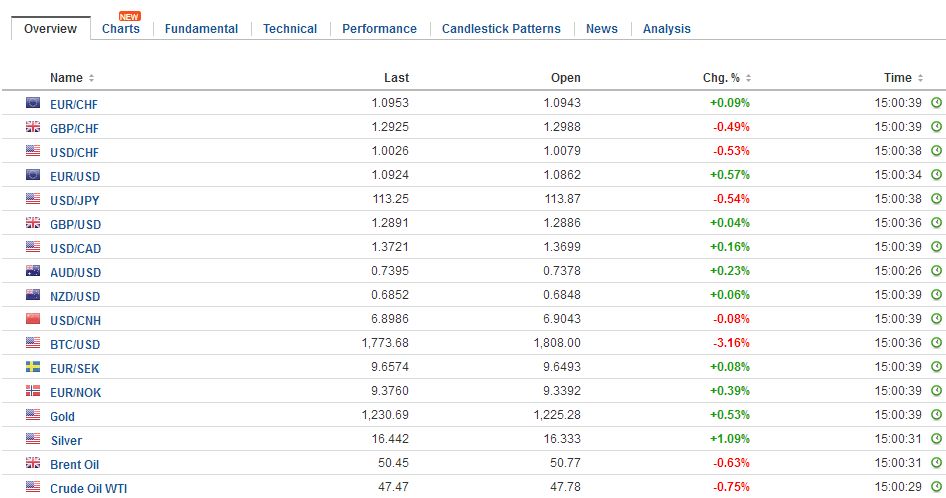

FX RatesThe foreign exchange market is becalmed, and the major currencies are little changed. The US dollar is mixed, but mostly a little lower. Option expires yen do not seem particularly relevant now (JPY113.90-JPY114.00 for $800 mln). Nor does sterling ($1.29 for GBP445 mln). However, the Australian dollar and Canadian dollars are near strikes. The $0.7400 in the Aussie houses an A$420 mln strike. There is are options struck at CAD1.37 for $555 mln at may be in play The yen is the strongest of the majors, gaining about 0.2% against the greenback. The dollar lost a third of a percentage point against the dollar yesterday. This could be the first two-day dollar loss in since April 11-12. Our work suggests it ought not to be surprising to learn that the US 10-year yield also pulled back yesterday and is trading a little heavier now. The yield peaked yesterday near 2.42% and is back near 2.37% now. |

FX Daily Rates, May 12 |

| The market refrained from pushing the euro into the gap created in response to the first round of the French presidential election. The top of the gap is near $1.0820. Yesterday’s low was about $1.0840. The euro has been confined to less than a quarter cent range today near the middle of yesterday’s range. Large option strikes may influence the price action. Between $1.0880 and $1.0900, there are about 1.3 bln euro strikes expiring today. Between $1.0830 and $1.0845, there are more than two bln euro of options expiring.

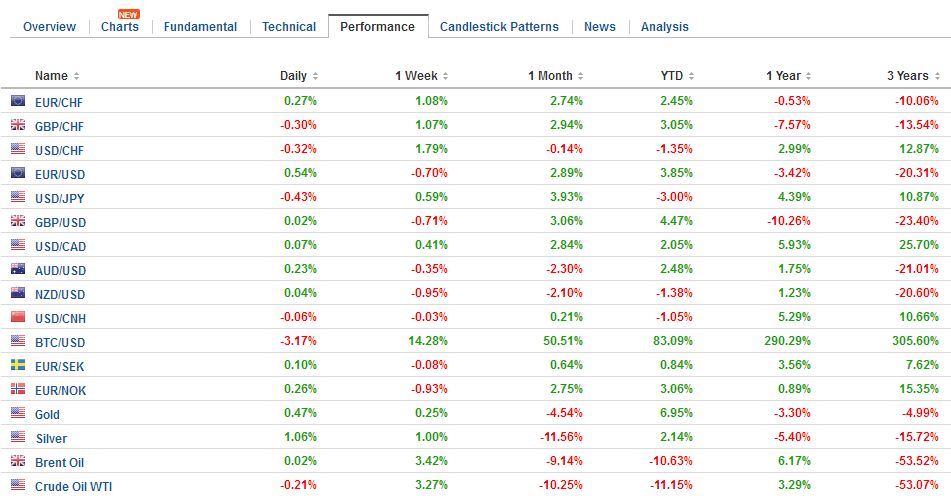

On the other hand, the Dollar Index is having its best week of the year, with around a one percent gain this week. The greenback advanced against all the major currencies, gains of one percent against the Swiss franc, euro, sterling, Swedish krona and New Zealand dollar. The Dollar Index had recorded lows for the year on Monday, in the initial response to the French election, but reversed high before the session was over. The key reversal saw follow-through buying lifted the index from 98.50 to almost 99.90, which corresponds to the 50% retracement objective of the decline since April 10 high near 101.35. The 61.8% retracement is found at 100.25. The market refrained from pushing the euro into the gap created in response to the first round of the French presidential election. The top of the gap is near $1.0820. Yesterday’s low was about $1.0840. The euro has been confined to less than a quarter cent range today near the middle of yesterday’s range. Large option strikes may influence the price action. Between $1.0880 and $1.0900, there are about 1.3 bln euro strikes expiring today. Between $1.0830 and $1.0845, there are more than two bln euro of options expiring. |

FX Performance, May 12 |

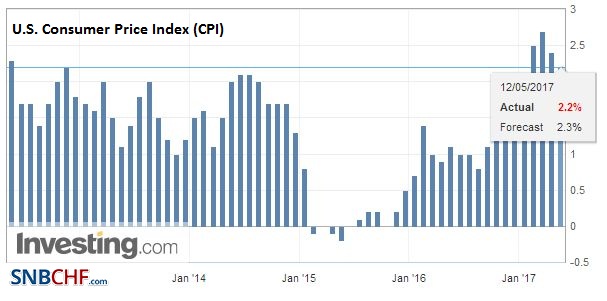

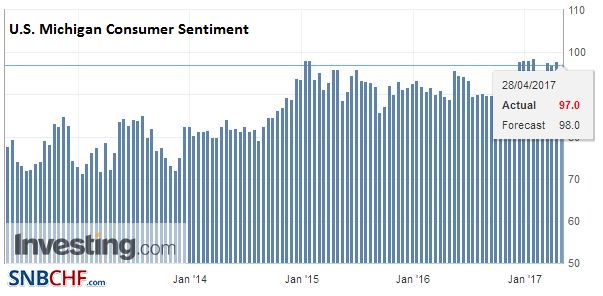

United StatesThe North American session features the data highlight of the week for the US with April CPI and retail sales due. Ideas that the US economy is recovering from the unusually weak Q1 and that the Fed is still on track to lift rate next month requires evidence that the US consumer is returning after hibernating in Q1 and that the March decline in consumer prices was a fluke. US consumer prices fell in March; 0.3% on the headline and 0.1% at the core. April is expected to see a bounce back in prices with a 0.2% increase in both the headline and core levels. This is needed to keep the core rate at 2.0% year-over-year. The headline rate may still ease due to the base effect to 2.3% from 2.4%. With both reports, disappointment may take a heavier toll than positive upside surprises. Bloomberg continues to show that the market is implying that a June hike is a done deal (98.8% discounted). The CME and our own calculation is a bit lower (80%-83%) but still showing it mostly priced into the Fed funds futures strip. |

U.S. Consumer Price Index (CPI) YoY, April 2017(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

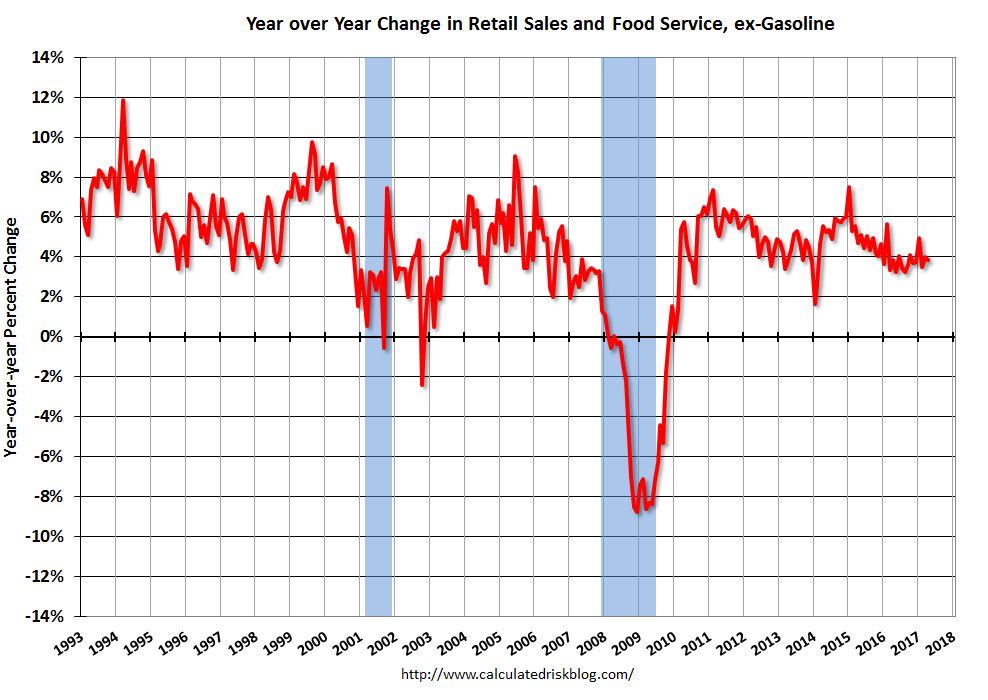

| Retail sales are forecast to bounce back smartly after the 0.2% decline in March. The Bloomberg survey produced a median guesstimate of 0.6%. The components used for GDP calculations are expected to rise 0.4% after rise nearly 0.6% (0.59%) in March. Last year, this measure of core retail sales rose an average of 0.23% a month. Still, keep in mind that one cannot go from this measure of retail sales to personal consumption expenditures. Note that the core retail sales rose by an average of 0.23% in Q4 16 when the consumption in GDP rose 3.5% and rose 0.27% in Q1 17 when consumption in GDP rose 0.3%. Nevertheless, a robust retail sales report is seen as necessary to keep expectation intact. |

U.S. Retail Sales, April 2017(see more posts on U.S. Retail Sales, ) Source: macro.economicblogs.org - Click to enlarge |

|

|

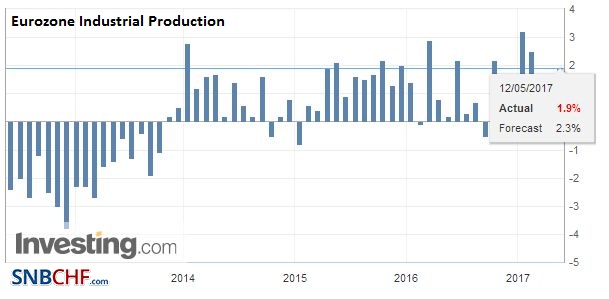

Eurozone |

Eurozone Industrial Production YoY, March 2017(see more posts on Eurozone Industrial Production, ) Source: Investing.com - Click to enlarge |

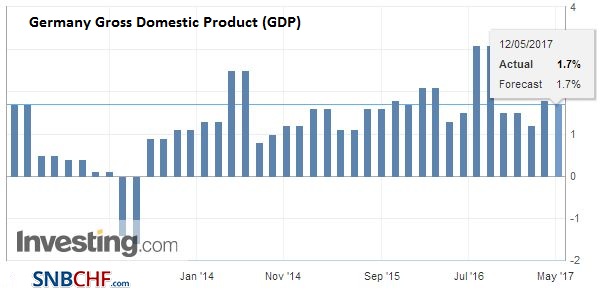

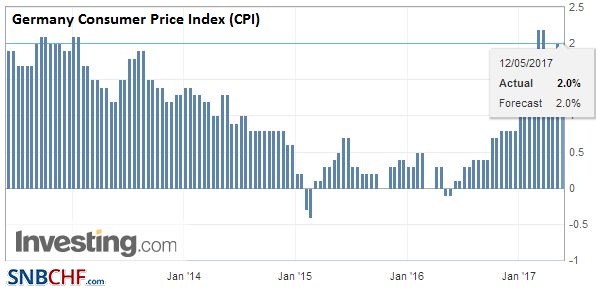

GermanyThe news stream is light. It has been largely confined to Germany confirming its earlier April CPI estimate of 2.0% and the release of its first estimate of Q1 GDP at 0.6%, spot on expectations. Separately, but with same little impact on the capital markets, the US and China have reached a limited trade agreement covering ten areas, which seem like mostly Chinese concessions on a range of products, including natural gas, beef and access for foreign credit card companies and rating agencies. This is the first bilateral trade agreement struck by the Trump Administration. While it is unlikely to substantially change the trade imbalance, it is seen as constructive and positive. |

Germany Gross Domestic Product (GDP) YoY, Q1 2017(see more posts on Germany Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

Germany Consumer Price Index (CPI), May 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Germany holds the last state election this weekend ahead of the national election in September. Although the new SPD leader caused a short-term pop in the polls, Merkel’s CDU has bounced back. It is expected to do sufficiently well in the weekend contest in North Rhine-Westphalia to force a change in the current SPD-Green coalition. Watch the recovery of the FDP, which could presage developments on the national stage. The FDP had been the CDU’s traditional coalition partner, but its demise in the early days of the European crisis led to grand coalitions, which no one particularly likes.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone Industrial Production,Featured,FX Daily,GBP/CHF,Germany Consumer Price Index,Germany Gross Domestic Product,newslettersent,Options,U.S. Consumer Price Index,U.S. Michigan Consumer Sentiment,U.S. Retail Sales