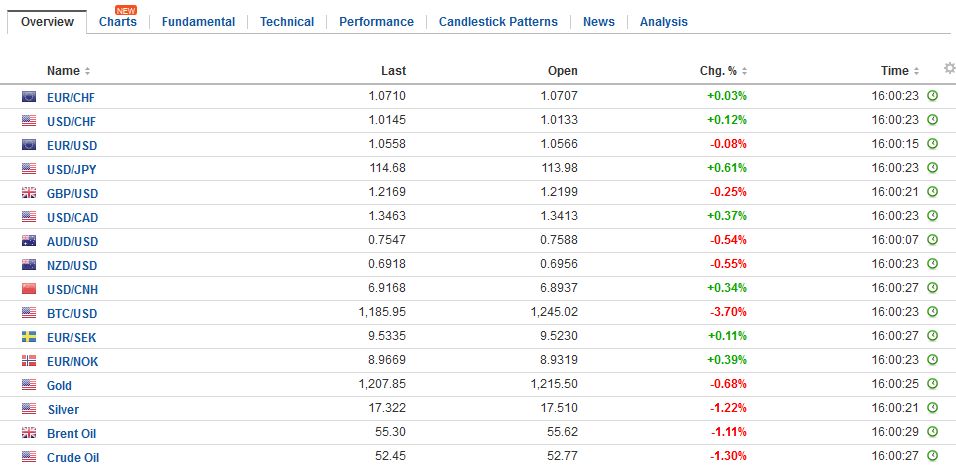

Swiss Franc Switzerland Consumer Price Index (CPI) YoY, February 2017(see more posts on Switzerland Consumer Price Index, ) Source: Investing.com - Click to enlarge GBP/CHF The pound to Swiss Franc rate has deteriorated further in the last 24 hours as uncertainty over the Brexit and economic data for the UK weigh on the performance of the pound. I would suggest rates are going to continue to struggle for Swiss Franc buyers in the coming weeks as the UK triggers Article 50 and investors start to rethink just how successful and stable the UK economy will be in the coming months and years. The sacking of Lord Heseltine has not helped the situation and just underlines how strong Theresa May’s hand is in all of this. The pound to Swiss Franc rate could I believe drop lower now as the Franc strengthens owing to uncertainty in the global economy. As a safe haven currency, the Swiss Franc does better in times of global economic uncertainty. The French elections, Dutch elections and German elections are all starting to weigh on investor sentiment and in most cases are likely to see the Swiss Franc rise further.

Topics:

Marc Chandler considers the following as important: $CNY, AUD, CAD, China Exports, China Imports, China Trade Balance, EUR, Featured, FX Trends, GBP/CHF, JPY, newslettersent, Switzerland Consumer Price Index, U.S. A, U.S. ADP Nonfarm Employment Change, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

Switzerland Consumer Price Index (CPI) YoY, February 2017(see more posts on Switzerland Consumer Price Index, ) Source: Investing.com - Click to enlarge |

GBP/CHFThe pound to Swiss Franc rate has deteriorated further in the last 24 hours as uncertainty over the Brexit and economic data for the UK weigh on the performance of the pound. I would suggest rates are going to continue to struggle for Swiss Franc buyers in the coming weeks as the UK triggers Article 50 and investors start to rethink just how successful and stable the UK economy will be in the coming months and years. The sacking of Lord Heseltine has not helped the situation and just underlines how strong Theresa May’s hand is in all of this. The pound to Swiss Franc rate could I believe drop lower now as the Franc strengthens owing to uncertainty in the global economy. As a safe haven currency, the Swiss Franc does better in times of global economic uncertainty. The French elections, Dutch elections and German elections are all starting to weigh on investor sentiment and in most cases are likely to see the Swiss Franc rise further. Investors have been pouring money into the US dollar lately on the belief they will raise their interest rate which could come as soon as If you have a transfer to buy or sell the Swiss Franc and the pound then the next few weeks are going to be very interesting. When will Article 50 be triggered? How will the pound react? These are two very important questions which I would suspect will be answered very soon. Article 50 could potentially see the pound rise as we have clarity over the outcome on the Brexit. We will know it is happening and this may help the pound. Personally I think the pound will move lower but there are no clear outcomes. |

GBP/CHF - British Pound Swiss Franc, February 2017(see more posts on GBP/CHF, ) |

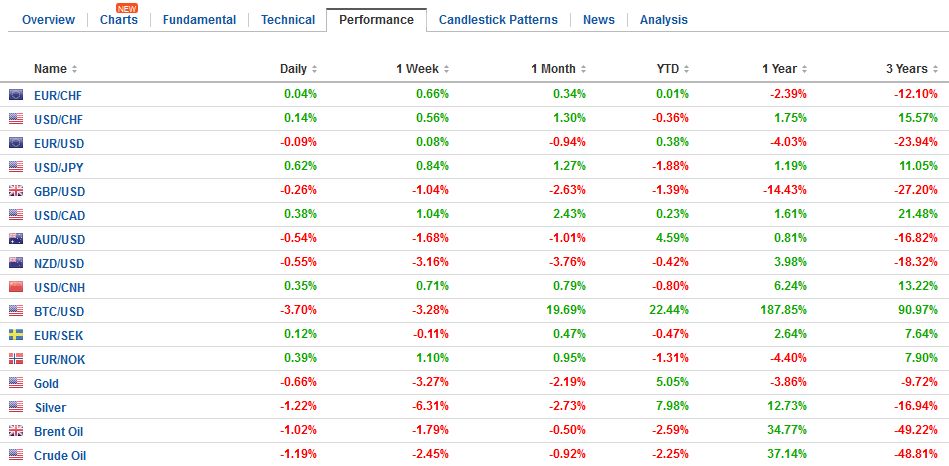

FX RatesThe US dollar is moving higher against nearly all the other major foreign currencies today. As far as we can tell, the driving force remains interested rate considerations. US rates are rising in absolute terms and about Europe and Japan. The US 10-year yield is moving above the downtrend that has been in place since the day after the Fed hiked rates last December. It is now near 2.53%. The US two-year yield is making new multiyear highs today. At the same time, official, investors and collateral-related demand for German paper have continued to widen the interest rate differential. The correlation (60-day, percentage change) between the rate differentials and the euro-dollar and dollar-yen exchange rates remains high. The euro is lower for the third session. Recall that last Friday; the euro snapped a three-day slide. It is now retraced 61.8% of its bounce (~$1.0550). The euro was unable to resurface above $1.06 in North America yesterday, and this will likely continue to cap the single currency ahead of the ECB meeting tomorrow. The strong German (January 2.8% and December revised to -2.4% from -3.0%) and Spain (0.3% vs. consensus 0.2%) were largely ignored by the market. There had been some talk last week that the ECB could alter its forward guidance at tomorrow’s meeting, but most seem to be downplaying the likelihood in recent days. |

FX Daily Rates, March 08 |

| Sterling continues to trade like a dog. Last Friday was the only session since February 23 that has not fallen. Once it broke $1.24, it has not looked back. Perhaps the Gilt market is awaiting Hammond’s budget, but the foreign exchange market is not. Sterling is extending its losses below $1.22. We continue to look for a test on the two-point trendline from the spikes of the flash crash last October and the mid-January dip below $1.20. It is found near 1.2050 and edges up to about $1.2065 by next Wednesday (when the Fed meets and the Dutch hold elections).

Yesterday the S&P 500 posted its first consecutive losses since the end of January. Asia followed America’s lead, and the MSCI Asia-Pacific Index was off 0.2%, snapping a two-day advance. European shares firmer as the Dow Jones Stoxx 600 is trying to snap a four-day drop (for a total drop of 1%). Industrial metals are stabilizing. Copper is firmer after its four-day slide. Chinese steel futures hit eight-day lows, though iron ore eked out a small gain (0.5%) after being up nearly two percent earlier. Higher API oil inventory estimate weighs on oil prices today. The Australian dollar has given up yesterday’s gains and is approaching the multi-week low set before the weekend near $0.7545. Below there, support is seen in the $0.7500-$0.7520 area. The US dollar is making near highs against the Canadian dollar and is approaching the year’s high set on January 3 near CAD1.3460. |

FX Performance, March 08 |

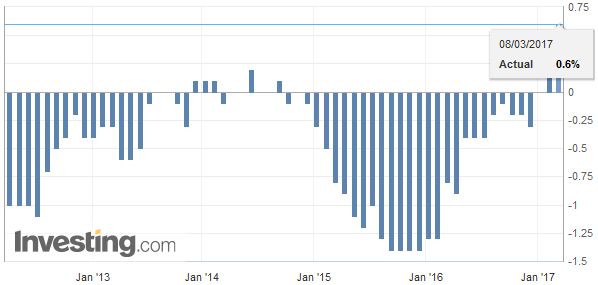

JapanThe US 10-year yield is higher for the eighth consecutive session. Over this span, the dollar has risen against the yen in six sessions, including today. That said, the ranges remain tight. For the third day, the dollar is in a JPY113.50 to the JPY114.15 range. The small upward revision to Q4 16 GDP was of little importance to trading. |

Japan Gross Domestic Product (GDP) Private Consumption QoQ, February 2017(see more posts on Japan Private Consumption, ) Source: Investing.com - Click to enlarge |

| The upward revision to 0.3% from 0.2% left consumption flat and seemed to be mostly a function of slightly stronger capex, which appears tied to the export sector. It was the fourth consecutive quarter that the world’s third-largest economy expanded in three years. The key test for the dollar comes near JPY115.00. |

Japan Gross Domestic Product (GDP) QoQ, February 2017(see more posts on Japan Gross Domestic Product QoQ, ) Source: Investing.com - Click to enlarge |

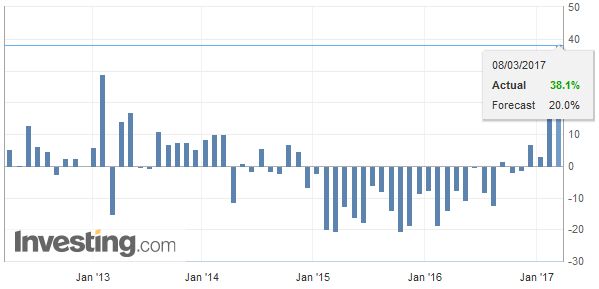

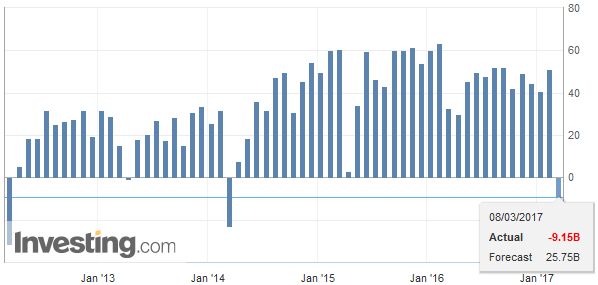

ChinaChina surprised the market. Despite being well aware of distortions caused by the Lunar New Year, investors were surprised by the news that China recorded a trade deficit in February. The $9.15 bln shortfall is the first since February 2014. Exports collapsed, falling 1.3% after rising 7.9% year-over-year in January. The median estimate in the Bloomberg survey was for a 14% increase. |

China Exports YoY, February 2017(see more posts on China Exports, ) Source: Investing.com - Click to enlarge |

| Imports surged 38.1% (16.7% in January), compared with the median estimate of 20%. |

China Imports YoY, February 2017(see more posts on China Imports, ) Source: Investing.com - Click to enlarge |

| The recorded trade deficit and the build in reserves reported yesterday are not preventing new yuan weakness. The dollar is edging above CNY6.91 to reach its highest level since mid-January. It has nearly retraced 61.8% of this year’s fall (~CNY6.9135). It seems more a case of dollar strength then yuan weakness. |

China Trade Balance, February 2017(see more posts on China Trade Balance, ) Source: Investing.com - Click to enlarge |

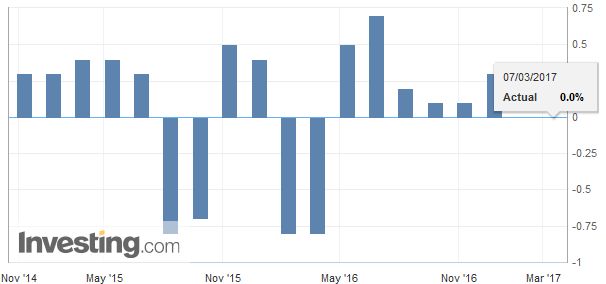

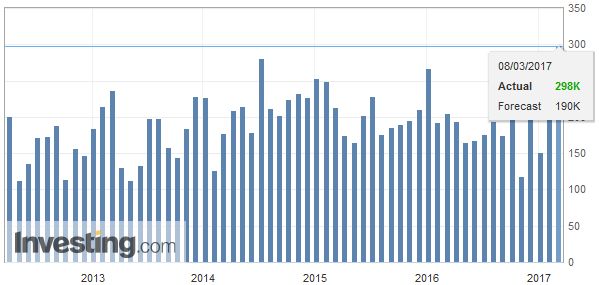

United StatesThe ADP estimate of US private sector employment is the most important report today. A gain of around 190k is expected. Productivity and unit labor costs for Q4 16 that will also be reported are functions of last week’s revised GDP report. Recall that contrary to expectations there was no upward revision and that warns of risks to survey expectations of a small increase in productivity and a tick down in unit labor costs. Canada reports Q4 productivity and housing starts and permits. |

U.S. ADP Nonfarm Employment Change, February 2017(see more posts on U.S. ADP Nonfarm Employment Change, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$CAD,$CNY,$EUR,$JPY,China Exports,China Imports,China Trade Balance,Featured,GBP/CHF,newslettersent,Switzerland Consumer Price Index,U.S. A,U.S. ADP Nonfarm Employment Change