The Swiss National Bank will have difficulties to weaken the Swiss Franc, because she is obliged to maintain her mandate, the avoidance of inflation. Already in January 2015, she gave up, because continuing interventions – at the excessively high euro rate of 1.20 – could have endangered her inflation mandate. Therefore we expect that EUR/CHF moves towards parity, for more read here. Year on year inflation was 0.6% (+0.5% against the previous month). Food prices are up 1.8%, expenditures for rent and heating up 1.5%, transport costs went up by 2.4%. These three categories make a big part of the consumer basket of poorer people. Given that the SNB has stopped the appreciation of the franc, imported goods are 1.6% more expensive than last year. Switzerland Consumer Price Index (CPI) YoY, February 2017(see more posts on Switzerland Consumer Price Index, ) Source: Investing.com - Click to enlarge Download press release Swiss Consumer Price Index in February 2017 German text: Landesindex der Konsumentenpreise im Februar 2017 Landesindex der Konsumentenpreise im Februar 2017 Die Konsumentenpreise steigen um 0,5 Prozent Neuchâtel, 08.03.

Topics:

George Dorgan considers the following as important: Featured, newslettersent, Swiss Macro, Switzerland Consumer Price Index, Switzerland inflation

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The Swiss National Bank will have difficulties to weaken the Swiss Franc, because she is obliged to maintain her mandate, the avoidance of inflation. Already in January 2015, she gave up, because continuing interventions – at the excessively high euro rate of 1.20 – could have endangered her inflation mandate.

Therefore we expect that EUR/CHF moves towards parity, for more read here.

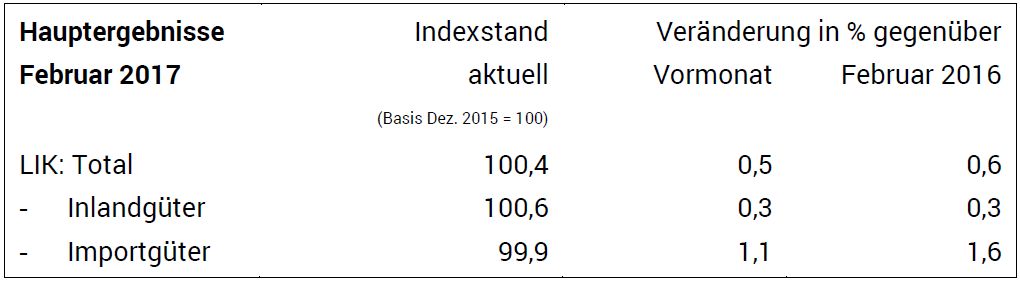

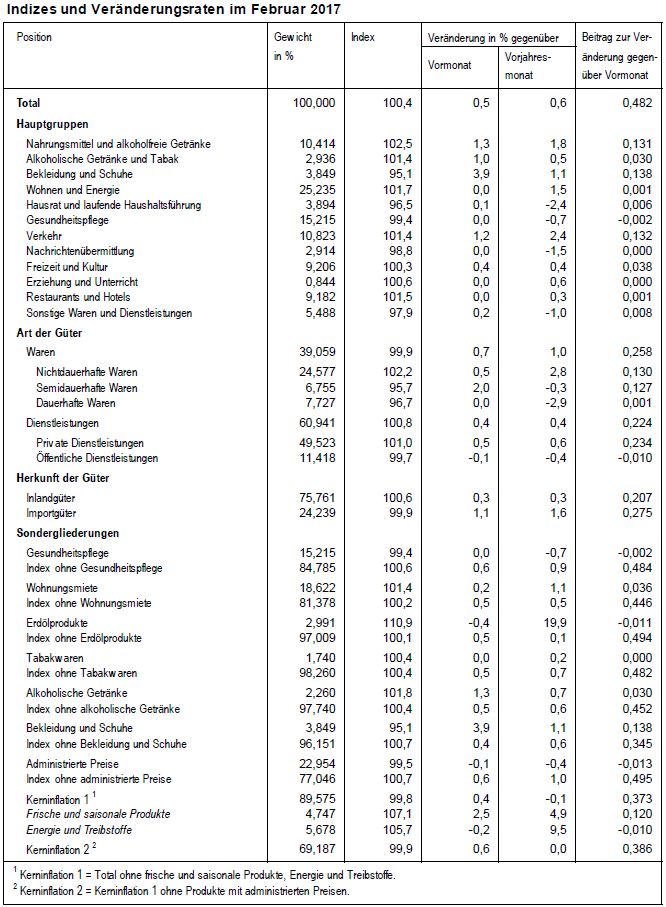

| Year on year inflation was 0.6% (+0.5% against the previous month).

Food prices are up 1.8%, expenditures for rent and heating up 1.5%, transport costs went up by 2.4%. |

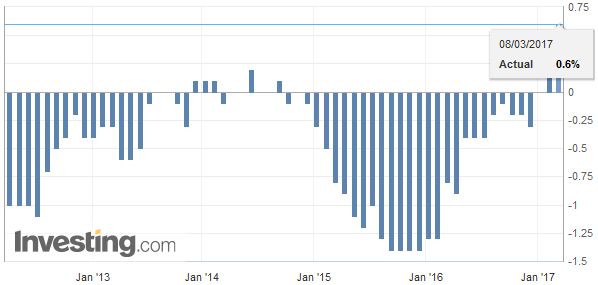

Switzerland Consumer Price Index (CPI) YoY, February 2017(see more posts on Switzerland Consumer Price Index, ) Source: Investing.com - Click to enlarge |

German text: Landesindex der Konsumentenpreise im Februar 2017

Landesindex der Konsumentenpreise im Februar 2017

Die Konsumentenpreise steigen um 0,5 Prozent

Neuchâtel, 08.03.2017 (BFS) – Der Landesindex der Konsumentenpreise (LIK) nahm im Februar 2017 im Vergleich zum Vormonat um 0,5 Prozent zu und belief sich auf 100,4 Punkte (Dezember 2015=100). Die Teuerung gegenüber dem entsprechenden Vorjahresmonat betrug 0,6 Prozent. Dies geht aus den Zahlen des Bundesamts für Statistik (BFS) hervor.

Für die Zunahme um 0,5 Prozent im Vergleich zum Vormonat sind mehrere Faktoren verantwortlich. Die Preise für den Luftverkehr sowie für Gemüse sind stark angestiegen. Ebenfalls eine Preiserhöhung registrierten die Pauschalreisen ins Ausland. Die Preise für Heizöl, Kaffee und Beeren sind hingegen gesunken.

Tags: Featured,newslettersent,Switzerland Consumer Price Index,Switzerland inflation