Swiss Franc EUR/CHF - Euro Swiss Franc, February 10(see more posts on EUR/CHF, ) - Click to enlarge Sterling vs the Swiss Franc has been climbing recently as the Brexit talks appear to be going the right way at the moment. The talks are progressing and it has been confirmed that the government will be allowed to vote on the final agreement prior to the triggering of Article 50. The Pound is still under huge pressure against all major currencies as it is still not yet clear as to whether the UK will opt for a hard or a soft Brexit. However, every time power returns to the government the Pound appears to rise so it could be argued that when Article 50 is triggered this could potentially strengthen Sterling although having said that there a sill a huge number of unknowns ahead. As we saw with the Brexit vote Sterling went into a tailspin as uncertainty took over and we have yet to see any real improvement for Sterling vs the Swiss Franc during this period. The Swiss Franc is also used as what is called a carry trade currency which means global investors borrow in low yielding currencies and invest in higher yielding risk based currencies such as the Australian Dollar or the South African Rand.

Topics:

Marc Chandler considers the following as important: AUD, China, China Exports, China Imports, China Trade Balance, Featured, FX Trends, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc, February 10(see more posts on EUR/CHF, ) |

|

Sterling vs the Swiss Franc has been climbing recently as the Brexit talks appear to be going the right way at the moment. The talks are progressing and it has been confirmed that the government will be allowed to vote on the final agreement prior to the triggering of Article 50. The Pound is still under huge pressure against all major currencies as it is still not yet clear as to whether the UK will opt for a hard or a soft Brexit. However, every time power returns to the government the Pound appears to rise so it could be argued that when Article 50 is triggered this could potentially strengthen Sterling although having said that there a sill a huge number of unknowns ahead. As we saw with the Brexit vote Sterling went into a tailspin as uncertainty took over and we have yet to see any real improvement for Sterling vs the Swiss Franc during this period. The Swiss Franc is also used as what is called a carry trade currency which means global investors borrow in low yielding currencies and invest in higher yielding risk based currencies such as the Australian Dollar or the South African Rand. With the US economy showing signs of growth as well as a potential interest rate rise over the next few months this has increased investor appetite globally and kept the Swiss Franc very strong against the Pound. With UK GDP data due out at 3pm this afternoon I expect this to come out positively and if my prediction is correct I think we could see GBPCHF exchange rates end the week on a high. |

GBP/CHF - British Pound Swiss Franc, February 10(see more posts on GBP/CHF, ) |

FX RatesThe US dollar is about 12 hours away from gaining against all the major currencies this week. The main talking points today remain Trump-centric. The US dollar is mixed as European trading gets underway. Of note the dollar is continuing to gain on the yen. The yen is off 0.4%, which is nearly half the week’s decline. The Aussie is the strongest on the day, up about 0.2% to trim the week’s loss to about 0.45%. Sterling is the strongest of the majors this week and it is off about 0.1%. Ahead of the meeting with Abe, Trump indicated that currency manipulation, which he has accused several countries, including Japan, is not on the top of the agenda. This may have encouraged further yen weakness today. |

FX Daily Rates, February 10 |

| Trump also reportedly indicated to Chinese President Xi that the US will continue to abide by its previous commitment to a one-China policy. These two developments reinforce a sense of negotiating bluster style of the new Presidents. The US president also had another legal setback as a US federal appeals court rules unanimously rejected reinstating ban on immigrants from 7 Muslim-majority countries. Case on way to Supreme Court.

MSCI Asia Pacific has alternated between gains and losses this week and as it lost ground yesterday, it is only fitting that it was up today (+0.9%). It was up 1.2% for the week and it is the third weekly gain. |

FX Performance, February 10 |

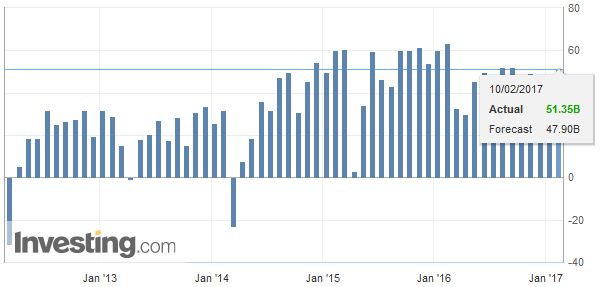

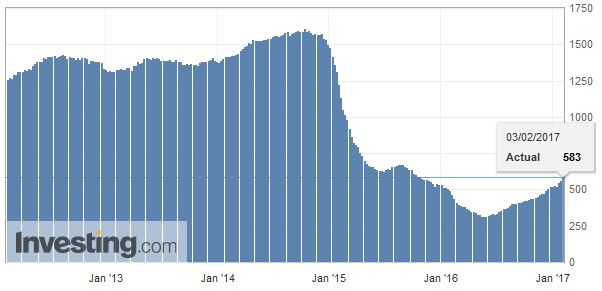

ChinaChina’s trade surplus may be the largest macro report. Caution is that Jan-Feb data distorted by Lunar New Year. Still, the direction is favorable. The surplus was $51.3 bln up for $40.7 and $48.5 bln. |

China Trade Balance, January 2017(see more posts on China Trade Balance, ) Source: Investing.com - Click to enlarge |

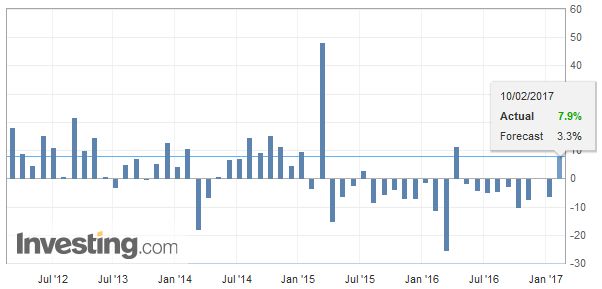

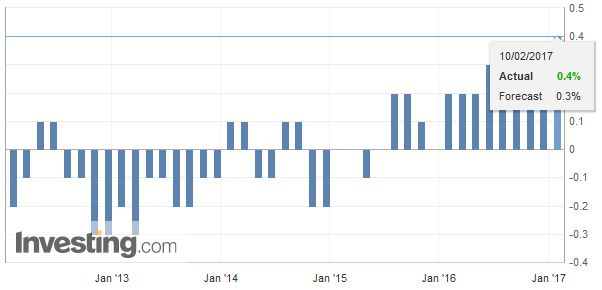

| Exports rose 7.9% year-over-year after beings off 6.2% in Dec and is more than twice expected. |

China Exports YoY, January 2017(see more posts on China Exports, ) Source: Investing.com - Click to enlarge |

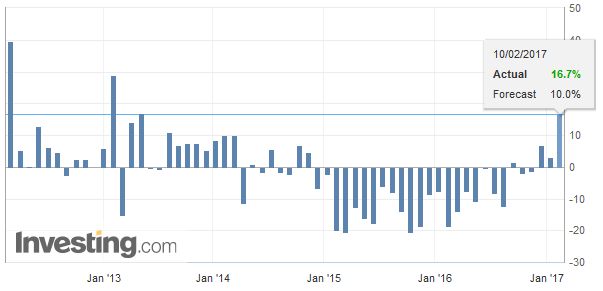

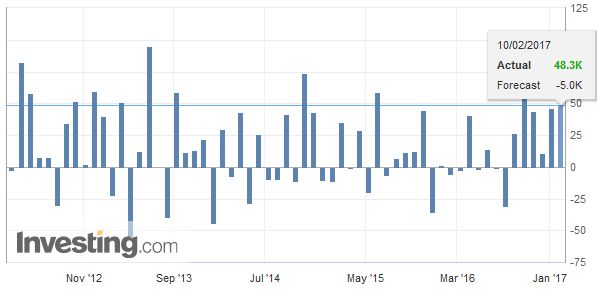

| Imports rose 16.7%, this is good for countries that export into China, which is many countries and many even have surpluses with China (not US) and were up 3.1% in Dec. Economists knew they would bounce back and expected 10% increase. |

China Imports YoY, January 2017(see more posts on China Imports, ) Source: Investing.com - Click to enlarge |

EurozoneThe front page story in the FT is about Greece. Surge in yields as divisions within IMF played up. Will try to have a post on it later today, but key point here is Greece does not need the funds until July when it has big payment due. Dutch parliament dissolves shortly for March election so not decision by Feb 20 and it means nothing probably until after the French elections. Brinkmanship is still the most likely scenario. |

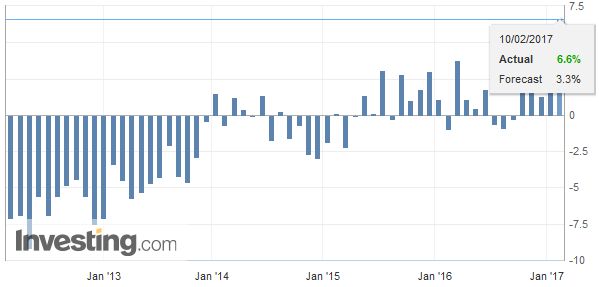

Italy Industrial Production YoY, January 2017(see more posts on Italy Industrial Production, ) Source: Investing.com - Click to enlarge |

United StatesMeanwhile Trump yesterday indicated that a “phenomenal” tax-related announcement would be made in the next several weeks. During the campaign talked about 15% corp tax rate while GOP plan was for 20%. The Government Accounting Office says US large corps paid an average 14% rate in 2008-2012. Other studies say that overall US business pay 21.1% vs 21.7% OECD average. |

U.S. Baker Hughes Oil Rig Count, January 2017 Source: Investing.com - Click to enlarge |

France |

France Non-Farm Payrolls, January 2017(see more posts on France Non-Farm Payrolls, ) Source: Investing.com - Click to enlarge |

Canada |

Canada Employment Change, January 2017(see more posts on Canada Employment Change, ) Source: Investing.com - Click to enlarge |

Canada Participation Rate, January 2017(see more posts on Canada Participation Rate, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$JPY,China,China Exports,China Imports,China Trade Balance,Featured,newsletter