Swiss Franc EUR/CHF - Euro Swiss Franc, November 30(see more posts on EUR/CHF, ). - Click to enlarge Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked government document titled Have cake and eat it, the markets and sterling were largely unphased. The pound has seen an excellent day against the Swiss Franc after very strong UK mortgage approvals from the Bank of England which gave sterling a big injection. The mood is starting to look considerably more upbeat and Brexit does not appear to be such a concern as it was immediately following the vote to leave. Tomorrow sees a meeting for OPEC where it is expected that there will be a concerted effort to cut oil production and raise the price of oil. This is likely to have knock on effects fro all of the major currencies so it one to be aware of. The Italian referendum is also now literally just around the corner and this could have some very serious implications for the Euro.

Topics:

Marc Chandler considers the following as important: $CNY, ADP, AUD, EUR, Eurozone Consumer Price Index, FX Daily, FX Trends, GBP, Germany Retail Sales, Germany Unemployment Change, Japan Construction Orders YoY, JPY, newslettersent, Oil, OPEC, U.S. ADP employment Change, U.S. Chicago PMI, USD

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes Busy Wednesday: French Confidence Vote, Fed’s Powell Speaks, ADP Jobs Estimate, and Beige Book

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Swiss Franc |

EUR/CHF - Euro Swiss Franc, November 30(see more posts on EUR/CHF, ) |

|

Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked government document titled Have cake and eat it, the markets and sterling were largely unphased. The pound has seen an excellent day against the Swiss Franc after very strong UK mortgage approvals from the Bank of England which gave sterling a big injection. The mood is starting to look considerably more upbeat and Brexit does not appear to be such a concern as it was immediately following the vote to leave. Tomorrow sees a meeting for OPEC where it is expected that there will be a concerted effort to cut oil production and raise the price of oil. This is likely to have knock on effects fro all of the major currencies so it one to be aware of. The Italian referendum is also now literally just around the corner and this could have some very serious implications for the Euro. The referendum could go either way and if Prime Minister Matteo Renzi does lose the vote then he has signalled that he would resign which would create a raft of political outcomes. It could spell big problems for the EU and the Swiss Franc could also be affected by this outcome. |

GBP/CHF - British Pound Swiss Franc, November 30(see more posts on GBP/CHF, ) |

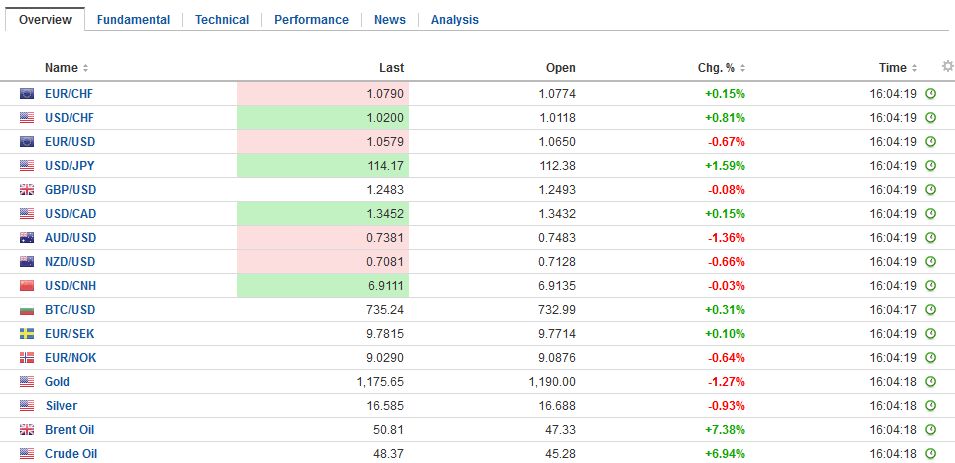

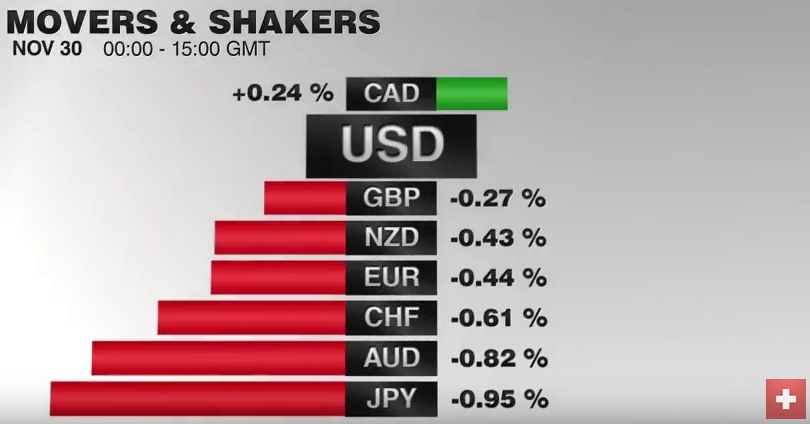

FX RatesYesterday’s pessimism about a potential deal at today’s oil producers’ meeting in Vienna has been replaced by optimism and that crude oil around 5%. Supportive comment by Iranian officials about there being acceptable proposals on the table and intimations that Russia may also participate in cuts fanned the newfound hopes. Still, there is some moving parts. Iran has continued to indicate that freezing its own output is not on the agenda. It is not clear that that would satisfy the Saudis. Over the past year, the dispute between Saudi Arabia and Iran has been a major stumbling block preventing agreement. |

FX Performance, November 30 2016 Movers and Shakers . Source: Dukascopy - Click to enlarge |

| The sharp rise in oil prices is helping lift some oil-sensitive currencies, like the Russian ruble, the strongest of the emerging market currencies today. The Mexican and Colombian pesos may also be supported. Among the majors, the surge in oil is giving the Norwegian krone a fillip; any may be helping Canadian dollar hold on to yesterday’s gains. The US dollar is holding just above CAD1.34. It has not been below CAD1.3380 since the US election.

Against most of the major currencies, the US dollar is little changed. The greenback is strongest against the yen, gaining nearly 0.5%. It held JPY112.00 in early Asia and poked through JPY113 in the European morning, which appears to have largely exhausted the technical scope. The euro is holding on to the bulk of yesterday’s gains; finding support near $1.0620, but unable to make much headway toward Monday’s high near $1.0680. Sterling looks a bit heavier than the euro, but support near $1.2450 remains intact. The results of the BOE stress test showed only one bank having to bolster its capital plans and two other banks slight inadequate results. This may have weighed on the financials, but has prevented a broader equity advance in the UK, led by energy and consumer staples. |

FX Daily Rates, November 30 (GMT 16:04) |

| The Australian dollar stalled in front of $0.7500. It has been stymied by this cap this week as the rebound from $0.7300 on November 21 stalled. The precipitating cause today may have been the unexpectedly sharp drop in building approvals. The 12.6% drop contrasts with expectations for around a 2% gain, which was to follow an 8.7% decline in September. The September series was revised to show a 9.3% decline. It is the third consecutive decline, a streak not seen since Q4 13. Some pressure on the Australian dollar may also be coming from month-end flows and the profit-taking in some of the industrial metals. In particular, coking coal, iron ore, and steel were limit down in China on Wednesday, according to reports.

The nearly 5% rally in oil prices is commanding attention and is helping lift many of the oil-sensitive currencies. Higher energy prices may be exerting upward pressure on yields, while the energy sector is underpinning equity markets. MSCI Asia-Pacific Index eked out a small gain, its fourth rise in five sessions. The Topix’s 12-day advance was snapped yesterday, but perhaps a new streak began today. Month-end pressures were evident in China, where equities eased, and the overnight repo rate soared to over 9%. |

FX Performance, November 30 |

EurozoneThe Dow Jones Stoxx 600 is up about 0.4% in the European morning, helped by a 2.4% rally in the energy sector. Of note, Italian assets continue to fare well despite the uncertainty about the fallout from this weekend’s referendum. Italian shares are leading the major markets with a nearly 1% gain, though bank shares are flat after yesterday’s 4% advance. Italian bonds are flat, while Spain and Portuguese yields are firmer. US 10-year yields are four basis points higher at 2.33%. The US dollar is mostly heavier, leaving the weakness of the yen and the Australian dollar as exceptions. France reported a flat November CPI, which due to the base effect, was sufficient to lift the year-over-year rate to 0.7% (from 0.5%). As recently as April it stood at minus 0.1%. The 0.7% rise is the largest in two and a half years. Despite the slight disappointment with yesterday’s German report (0.7% year-over-year rise in CPI rather than 0.8%), the aggregate for the eurozone CPI rose 0.6% year-over-year, in line with expectations, while the core was flat at 0.8%. The flat core suggests that the rise in the headline is stemming from food and energy. Note that energy prices in France have been edging higher as several nuclear plants have been undergoing safety checks. Reports indicate that due to some damaged cables, the UK-French electricity connection may only be at half capacity for a few months. Typically, the UK takes electricity from France, but recently it has been the another way around. |

Eurozone Consumer Price Index (CPI) YoY, November 30 2016(see more posts on Eurozone Consumer Price Index, ) . Source: Investing.com - Click to enlarge |

JapanThere were three more economic reports of note. First, Japan’s October industrial output was in line with expectations. It rose 0.1% on the month, the third consecutive gain. However, the year-over-year rate slumped back into negative territory./ The 1.3% fall snaps the two months it has been positive. The sentiment is positive for November output, where the government’s survey suggests expectations for a strong rise (~4.5%) before falling again in December. Japan’s industrial shipments rose 2.2% in October, while inventories fell 2.1%. The Japanese economy appears to be finding some traction, helped by rising exports and somewhat better domestic consumption figures. |

Japan Construction Orders YoY, November 2016(see more posts on Japan Construction Orders, ) . Source: Investing.com - Click to enlarge |

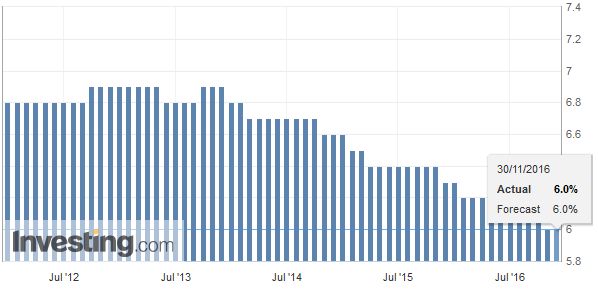

GermanyThird, Germany’s November employment report was in line with expectations (6.0% unemployment rates and a 5k decline in the number of unemployed). However, where Germany shoppers surprised by being particularly active in October. |

Germany Unemployment Rate, November 2016(see more posts on Germany Unemployment Rate, ) . Source: Investing.com - Click to enlarge |

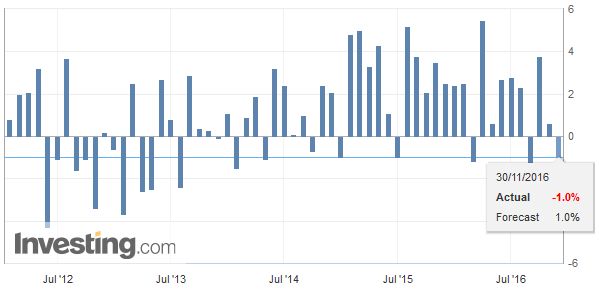

| Retail sales jumped 2.4% on the month, more than twice what was expected and more than offsetting the 1.5% decline in September. |

Germany Retail Sales YoY, November 2016(see more posts on Germany Retail Sales, ) . Source: Investing.com - Click to enlarge |

United StatesAs the North American session gets underway, there are three developments that will vie for attention. First, the sound bites from the OPEC meeting may still pose headline risks. We suspect there is still scope for disappointment, even if some agreement on paper materializes. Enforcing the cuts, and the rise of Libyan supplies and non-OPEC producers may deter a sustained rally. Second, President-elect Trump may formally announce Ross as Commerce Secretary and Mnuchin as Treasury Secretary. |

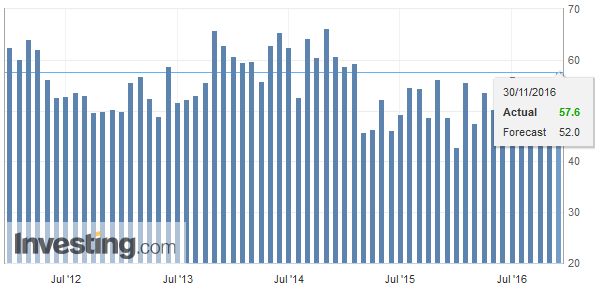

U.S. Chicago PMI, November 2016(see more posts on U.S. Chicago PMI, ) . Source: Investing.com - Click to enlarge |

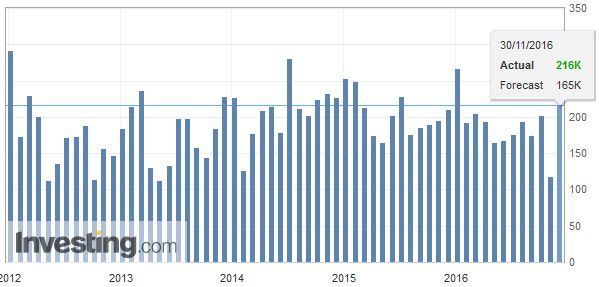

| Third is the US economic data. The ADP jobs report may be the most important, but the October personal consumption and Chicago PMI will also attract attention. Later the Beige Book will be released ahead of the mid-December FOMC meeting. |

U.S. ADP Nonfarm Employment Change, November 2016(see more posts on U.S. Nonfarm Employment Change, ) . Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.