The decline in equity markets since the start of the year stands out as one of the largest in history in January, not only in its magnitude but also its suddenness. One has to go back to 1897 to find such a bad start for equity markets. This note will analyse the situation on the markets and the prospects for a rebound. As often in a large correction, one can find many causes. We think the following are the most significant: Monetary policy running out of steam. The fall in commodities prices. Concerns about China. The strengthening US dollar. The rise in corporate bonds yields, notably in the High-Yield market Chinese circuit breakers, market liquidity and risk reduction With regard to the sell-off in China, an important point is that policy mis-steps exacerbated the draw-down. On 1 January the Chinese authorities implemented new circuit-breaker rules. Instead of limiting market volatility, they actually amplified it. Twice during the first week of January, investors rushed to sell and thus triggered the first circuit breaker at -5%. When markets reopened, new sell orders were added on top of the ones that had been unexecuted, thus triggering the daily market close at -7%. Those measures were abandoned after only one week.

Topics:

Alexandre Tavazzi and Jacques Henry considers the following as important: equities, financial markets, Macroview, rebound

This could be interesting, too:

Marc Chandler writes Dollar Consolidates as Stocks Melt

Lance Roberts writes Retail Sales Data Suggests A Strong Consumer Or Does It

Lance Roberts writes Immigration And Its Impact On Employment

Lance Roberts writes Blackout Of Buybacks Threatens Bullish Run

The decline in equity markets since the start of the year stands out as one of the largest in history in January, not only in its magnitude but also its suddenness.

One has to go back to 1897 to find such a bad start for equity markets. This note will analyse the situation on the markets and the prospects for a rebound.

As often in a large correction, one can find many causes. We think the following are the most significant:

- Monetary policy running out of steam.

- The fall in commodities prices.

- Concerns about China.

- The strengthening US dollar.

- The rise in corporate bonds yields, notably in the High-Yield market

Chinese circuit breakers, market liquidity and risk reduction

With regard to the sell-off in China, an important point is that policy mis-steps exacerbated the draw-down. On 1 January the Chinese authorities implemented new circuit-breaker rules. Instead of limiting market volatility, they actually amplified it. Twice during the first week of January, investors rushed to sell and thus triggered the first circuit breaker at -5%. When markets reopened, new sell orders were added on top of the ones that had been unexecuted, thus triggering the daily market close at -7%. Those measures were abandoned after only one week. Since August 2015, Chinese authorities have demonstrated that their management of financial markets is still approximate at best, thus reinforcing investors’ worries. One can only hope that the recent episode in both the currency and equity markets will lead to a better understanding of financial markets.

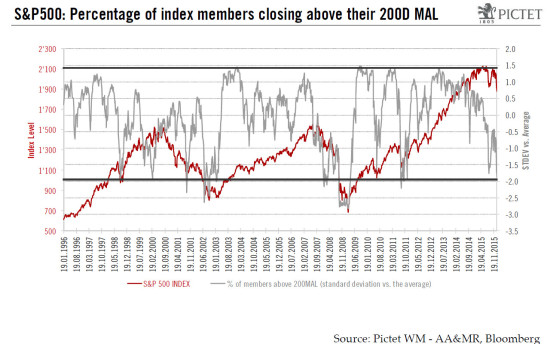

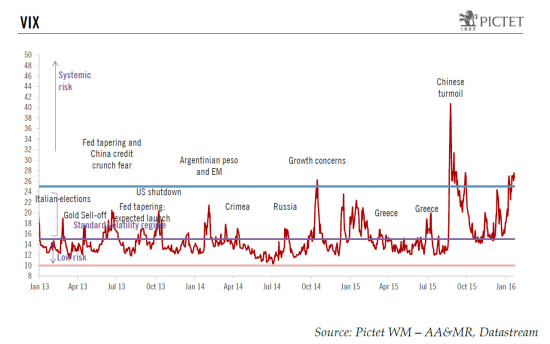

More widely, taking the example of the S&P500, and comparing the recent drawdown with that in August 2015 shows many similarities, but also a key difference. In August, it took six sessions for the index to decline by 11.2%. In the recent episode, it took 15 sessions to decline by 10.5%. During August, the Vix index rose from 14% to 41% in four sessions only, then declined rapidly to the mid-20% level. In 2016, the Vix rose gradually from 16.5% to the current 27%. From a risk-management point of view, the more gradual and sticky rise in volatility in January was more likely to generate risk-reduction measures by investors. When deciding which risky assets to sell, investors currently have to face illiquid markets, notably those which depend on market-making activities like fixed income. As we have seen in previous stress periods, equity markets can be sold for risk-adjustment purpose as other financial markets freeze. The resulting heavy selling pressure then pushes a record high percent of equity index constituents below their long-term moving averages, leading to technically oversold conditions. During the last week, many companies were sold independently from their fundamentals. Such a lack of discrimination could indicate that we have entered the last phase of the portfolio risk-adjustment process.

Valuations, growth and return to shareholders

Are conditions now favourable for a rebound? At respectively 15x and 13.8x forward earnings on the S&P 500 and Stoxx Europe 600, equity markets are not very cheap. Indeed, the S&P 500 is in line with its average since 1988, and above the average by 6.3% excluding TMT bubble. The Stoxx 600 is above its average over the same period by 3.9%, and by 15.5% excluding TMT bubble. Moreover, we expect that volatility, which stood at trough levels from 2013 to H1 2015, will remain higher for longer. The safety net from the Fed has vanished as it has entered its rate-tightening cycle, and this has translated into higher skew levels, which currently stand close to peak levels. The higher the volatility, the more dispersion on valuation levels, but with a lower mean on average. Thus valuation levels should offer little support for equities in 2016.

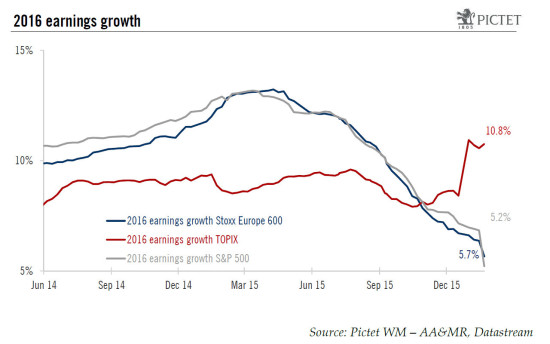

As valuations are not a positive factor, what about earnings? Equity markets sold off at a time when earnings are trending lower globally. The pace of earnings downgrades has accelerated since September 2015, and has not curbed yet. Currently earnings growth for 2016 stands at 5.7% for the Stoxx Europe 600 and 5.2% for the S&P 500. The Japanese TOPIX fares a little better, with 10.8% for this year, owing to strong downgrades on 2015 earnings. Oil & gas sector earnings are expected to shrink further in 2016 after a massive decline in 2015, and their contribution to 2016 earnings growth has already significantly decreased. A sustained market increase would require stronger earnings figures.

In addition, bond market support is clearly diminishing. The rise in corporate yields indicates that the long-term decline in funding is coming to an end. This may influence negatively corporate profitability and decrease companies’ distribution policies. In recent years US companies returned around 2% of their market cap to shareholders through buybacks.

Rationale for a bounce-back: internal market dynamics

Although fundamentals are not necessarily supportive, internal market dynamics may still point to a bounce-back. Since early January implied volatility as measured by the VIX in the US and the V2X in Europe has switched to the highest regime, where the VIX index is above the 25 threshold. It is worth mentioning though that YTD implied volatility has congested around 25, without spiking any further, despite the S&P 500 making a new low close to the August 2015 level. The widening gap between the stock market level and volatility, especially in the US, suggests that the likelihood of a bounce-back has increased.

In terms of drawdowns, a regime shift has occurred since H2 2015. From November 2011 and July 2015, drawdowns on the S&P 500 were mild, ranging from 3.7% to 9.6%. Between 20 July 2015 and 25 August 2015, S&P 500 total return declined by 12%, followed by a further 11.3% between 1 December 2015 and 20 January. Thus sell-offs greater than 10% are no longer unusual, and do not necessarily suggest an imminent market crash. The duration of the sell-off is also significant. On average, pull-backs on the S&P 500 since 2007 have lasted 54 calendar days. The recent selloff has lasted 50 days, suggesting a higher likelihood that equity markets can bounce back from around current levels.

Thus, the divergence between volatility and prices, the duration of the recent correction, as well as the technically oversold situation markets have reached, make a rebound quite likely. The ECB’s indication last Thursday that it will probably further ease monetary policy was likely the catalyst that investors were looking for. However, a sustained rally will depend on action taken by the Federal Reserve. Any indication that rate rises will be slowed, or even cancelled, will ease the dollar’s strength, thus enabling a stabilisation of commodity prices, less tensions in the HY bond market, and an end to the continuous downwards revisions in earnings.