The first chapters to China’s new story now playing out in Shanghai were written down in October 2017. Planning for them had begun years earlier, their author Xi Jinping requiring more research before committing them to paper. Communist authorities there had grown increasingly concerned about the lack of growth potential for its political system by then utterly dependent for a quarter-century on the economy growing. So long as other places around the world wanted what the Chinese could produce relatively more cheaply, then Deng Xiaoping’s vision of a quasi-capitalist (but not really) China would proceed toward that version of “prosperity.” Along came the “somehow” Global Financial Crisis and its Great “Recession, before too long (2011’s Euro$ #2) it just didn’t

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, China, currencies, economy, Featured, Federal Reserve/Monetary Policy, fixed asset investment, GDP, industrial production, Markets, newsletter, Nominal GDP, real GDP, Retail sales, RMB, Xi Jinping

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

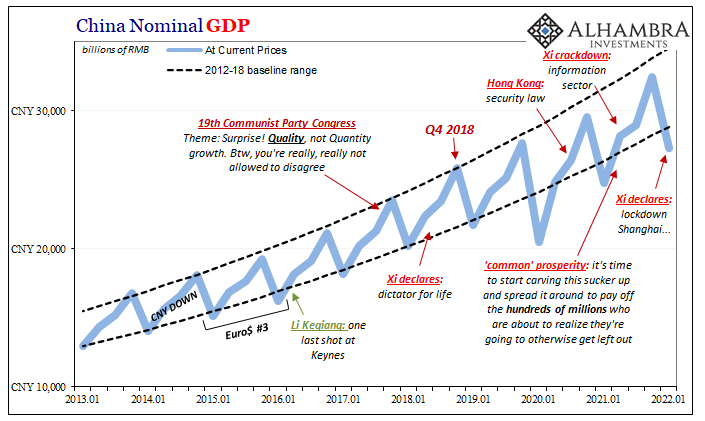

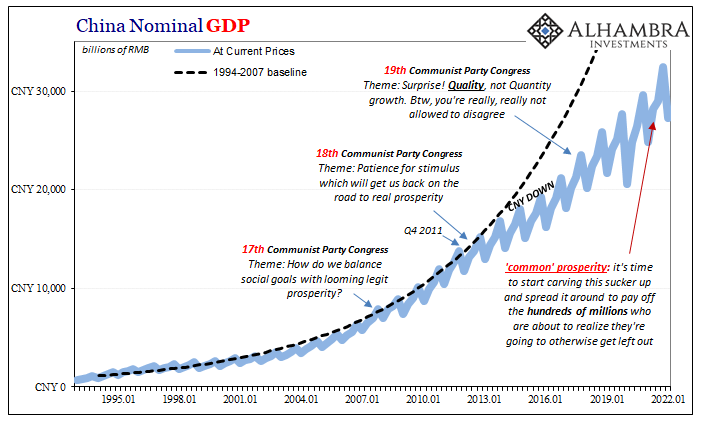

| The first chapters to China’s new story now playing out in Shanghai were written down in October 2017. Planning for them had begun years earlier, their author Xi Jinping requiring more research before committing them to paper. Communist authorities there had grown increasingly concerned about the lack of growth potential for its political system by then utterly dependent for a quarter-century on the economy growing.

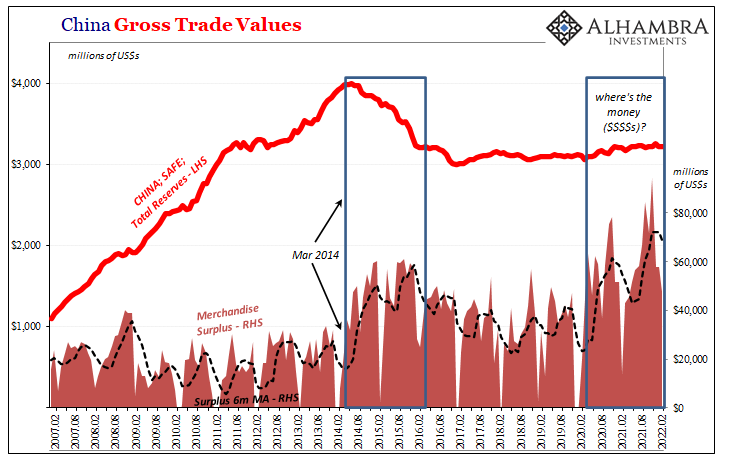

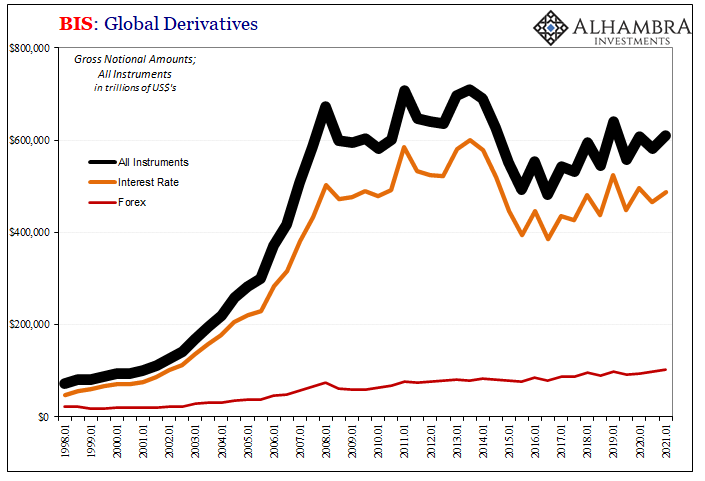

So long as other places around the world wanted what the Chinese could produce relatively more cheaply, then Deng Xiaoping’s vision of a quasi-capitalist (but not really) China would proceed toward that version of “prosperity.” Along came the “somehow” Global Financial Crisis and its Great “Recession, before too long (2011’s Euro$ #2) it just didn’t work that way any longer; despite everyone talking about recovery, consumers around the globe never would recover. The problem with the 2012 slowdown which came next became very apparent in and to Beijing; even if the rest of Western Economists and officials allowed themselves to be deluded by QE’s and other asset purchasing programs from clueless central bankers more interested in playing the Amazing Kreskin rather than being true central bankers. |

|

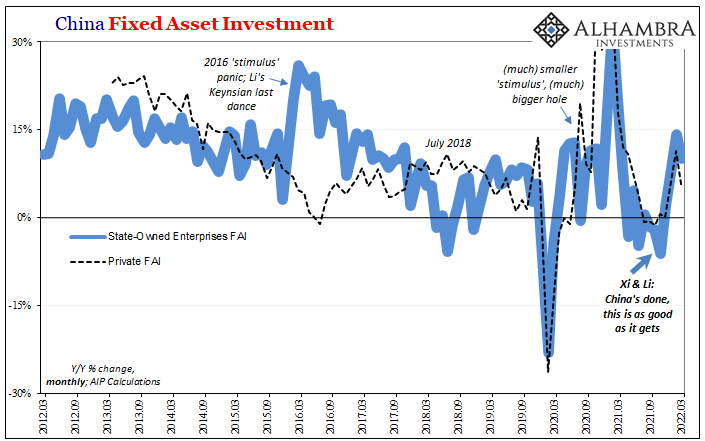

| Xi let Li give it one more Keynesian try, early 2016, if only to make sure China didn’t end up plummeting into Japan 1989 (then risk becoming Soviet Russia circa 1991). Whatever the effects of massive “stimulus”, they weren’t recovery, either. With all the evidence therefore gathered, the Communists would gather in October 2017 to seal every Chinese citizen’s fate.

Ever since that moment, newly-crowned Emperor Xi has been explicitly expanding – and using – his incrementally rising dictatorial powers. Sometimes making demonstrations, such as in Hong Kong, other times more subtle pokes with his multitudes of (re)sharpened sticks (internal police forces). Even the most incorruptible of committed Communists can find themselves at the wrong end of a “corruption” charge leveled from way up on high. These new post-modern Chinese chapters were literally written into China’s Communism-soaked constitution by the man himself; straight away by early 2018 abolishing term limits to set himself up as dictator-for-life, the purposefully audacious revival of Mao-style Cult of Xi, and increasingly harsh social “credit” and demands (Jinping the Pooh now says no kids in China will play more than three hours of video games per week since he demands they do little other than study given this new Chinese economy and its need for a total Hail Mary of home-grown “scientific” “innovation”). The Shanghai lockdown of 2022 has as much to do with COVID as last year’s crackdown on the information sector over there did. |

|

| Both of those little more than the same progression hardwired into the politics-by-economy four and a half years ago when globally synchronized growth revealed itself to be a planted, officially sanctioned (in the West) mirage.

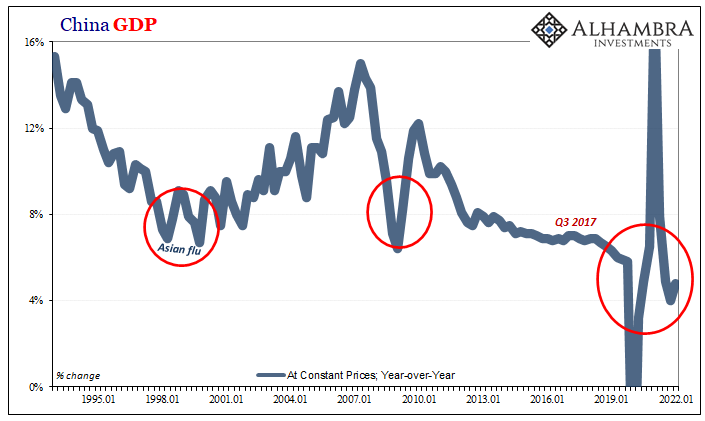

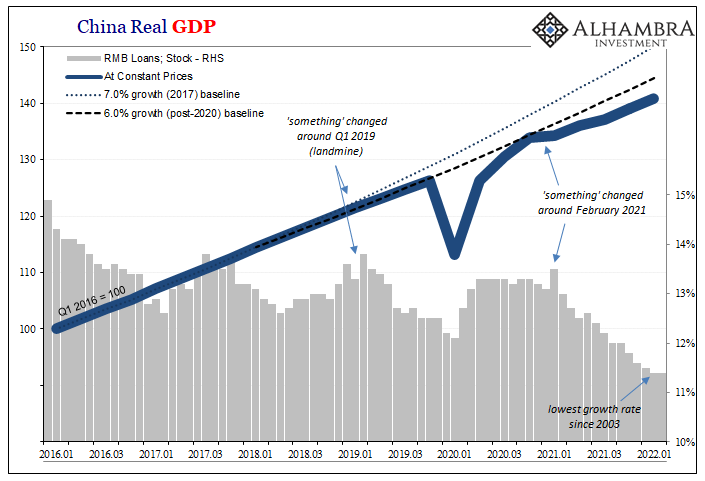

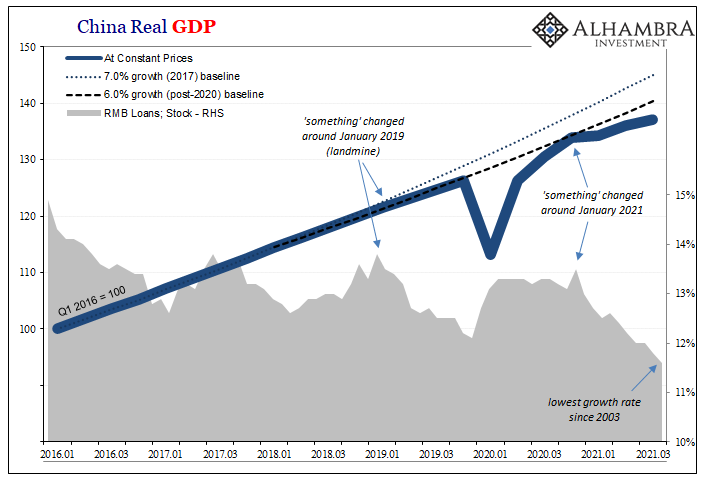

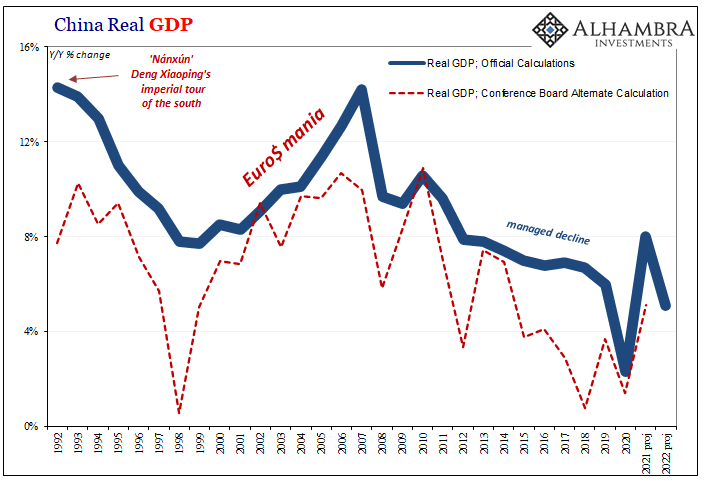

Updated economic data produced for the first quarter of 2022, released in the late hours last night, draw these straight lines out perfectly, one thing to the next – even if one of those “nexts” in between just happened to be the global coronavirus freakout. Regardless of the pandemic, just look how cleanly China’s economy cleaved pre-19th in late 2017 versus post-19th 2018 and thereafter to this day. At this point, the numbers themselves really don’t matter. Up or down, hit or miss, what’s only-too-clear is how they are, continuously, in the same post-2018 malaise. The best months or quarters would only have once qualified as among the worst; while the current bad estimates reach new lows of worst. The specifics anyway: real GDP was better than expected, slightly, rising 4.8% year-over-year instead of slowing a touch from Q4 2021’s really low level. |

|

| Quarter-over-quarter, China’s NBS says (I know, manipulated is all we have to go on) GDP at constant prices increased 1.3%, which, as I just wrote, merely continues the same level of not-good. | |

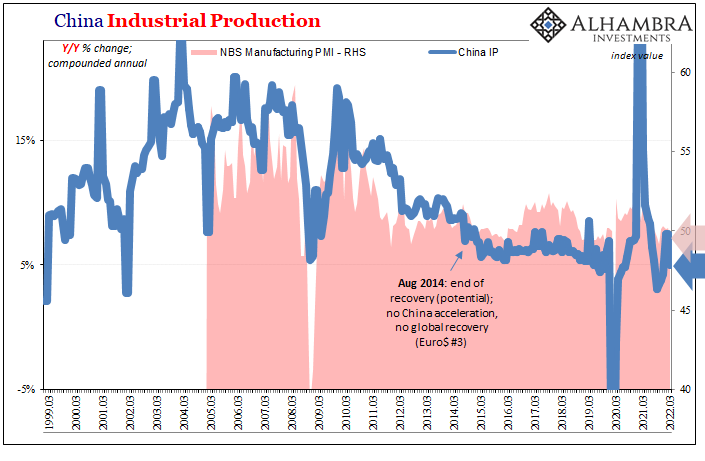

| Apart from GDP, the Big Three of Retail Sales, Industrial Production, and Fixed Asset Investment (FAI) – each updated for the month of March 2022 – all disappointed regardless of whether one or another matched or exceeded current estimates by the slimmest margin.IP last month rose a dim 5.0% year-over-year, blamed on COVID rather than 19th Congress Xi. That somewhat matches the sentiment data already provided by the NBS’s PMI which dropped below 50 for the same month of March; with more downside room to spare in each.

Compared to March 2019, pre-corona, China’s industrial output has scraped together a 5.8% growth rate, annualized, for all three years. |

|

| As I have to write every month now, it used to be 8% was considered a long-run floor; then it was 7%; nowadays, a three-year of less than six per is being touted as success and inflationary global growth. | |

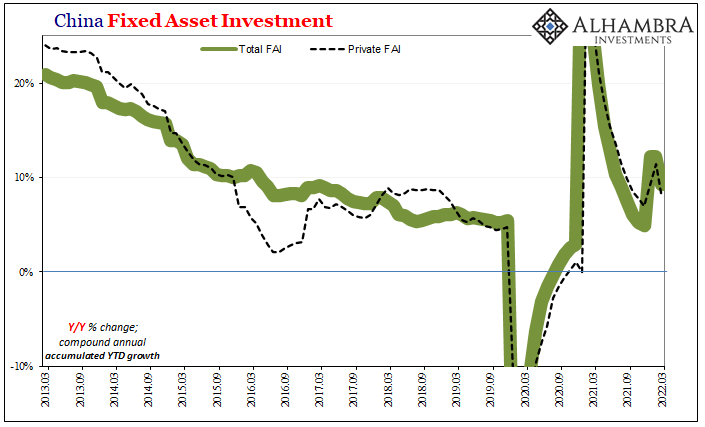

| FAI had surprised to the upside in last month’s January-February update, no longer for the vastly more voluminous March. According to the latest estimates, accumulated (meaning, YTD including surprising Jan-Feb) FAI rose just 9.3% from the first three months of 2021. That was down rather sharply from 12.2% posted during the prior pair, meaning a considerable slowdown just the one updated month.

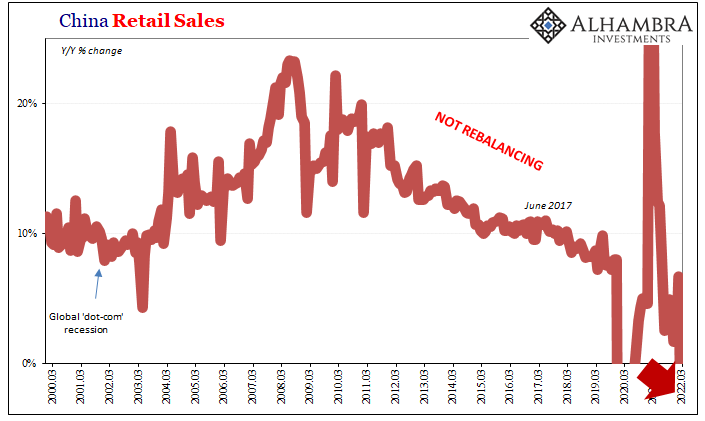

Blamed on COVID, what else? Then there are China’s consumers, who, since Xi first took over a decade ago, have been said to lead the Chinese economy’s transformation (rebalancing) away from investment-industry first and into the Western-style Maoist 21st century wealth-driven dream. |

|

| If that was ever a realistic goal, oh boy.

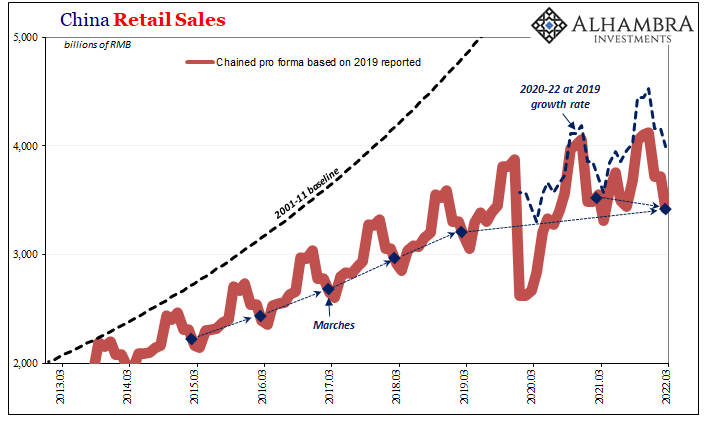

NBS estimates put total retail sales down 3.5% (off the chart below) in March 2022 compared to a not-really-robust March 2021. Yes, Shanghai makes some of this difference, but the real difference is, like GDP, ever since 2018 long before the coronavirus. That latter factor merely produces more low in these new lows, having nothing to do with its very well-established multi-year trajectory. |

|

| Total retail sales are now so far behind, and so consistently behind, even their lowered 2019 trend that it can’t really be about pandemic politics so much as political economy.

Shanghai’s lockdown, therefore, a response to it as much as the reason for the sinking of retail sales in March 2022. For many who bought into globally synchronized growth way back when, it only seems as if Xi’s tough-guy stance is something new, a locked-in health-related attempt to save face under surprising COVID struggles. No. This is so much more than the virus. The real disease infects the global economy. Xi Jinping certainly isn’t its first nor primary author. Give the man some credit, though: the guy’s been authoritative on the subject as he’s acted more authoritarian in as many ways as he can imagine. |

Tags: Bonds,China,currencies,economy,Featured,Federal Reserve/Monetary Policy,fixed asset investment,GDP,industrial production,Markets,newsletter,Nominal GDP,real GDP,Retail sales,RMB,Xi Jinping