Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar. It wasn’t a true gold standard as only other countries that were party to the agreement could demand gold in exchange for their dollars, but it was at least a standard of some kind. Nixon didn’t intend to end Bretton Woods altogether but rather anticipated a negotiation that would result in some devaluation of the buck. A very tall future Fed Chairman named Paul Volcker, at Treasury at the time, did indeed try to negotiate a devaluation but it was never implemented. . And since

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Portfolios, Alhambra Research, bonds, Bretton Woods, commodities, Consumer Sentiment, currencies, Economics, economy, european stocks, exorbitant privilege, Featured, Federal Reserve/Monetary Policy, Friedrich Hayek, Gold, Japan, japanese stocks, John Maynard Keynes, jolts, LTCM, Markets, newsletter, Real estate, Richard Nixon, stocks, US dollar

This could be interesting, too:

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Ryan McMaken writes A Free-Market Guide to Trump’s Immigration Crackdown

Wanjiru Njoya writes Post-Election Prospects for Ending DEI

Swiss Customs writes Octobre 2024 : la chimie-pharma détermine le record à l’export

| Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar. It wasn’t a true gold standard as only other countries that were party to the agreement could demand gold in exchange for their dollars, but it was at least a standard of some kind. Nixon didn’t intend to end Bretton Woods altogether but rather anticipated a negotiation that would result in some devaluation of the buck. A very tall future Fed Chairman named Paul Volcker, at Treasury at the time, did indeed try to negotiate a devaluation but it was never implemented. | |

| And since that day the dollar and most developed country currencies have floated, their value dependent on the market’s judgment of their value. It was a brave new world that took us a while to figure out but…well, never mind, we still haven’t really figured it out. The Fed still seems largely ignorant of the forces that shape dollar supply and demand and surely the politicians who shape economic policy have no clue. One thing hasn’t changed though. John Connally, the Treasury Secretary at the time, said the dollar was “our currency, but your problem” and boy has that proven true over the decades since.

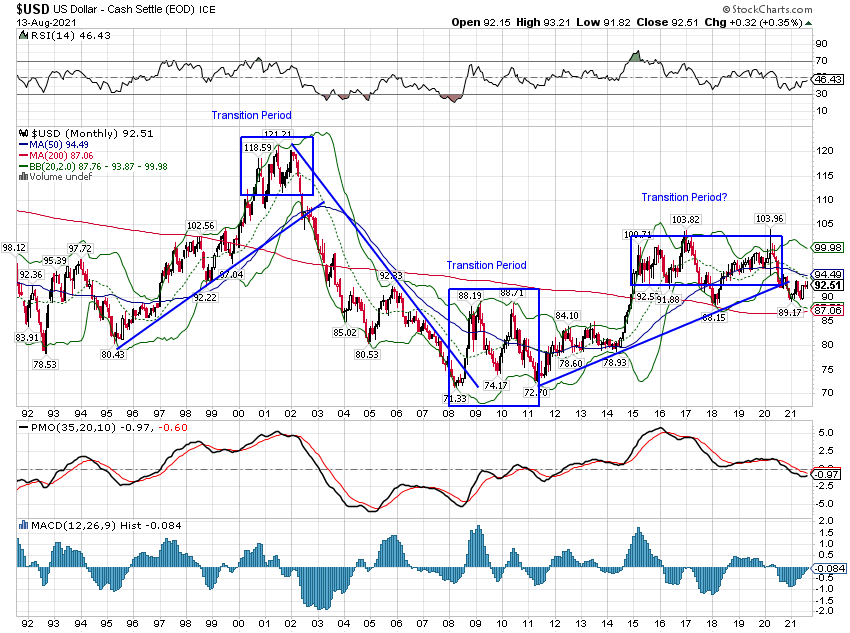

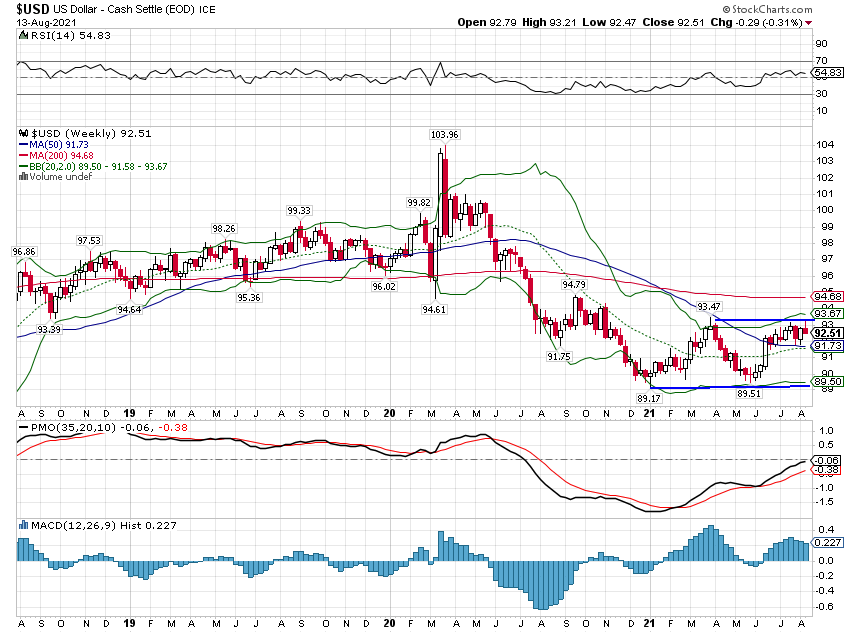

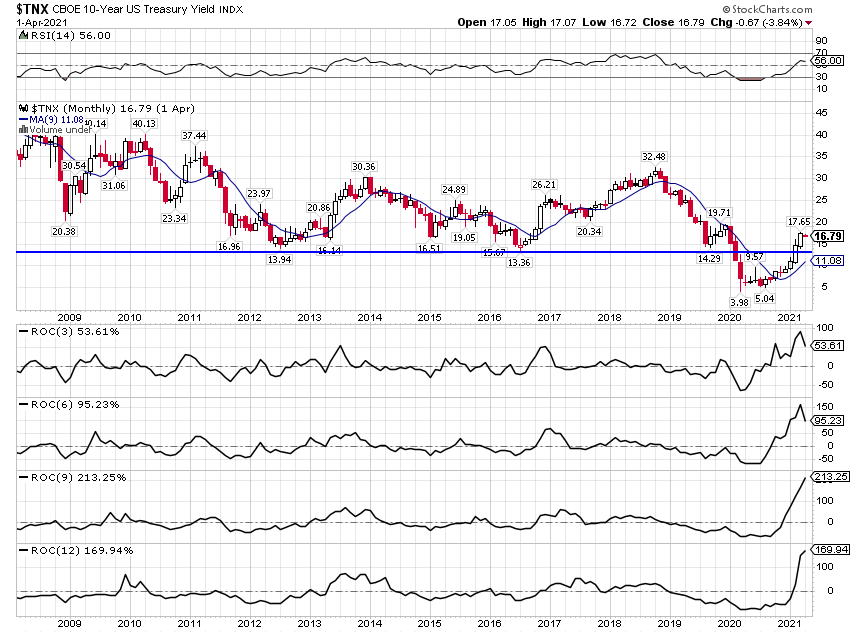

I have been investing since 1982 and the movement of the dollar has been an important factor (cause and/or effect) in a number of the important market events that have happened during the 4 decades I’ve been paying attention. The dollar played a significant role in the 1984 Peso crisis, the Japanese stock and real estate bubbles and subsequent collapse (Plaza and Louvre Accords), the US stock market crash of 1987, the S&L crisis of the early 90s, another Peso crisis in 1994, the Asian crisis of 1997-98 which also brought down LTCM, the dot com bubble in the late 90s, the real estate and commodity booms of the early 00s that led directly to the 2008 crisis and the QE world we’ve lived in ever since. Some of those crises were precipitated by a too strong dollar while others were created from a too weak dollar which is why I have said for many years that what we should strive for is not a strong or weak dollar but rather one that is stable. Fixed exchange rates may be too tight a straightjacket but too much volatility also presents some problems. The volatility of the dollar does present some problems for the world but, for better or worse, it is the world’s reserve currency and I see no real threat to that status on the horizon. We spend a lot of time thinking and writing about the dollar at Alhambra because we think it is the most important price in the world. It affects capital flows around the world which impact global inflation and economic growth and therefore returns in a variety of markets. The trend of the dollar plays an outsized role in our investment process affecting our allocations to stocks, real estate, commodities and bonds. Contrary to popular belief though, its value is not mostly a function of Federal Reserve policy. The dollar’s value is determined by the market, by individuals and companies and countries assessing a wide range of economic policies and conditions globally and making decisions about how to borrow and invest. And while the volatility can be inconvenient at times, we do prefer the market to a small group of politically motivated economists. One thing we can’t do though is predict the future course of the dollar. I have said this many times and I will keep repeating it because I am constantly asked what we “expect”. For the record I expect nothing and after nearly 40 years of this am surprised by little. We are not in the business of predicting the future. Economists are still infected today with what Hayek in his Nobel acceptance speech called the “pretense of knowledge”. Economics is not a hard science and there is no way to “acquire the full knowledge which would make mastery of the events possible” as socialists throughout history have discovered repeatedly. And yet, economists continue to believe that, while the socialists have failed, they will succeed in essentially the same task, predicting future economic statistics to hundredths of a percent. With no ability to predict the future, we must wait for the dollar to reveal its course and react accordingly. Dollar trends have, in the past, been fairly persistent and long lasting. Since the mid-90s there have been three distinct periods with a strong dollar from 1995-2001, a weak dollar from 2002-2008 and a strong dollar until 2017. Since 2017 the dollar index has traded in a narrow range of about 10%; trends within that range have been choppy and fairly short lived. There are other ways to measure the value of the dollar – versus gold for instance – and we certainly take those into account but it is the value relative to the other alternatives that has the biggest impact on asset prices and our portfolios. |

|

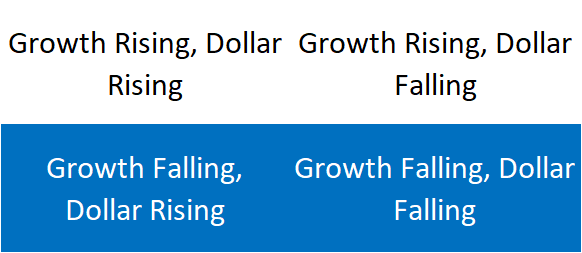

| I positioned our portfolios for a weak dollar period early last summer and maintained those positions until early this year when the dollar stopped falling. It has traded in an even narrower range since then and our portfolios have become increasingly more conservative as we await the next move. About all I can say is that historically, periods of stability have been fairly brief and so I expect a fairly sizable move sometime soon. But which direction? I don’t know and the dollar isn’t the only factor in our asset allocation process. Economic growth is also important and based on the recent volatility of interest rates there is no more consensus about that than the direction of the dollar. And of course, the two variables are related and feedback on each other. Strong growth attracts investment to the US which strengthens the dollar which tends to attract more investment that creates more growth. And of course, that can go in the other direction too. | |

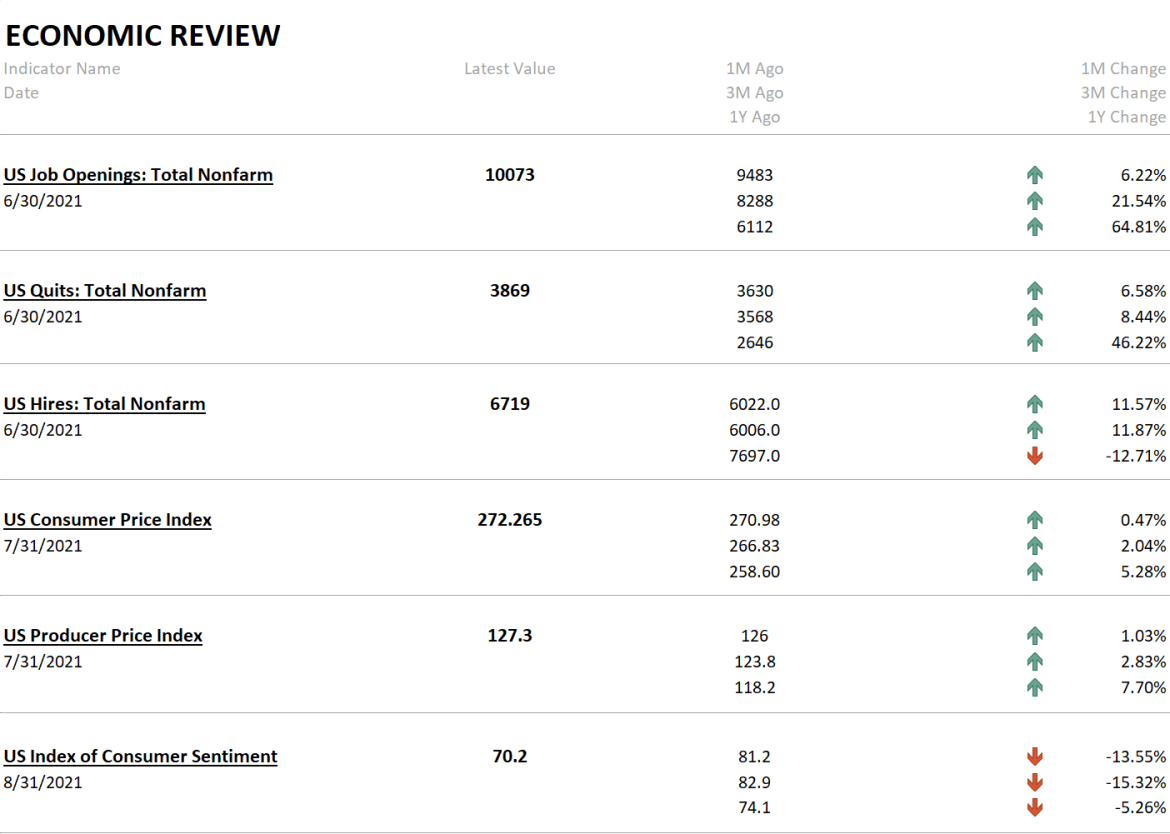

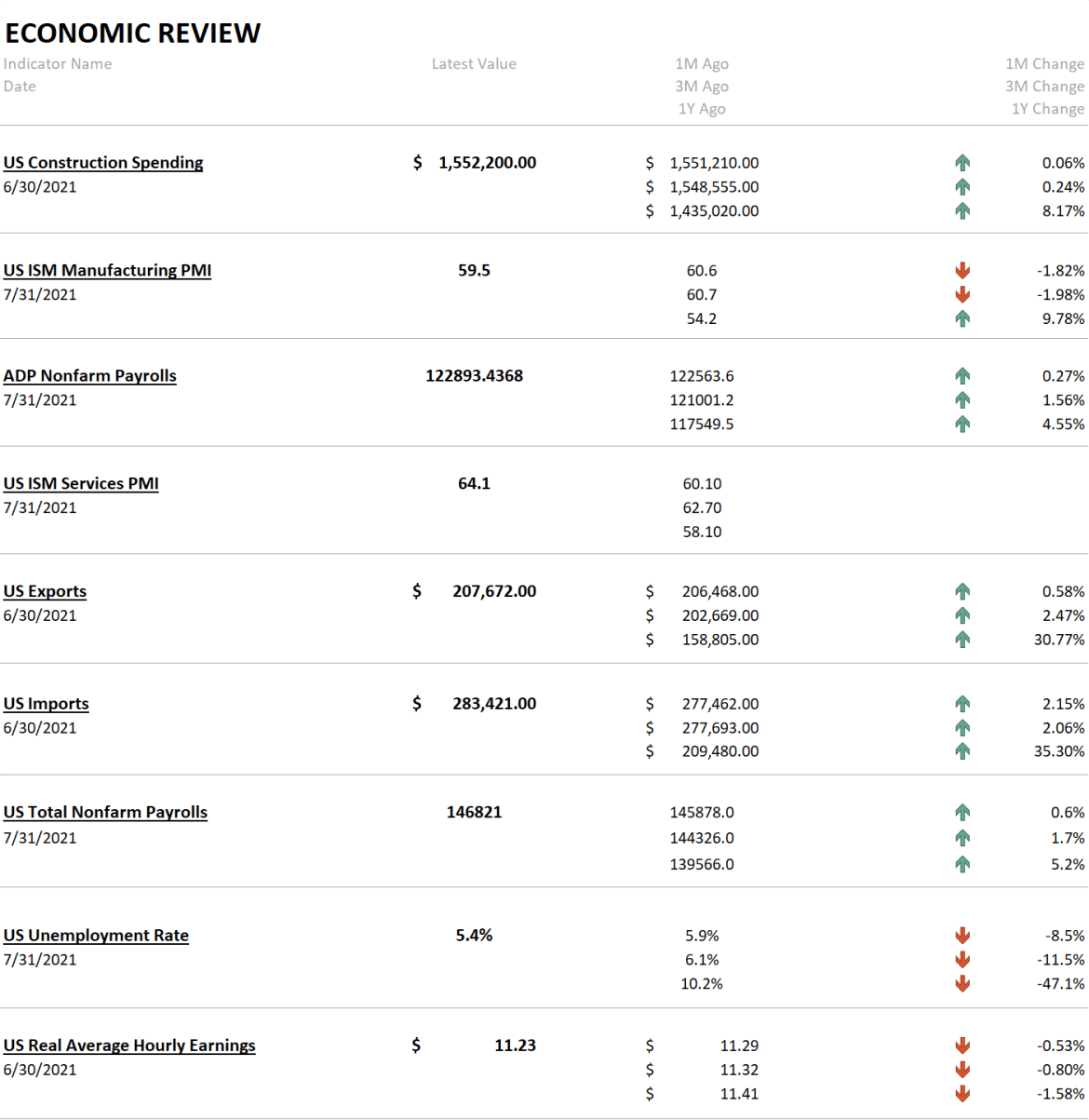

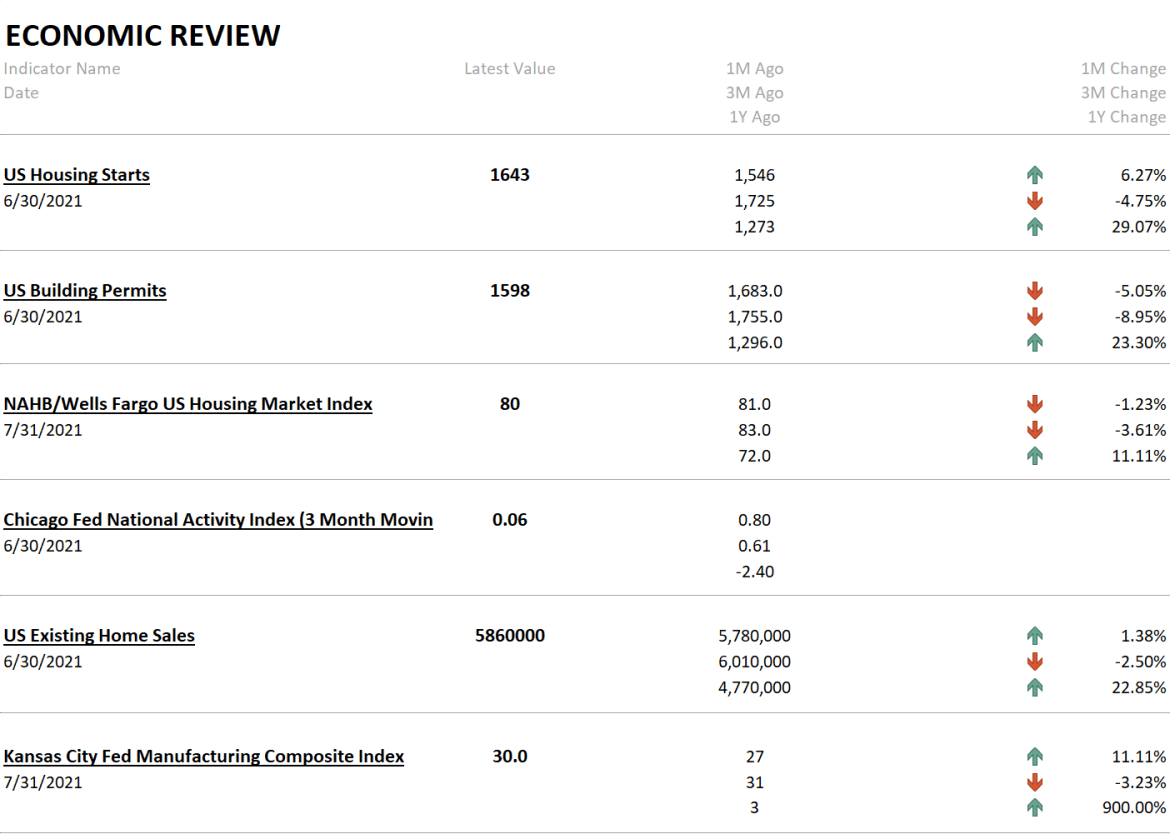

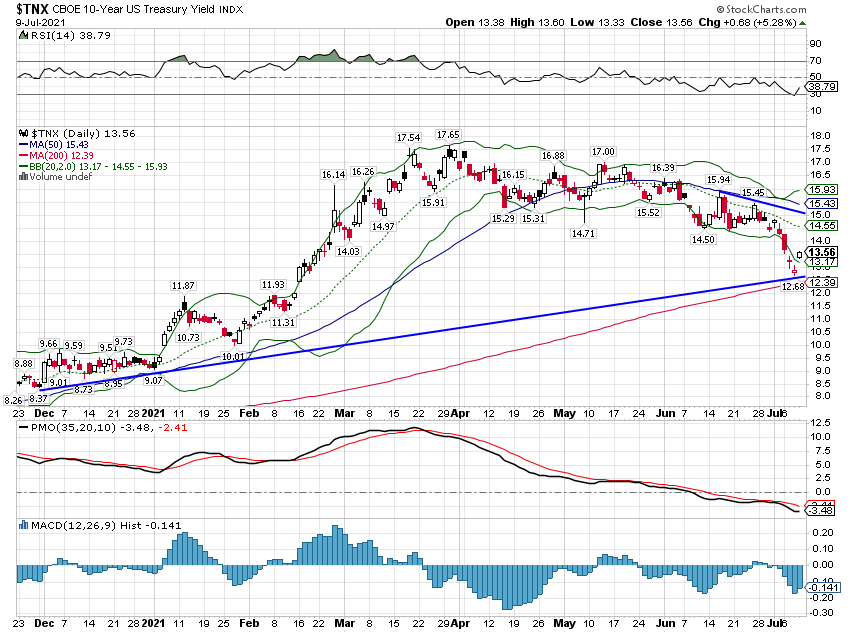

| On the economic growth front, the economic data we received last week was useless from the perspective of discerning a trend which is probably why, after trading in an 11 basis point range, the 10 year Treasury note ended the week essentially unchanged. Rates rose early in the week on a very strong JOLTS report that showed more job openings than people to fill them and fell late in the week on a stunningly weak consumer sentiment report. Unfortunately the Job Opening report was based on June data while sentiment reflects responses in the last couple of weeks. Consumer sentiment fell across the board with current conditions and expectations both down. The drop to 70.2 from 81.2 puts today’s sentiment lower than April of last year right after the economy was shut down and the stock market had crashed. | |

| The index has only dropped that severely 6 other times in the last 50 years, all of which were connected to sudden negative changes in the economy. The only larger percentage monthly drops were last April and October of 2008. The report put the blame on concerns about the COVID Delta variant but I think sticker shock played a role too. The percentage of respondents who said it was a good time to buy a car or a house fell to an all time low (30%). It isn’t coincidence that prices for both those items have risen dramatically over the last year.

With the economic outlook so uncertain, my instinct is to shrink the portfolio to a more neutral position and that is what we’ve done. I have no more chance of predicting the next dollar trend than I do the flip of a coin. The negative consumer sentiment may improve if the trend of COVID infections improves. Or it may become even more negative if prices continue to rise. There is no way to know and I don’t think I’m being paid to guess. So, I’m doing my best to be virtuous. Patience my friends, patience. |

|

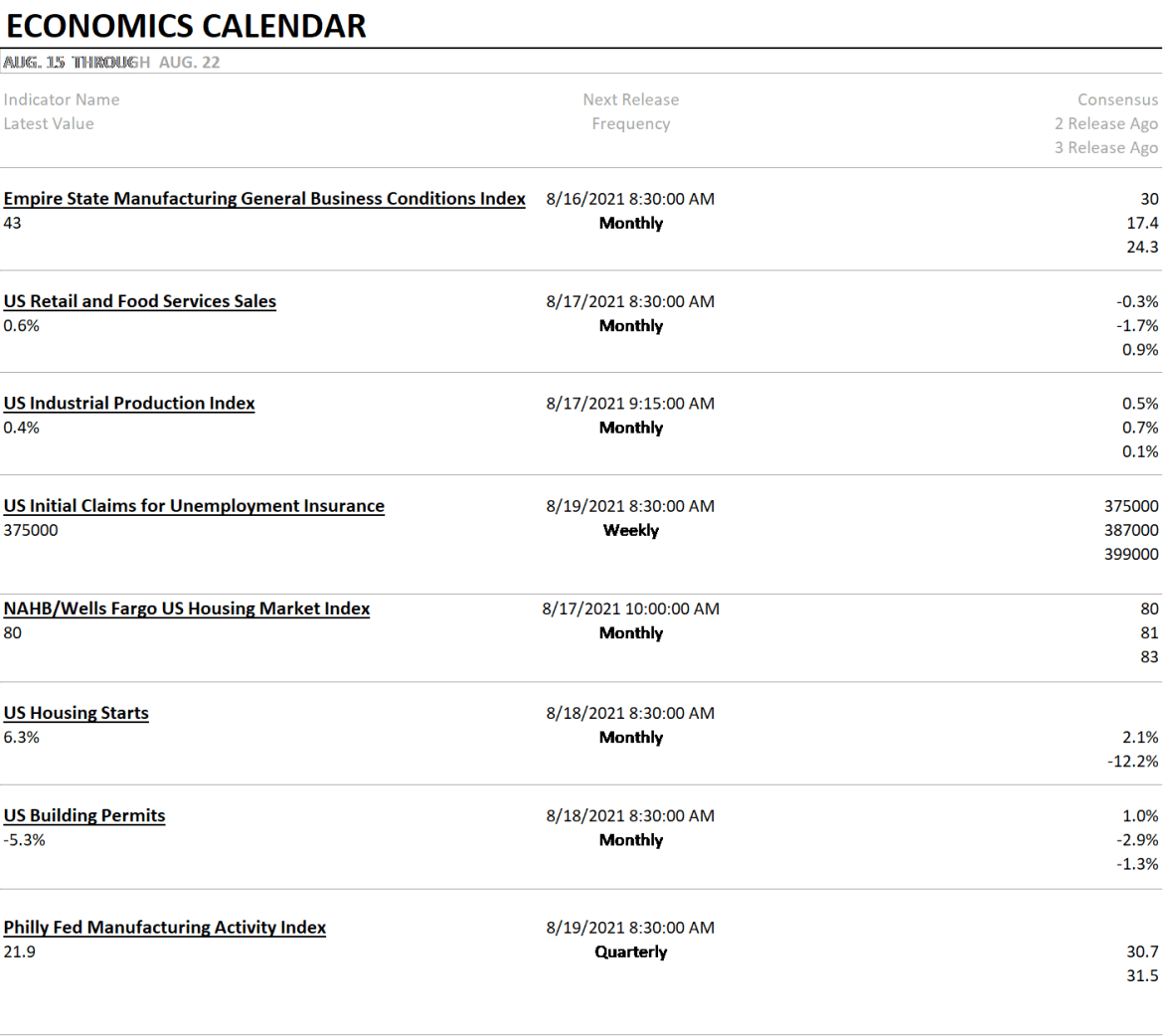

| This week we get several indicators on the goods side of the economy with the regional Fed surveys, industrial production and retail sales. We also get another look at the housing market which has been weak and a drag on last quarter’s GDP. | |

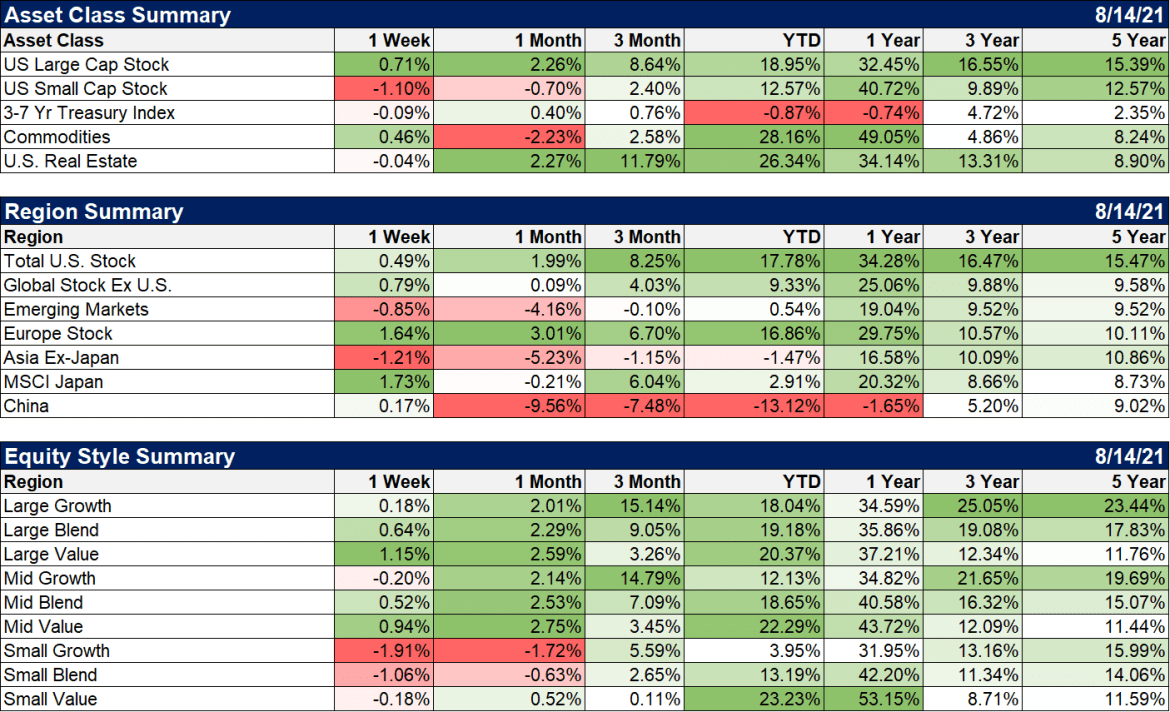

| Europe and Japan led the way last week while US markets were led by the value indexes. Europe’s economic conditions have recently improved and corporate earnings in Japan have been strong. If the dollar turns weaker those trends will likely persist and strengthen. The Yen is already looking stronger and the restructuring of the Japanese corporate sector continues apace. There are, obviously, geopolitical concerns in Asia but I have never found politics, domestic or international, to be a good investment guide. | |

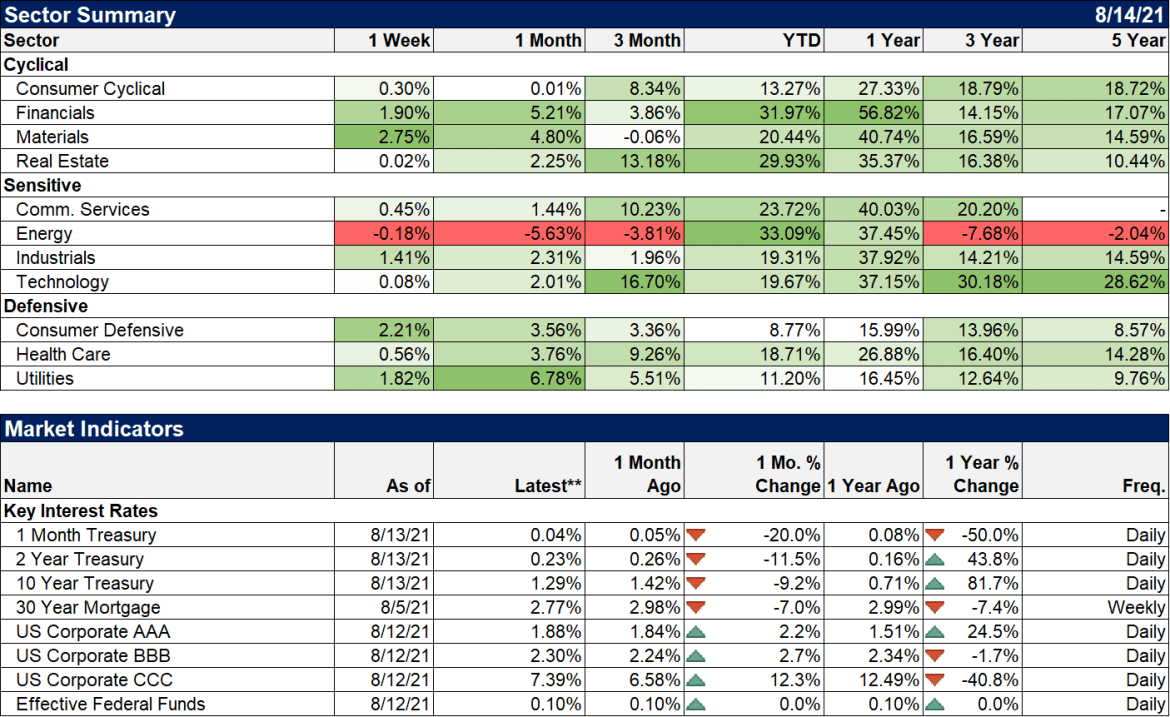

| Financials, real estate and energy continue to lead YTD but energy has hit a rough spot over the last quarter. We have pulled back on our real estate investments after a big run as valuations are not nearly as compelling as they were last year. | |

Richard Nixon’s move to delink the dollar from gold 50 years ago was seen at the time as something that would weaken the dollar’s “exorbitant privilege” as Giscard d’Estaing called its place as the world’s reserve currency. The dollar did weaken initially but its reserve currency role remains intact with nearly 90% of forex transactions involving the dollar. Yes, it’s market share in trade has fallen some but no other currency even approaches the importance of the dollar. My entire career I’ve been hearing calls for a return to gold or some other currency “system” but for all its drawbacks, the lack of any global agreement on currency values is probably better than anything that could be conceived through political negotiation. Trust the market. It works.

Tags: Alhambra Portfolios,Alhambra Research,Bonds,Bretton Woods,commodities,Consumer Sentiment,currencies,Economics,economy,european stocks,exorbitant privilege,Featured,Federal Reserve/Monetary Policy,Friedrich Hayek,Gold,Japan,japanese stocks,John Maynard Keynes,jolts,LTCM,Markets,newsletter,Real Estate,Richard Nixon,stocks,US dollar