The virus news stream is mixed; the dollar has stabilized; US-China tensions continue to ratchet up We will get some more US economic data for May; weekly jobless claims are expected at 2.4 mln Eurozone and UK reported firm preliminary May PMI readings; BOE officials continue to take a very dovish tone South Africa is expected to cut rates 50 bp to 3.75%; Turkey is expected to cut rates 50 bp to 8.25% Japan and Australia reported preliminary May PMIs; Korea reported weak trade data for the first 20 days of May The dollar is broadly firmer against the majors as rising US-China tensions dent market sentiment. Euro and sterling are outperforming, while the Antipodeans are underperforming. EM currencies are mixed. INR and RUB are outperforming, while CNY and TRY are

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The virus news stream is mixed; the dollar has stabilized; US-China tensions continue to ratchet up

- We will get some more US economic data for May; weekly jobless claims are expected at 2.4 mln

- Eurozone and UK reported firm preliminary May PMI readings; BOE officials continue to take a very dovish tone

- South Africa is expected to cut rates 50 bp to 3.75%; Turkey is expected to cut rates 50 bp to 8.25%

- Japan and Australia reported preliminary May PMIs; Korea reported weak trade data for the first 20 days of May

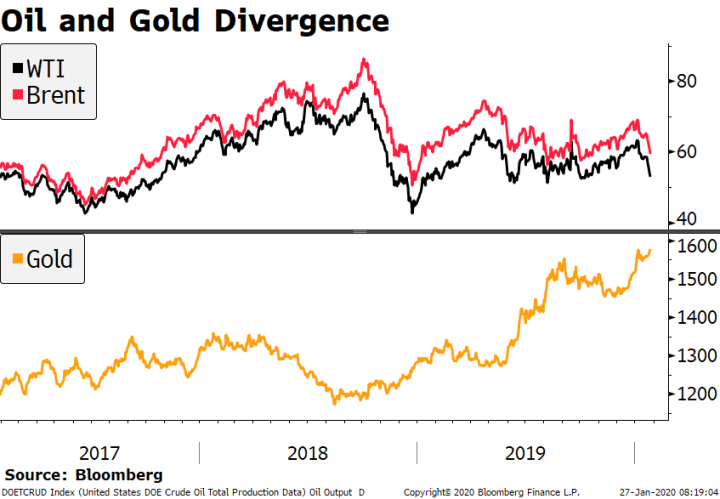

The dollar is broadly firmer against the majors as rising US-China tensions dent market sentiment. Euro and sterling are outperforming, while the Antipodeans are underperforming. EM currencies are mixed. INR and RUB are outperforming, while CNY and TRY are underperforming. MSCI Asia Pacific was down 0.4% on the day, with the Nikkei falling 0.2%. MSCI EM is down 0.1% so far today, with the Shanghai Composite falling 0.6%. Euro Stoxx 600 is down 0.7% near midday, while US futures are pointing to a lower open. 10-year UST yield is down 1 bp at 0.67%, while the 3-month to 10-year spread is down 1 bp +56 bp. Commodity prices are mixed, with Brent oil up 1.7%, WTI oil up 1.9%, copper down 0.3%, and gold down 0.8%.

The virus news stream is mixed. Total cases worldwide have now topped 5 mln, with over 1.5 cases in the US alone. Saudi Arabia and other Gulf states were forced to reimpose restrictions as cases spike during Ramadan. Restrictions had been eased for the Muslim holy fasting month, but Saudi Arabia announced a nationwide 24-hour curfew starting Saturday and into next week, when Eid al-Fitr marks the end of Ramadan. On the other hand, Japan lifted the state of emergency in Osaka, Kyoto, and Hyogo today and may end Tokyo’s as early as Monday if current trends continue.

The dollar has stabilized. DXY is trading higher off of yesterday’s low near 99 but remains below 100. The euro traded at its highest level since May 1 near $1.10 yesterday before running out of steam. Sterling feels heavy after failing to break above the $1.23 area yesterday. Lastly, USD/JPY has edged higher even as risk-on sentiment has faded a bit today, though 108 still looks tough to crack.

AMERICAS

US-China tensions continue to ratchet up. The US Senate passed a bill last night that could bar some Chinese companies from listing in the US. What’s noteworthy is that this effort was bipartisan, as the bill was introduced by Republican Kennedy (Louisiana) and Democrat Van Hollen (Connecticut). It would require companies to certify that they are not under the control of a foreign government or face delisting. Elsewhere, President Trump escalated the rhetoric against President Xi, accusing him of pushing a “disinformation and propaganda attack on the US and Europe.” Once the National People’s Congress this weekend is over, we expect stronger pushback from China.

We will get some more US economic data for May. Philly Fed survey is expected at -40.0 vs. -56.6 in April. Last week, the Empire survey came in at -48.5 vs. -60.0 expected and -78.2 in April. Preliminary Markit PMI readings will also be reported, with manufacturing expected to improve to 39.5 from 36.1 in April and services expected to improve to 32.3 from 26.7 in April.

Weekly jobless claims are expected at 2.4 mln vs. 2.981 mln last week. If so, this would mean that around 39 mln will have become jobless over the last nine weeks, which is over 25% of the labor force. Of note, this claims data is for the BLS survey week that contains the twelfth of the month. Consensus currently sees -7 mln jobs this month and follows -20.5 mln in April. Leading index and existing home sales will also be reported today.

FOMC minutes yesterday held few surprises. One interesting tidbit is that some officials felt that forward guidance could be more explicit, perhaps being either outcome-based or date-based. Yet at the same time, the Fed saw “extraordinary uncertainty” and “considerable risks” in the medium-term, which to us makes any sort of explicit forward guidance extremely tricky. For now, the Fed reiterated its stance of holding rates near zero until the pandemic is over and the economy is on track to meeting the Fed’s dual mandates. It’s worth noting that negative rates were not discussed.

Fed speakers today will likely give a more recent snapshot of Fed thinking than the April 28 FOMC minutes. Williams, Clarida, and Powell all speak. Despite the Fed pushback this past week, Fed Funds futures are still pricing in a small chance of negative rates by Q3 2021. We expect more pushback today and continue to believe that the Fed will never go negative.

EUROPE/MIDDLE EAST/AFRICA

Eurozone reported preliminary May PMI readings. Headline manufacturing rose to 39.5 vs. 38.0 expected and 33.4 in April, services rose to 28.7 vs. 25.0 expected and 12.0 in April, and the composite rose to 30.5 vs. 27.0 expected and 13.6 in April. Of note, German manufacturing PMI came in a bit weaker than expected at 36.8. Both Germany and France saw their composite readings rise from April to 31.4 and 30.5, respectively.

Bank of England officials continue to take a very dovish tone. Yesterday, Bailey, Broadbent, and Cunliffe all appeared before the Treasury Committee. Governor Bailey would not rule out negative rates and acknowledged that the bank is examining just what its lower bound for rates might be. Bailey admitted that his position on going negative had changed since entering the pandemic, but noted that negative rates had received “pretty mixed reviews” elsewhere. It’s very noteworthy that the BOE is not actively pushing back against negative rates like the Fed is. We don’t think either goes negative but these days, perception is everything. WIRP suggests the BOE may go negative as soon as this November, moving up significantly from May 2021 at the end of last week.

UK reported preliminary May PMI readings. Manufacturing rose to 40.6 vs. 37.2 expected and 32.6 in April, services rose to 27.8 vs. 24.0 expected and 13.4 in April, and the composite rose to 28.9 vs. 25.7 expected and 13.8 in April. On the other hand, the Confederation of British Industry reported total orders for May at -62 vs. -50 expected and -56 in April, suggesting the scope for recovery remains limited.

South African Reserve Bank is expected to cut rates 50 bp to 3.75%. However, expectations are all over the place as some analysts see no cut as well as cuts ranging from 25-100 bp. There’s been no news behind the recent rand outperformance, and think it’s mostly driven by the wider EM rally and improved market sentiment. We are surprised to see these gains ahead of the SARB meeting. Data have been coming in very weak and supports aggressive easing but we don’t think it’s ZAR-supportive.

Turkey central bank is expected to cut rates 50 bp to 8.25%. A handful of analysts look for deeper 75 or 100 bp cuts, while one sees a 25 bp move. Recent firmness in the lira may give the central bank confidence to cut deeper and so we see some risks of a dovish surprise today. CPI rose 10.94% y/y in April, the lowest since November but still well above the 3-7% target range. The weak lira is likely to pose some inflationary risks but policymakers remain focused on boosting the economy.

ASIA

Japan reported April trade and preliminary May PMI readings. Exports contracted -21.9% vs. -22.2% expected, while imports contracted -7.2% vs. -13.2% expected. The drop in exports was the biggest since 2009 and was the 17th straight month of contraction, which underscores the headwinds on the Japanese economy. Meanwhile, manufacturing PMI fell to 38.4 vs. 41.9 in April, services rose to 25.3 vs. 21.5 in April, and the composite rose to 27.4 vs. 25.8 in April. With the economy starting to reopen, we believe the Bank of Japan is in wait and see mode. It will hold a special meeting tomorrow to finalize details of its lending program but is not expected to change rates or QE.

Australia reported preliminary May PMI readings. Manufacturing fell to 42.8 vs. 44.1 in April, services rose to 25.5 vs. 19.5 in April, and the composite rose to 26.4 vs. 21.7 in April. For now, signals suggest the RBA is in wait and see mode. Next policy meeting is June 2 and no change is expected then. For now, WIRP suggests some risk of another rate cut but no risk of negative rates from the RBA. AUD was turned back from the .66 area as tension between US-China and Australia-China are still rising. Above that, the 200-day moving average near .6660 should prove tough to crack.

Korea reported trade data for the first 20 days of May. In the first 10 days of the month, Exports fell -16.9% y/y vs. -46.3% in the first 10 days, while imports fell -20.3% y/y vs. -37.2% in the first 10 days. Despite the improvement seen over the course of this month, the overall outlook for regional trade and growth remains poor. The Bank of Korea cut rates 50 bp to 0.75% in March but kept rates steady in April. Next policy meeting is May 28 and another cut then is likely.

Tags: Articles,Daily News,Featured,newsletter