The capital markets will turn increasingly quiet in the week ahead as the Christmas holiday thins participation. If this is the season of goodwill, investors are lapping it up. Global equity markets are finishing a strong year on a high note. Record highs were recorded in the S&P 500 and the Dow Jones Stoxx 600. The MSCI Emerging Markets equity index is at its best level since August 2018. Risk assets are doing well, while interest rates have backed up. The CRB Index of commodities is at the year’s highs. It is as if investors once again sense a synchronized recovery. There may be doubts over the magnitude of Chinese purchases of US goods over the next couple of years, but agreement signals an extension of the broad tariff truce, and this is seen as an unalloyed

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Canada, Featured, Japan, newsletter, Sweden, United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The capital markets will turn increasingly quiet in the week ahead as the Christmas holiday thins participation. If this is the season of goodwill, investors are lapping it up. Global equity markets are finishing a strong year on a high note. Record highs were recorded in the S&P 500 and the Dow Jones Stoxx 600. The MSCI Emerging Markets equity index is at its best level since August 2018. Risk assets are doing well, while interest rates have backed up. The CRB Index of commodities is at the year’s highs.

It is as if investors once again sense a synchronized recovery. There may be doubts over the magnitude of Chinese purchases of US goods over the next couple of years, but agreement signals an extension of the broad tariff truce, and this is seen as an unalloyed good. China’s economic data suggests some stabilization of the world’s second-largest economy. After cutting rates three times this year, Fed officials across the hawk-dove spectrum say the US economy is in a “good place,”

Recent data from East Asia suggests the trade implosion may be ending, and Micon’s guidance underpinning ideas the headwinds in the semiconductor industry may be abating. Japan’s economy is contracting in Q4, as the economy reels from the sales tax increase and the typhoon, but is expected to return to growth early in the New Year. The PMI readings in Europe suggest the worst may be passed, even if meaningful traction is still elusive.

The UK election lifts some Brexit uncertainties, but the terms of the new relationship with the EU is fraught with risks. Prime Minister Johnson is maneuvering to avoid a repeat of the Brexit delays, which means that if an agreement is not struck by the end of next year (and such negotiations usually take years to complete), the UK will leave with only the WTO standards governing this significant relationship. This is understood to be potentially significantly disruptive. The UK joins Japan and Canada among the G7 to provide fiscal stimulus in 2020.

The economic calendar is light next week, and in any event, ought not to challenge the holiday mood. The US reports the Chicago Fed’s National Activity Index. It has been in negative territory in all but two of the first ten months of the year. In 2018, it fell in three months. This year’s average reading is -0.29, while in the Jan-Oct period in 2018, it averaged 0.19. This is not a widely followed report, but like the Leading Economic Indicator, which has not risen in since July, offers some worrying signs about the strength of the US economy.

While the headline durable goods orders for November ought to have improved from the 0.5% reading in October, the details may be poorer. Most of the orders appear to be coming from the auto sector, and when transportation is eliminated, a small gain is likely. Shipments are expected to have fallen by after the 0.8% gain in October than snapped a three-month decline. Existing home sales set the cyclical high in September and slipped (by 0.7%) in October and may have slipped a touch again in November, according to the Bloomberg survey.

United StatesRounding out next week’s US data includes the Richmond Fed’s manufacturing survey and the weekly jobless claims. Three other Fed surveys for December have been reported. The Philadelphia and Kansas Fed survey were sequentially weaker and poorer than expected. The Empire State survey tick up (3.5 from 2.9) but missed the median forecast (Bloomberg survey) of 4.0. Weekly jobless claims spiked to year’s high (252k) in the week ending December 6 and pulled back (234k) in the week ending December 13. The four-week moving average before the jump was a little below 220k. The divergence between the Atlanta and New York Fed’s GDP trackers narrowed a bit last week as the former edged up to 2.1% (from 2.0%) while the latter nearly doubled to 1.3%. The implied yield of the December 2020 fed funds futures contract rose to 1.395% last week from 1.32% the previous week. It is the highest since August 1. The current effective average is 1.55%. This means that about a 60% chance of a cut next year has been discounted. |

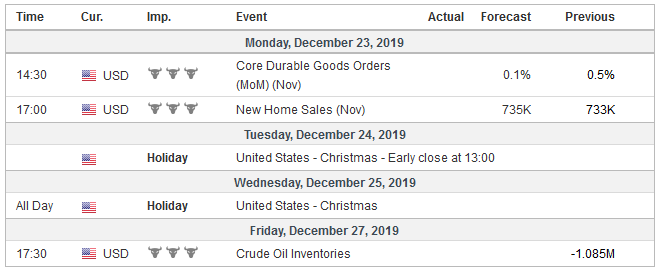

Economic Events: United States, Week December 23 |

Japan’s sales tax increase brought forward economic activity and especially consumption. This was evident in the depressing October reports. However, in the holiday-shortened week ahead, Tokyo will likely report a bounce back in retail sales in November. After a 14.2% drop in October retail sales, the median forecast in the Bloomberg survey calls for a 5% rise. However, industrial production, which slumped 4.5% in October, probably continued to contract in November. The median forecast looks for a 1.1% decline. It would be the third contraction in four months.

Canada and Sweden have parallel stories. Inflation is firm in both countries, and this appears to be the driver of monetary policy considerations, while the real economies disappoint. Sweden’s Riksbank became the first central bank to have introduced negative rates to bring them back zero. Sort of. The refi rate is at zero, but the repo rate and deposit rate remain in negative territory (-25 bp and -35 bp, respectively). The economy has disappointed. The composite PMI has not been above the 50 boom/bust level since August. The three-month average of house prices in November was at its lowest level of the year. Industrial orders fell for the fifth consecutive month in October. Unemployment is volatile in Sweden, but this year’s average through November is about 6.8%, nearly 0.5% above the year-ago period.

Many observers see the Riksbank move as indicative of some general official recognition that negative interest rates are not working. However, this seems to be an exaggeration. At her first press conference as ECB President Lagarde pushed back against such accusations and defended negative rates. The Swiss National Bank also shows no signs that it has become convinced that negative rates are counter-productive. Nor does the BOJ seem ready to throw in the towel on negative interest rates.

Canada reported the highest median core CPI (2.4%) in a decade last week, and that helped lift the two-year yield to nine-month highs (~1.75%) and seemed to reinforce the Bank of Canada’s decidedly neutral policy. Yet real sector data disappointed. The 38.4k full-time positions lost in November was the largest decline of the year. The median forecast in the Bloomberg survey called for a 10k increase. It was the first back-to-back loss of full-time jobs since March-April 2017. The latest disappointment was last week’s report that showed retail sales collapsed 1.2% in October, the largest decline since November 2017. Excluding autos, Canadian retail sales fell by 0.5%, the third consecutive monthly decline. It has not risen since June.

Canada will report October’s monthly GDP on December 23. The economy expanded at a monthly average of 0.1% and a 1.3% annualized pace in Q3. That compares with a monthly average of 0.3% in Q2 and an annualized pace of 3.5%. The median forecast expects that the economy stagnated in October. The risk appears to be on the downside.

Tags: Canada,Featured,Japan,newsletter,Sweden,United States