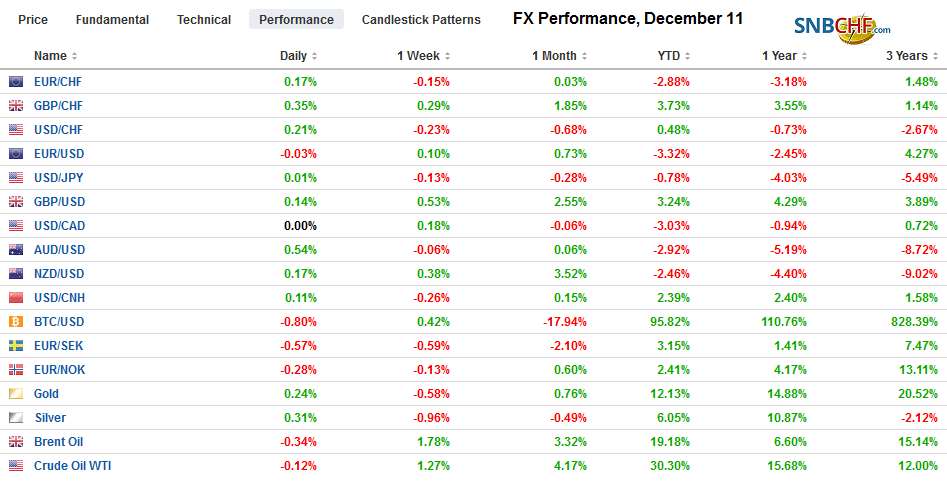

Swiss Franc The Euro has risen by 0.12% to 1.093 EUR/CHF and USD/CHF, December 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets continue to tread water as investors await this week’s key events. The first, the FOMC meeting concludes later today. Tomorrow features the UK election, where the race appears to have tightened, and Lagarde’s first ECB meeting at the helm. Global equities continue consolidating the recent gains. Asia Pacific equity markets were mostly higher. Hong Kong led the advancers with a 0.8% rise of the Hang Seng and a 1% rise in an index of H-shares. Tokyo was a notable exception. It slipped marginally (less than 0.1%) for the second consecutive session. Europe’s Dow

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Currency Movement, EUR/CHF, Featured, FX Daily, Japan Producer Price Index, NAFTA, New Zealand, newsletter, trade, U.S. Consumer Price index, U.S. Core Consumer Price Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.12% to 1.093 |

EUR/CHF and USD/CHF, December 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

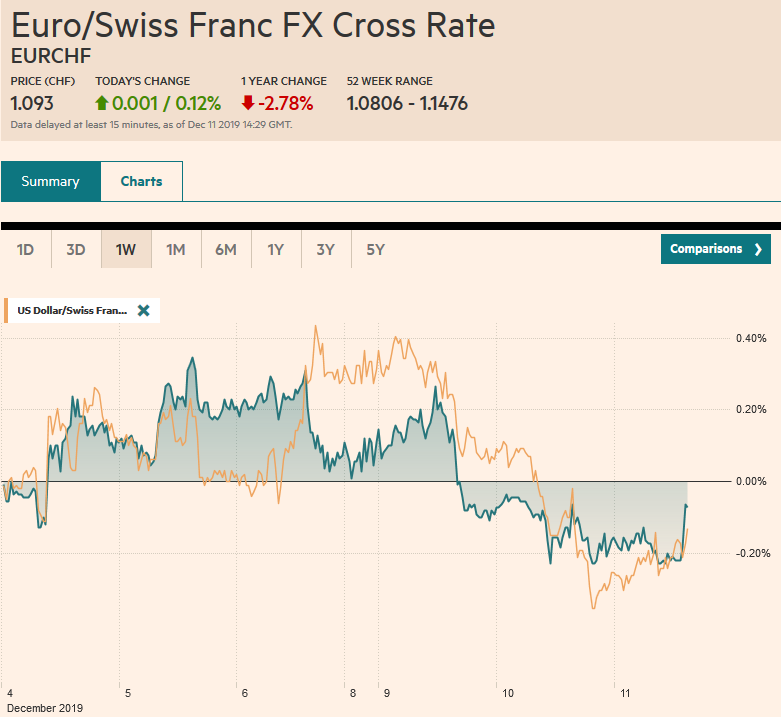

FX RatesOverview: The capital markets continue to tread water as investors await this week’s key events. The first, the FOMC meeting concludes later today. Tomorrow features the UK election, where the race appears to have tightened, and Lagarde’s first ECB meeting at the helm. Global equities continue consolidating the recent gains. Asia Pacific equity markets were mostly higher. Hong Kong led the advancers with a 0.8% rise of the Hang Seng and a 1% rise in an index of H-shares. Tokyo was a notable exception. It slipped marginally (less than 0.1%) for the second consecutive session. Europe’s Dow Jones Stoxx 600 recovered smartly yesterday, but there has been no follow-through buying today. It is nursing losses for the third consecutive session. If it closes lower today, it would be the eighth losing session in the past 10. The S&P 500 gapped higher in response to last week’s employment data. It entered the gap yesterday but failed to close it (bottom of the gap is ~3119.5). The 10-year US Treasury and most European benchmark yields are 1-2 bp lower today. The dollar remains mired in narrow ranges. Outside of the Swedish krona, where a firm CPI reading underpins expectations for a rate hike next week, and the Australian dollar, which appears to be benefitting from the unwinding of cross positions against the New Zealand dollar, most major currencies have drifted a little lower through late morning turnover in Europe. Oil and gold are little changed. |

FX Performance, December 11 |

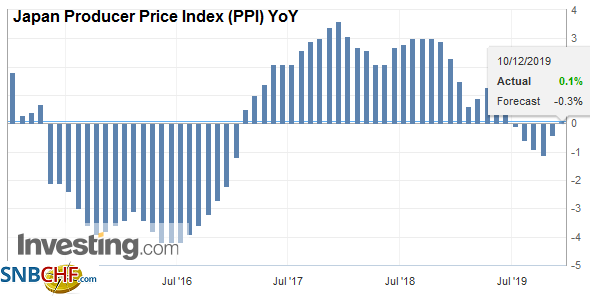

Asia PacificJudging from the press accounts, Chinese officials seem to be anticipating that the Sunday’s tariffs on around $160 bln on its goods entering the US will not be implemented. If it is, which is to say, if the tariff truce ends, then the attempt to negotiate a phase-one deal has ended unsuccessfully. While US officials have played up the possibility of an agreement that would make the December 15 tariffs unnecessary, a formal decision is not expected until at least Thursday, and probably not until Friday. Agriculture Secretary Perdue seemed to have been among the most explicit about “backing away” from new tariffs. This was partly blunted by comments from White House Trade Adviser Navarro, saying that he was not aware that any decision was made. Japan unexpectedly reported its first year-over-year increase in producer prices since May. The gain was small (0.1%) but feeds into a narrative in the making that the coming fiscal stimulus will lift the economy. The BOJ meets next week, and Governor Kuroda may echo the comments in the media, suggesting Prime Minister’s Abe’s spending bill could give an upside risk to the central bank’s GDP forecasts. Still, investors have the Tankan Survey to deal with this week, and it is expected to show a deterioration in business sentiment and weaker capex intentions. |

Japan Producer Price Index (PPI) YoY, November 2019(see more posts on Japan Producer Price Index, ) Source: investing.com - Click to enlarge |

New Zealand announced an NZ$12 bln of new capital investment that will produce a budget deficit in the current fiscal year and smaller surpluses in the next few years. This may take some pressure off monetary policy next year when New Zealand holds elections. The government forecasts 2.3% growth in the fiscal year through June (down from the May forecast of 3.2%), and with the fiscal support, 2.9% next year.

The dollar reached about JPY108.85, a three-day high in early Tokyo, but has drifted lower subsequently and returned to session lows in the European morning (~JPY108.65). There is an option for $450 mln at JPY108.75 and another for $1.3 bln at JPY109 that expires today. The Australian dollar held support at $0.6800 yesterday and is firmer today, trading to about $0.6830. A close above yesterday’s high (~$0.6840) would help lift the technical tone. The Aussie looks more attractive against the New Zealand dollar. Initially today, the Aussie fell to new four-month lows against the Kiwi but has since rallied back and is trading above yesterday’s high (~NZD$1.0430). The dollar is firm against the Chinese yuan, but it is shaping up to be the third consecutive session with less thana 0.1% net move.

Europe

A YouGov poll, using a statistical methodology that proved insightful in 2017, suggests tomorrow’s election outcome has narrowed considerably. This is broadly consistent with the pattern in 2017, where the Tories enjoyed a wide margin that diminished as the election drew near. To be sure, the YouGov poll still shows a Tory majority but only 28 seats rather than 68 seats that it had predicted a couple of weeks ago. The polls show the Tories winning 339 seats, down from 359. Some observers suggest that the tightening of the contest will influence the strategic voting and could be even closer than the YouGov projects. Sterling briefly traded above $1.32 yesterday and traded a little above $1.31 in early Asia. It is just below the middle of the range in late morning turnover in London.

The ECB meets tomorrow. No change is expected, and the broad economic assessment is unlikely to materially change. We expect Lagarde to bring stylistic changes to the ECB more than a change in the activist course Draghi paved. She may draw more for her senior team and give them more limelight. The review of the ECB’s monetary policy thrust may change the wording around the 2% inflation target, but most importantly will be addressing the dissents. Without formal recognition, those that disagree with the ECB seem compelled to take their case to the media. Other central banks find a way to give the dissents space, and this seems to be the direction the ECB will move.

The euro continues to consolidate the loss suffered in the wake of the stronger US jobs report before last weekend. It reached a high that day near $1.1110 before the report. Yesterday and today it traded just below $1.11. There is a 1.2 bln euro option struck there that expires today and another 1.1 bln euros tomorrow. Initial support is seen around $1.1075 today, and yesterday’s low was near $1.1065. Sterling recovered from the election jitters and is around the middle of the $1.31-$1.32 range. Expiring options may deter near-term gains. There is an option for about GBP435 mln at $1.3150, another for GBP315 mln at $1.3185, and a one for almost GBP390 mln at $1.3200.

AmericaIt appears that the USMCA has been approved in principle and now needs to be approved by the US Congress and Canada’s parliament. There was hope that this could be done this year, but it is looking increasingly unlikely. The majority leader in the Senate (McConnell) confirmed this yesterday and was quickly reflected in the pricing at PredictIt. However, given that the Speaker of the House (Pelosi) and the head of the AFL-CIO have endorsed it, approval seems to be a formality. The Federal Reserve meets today, the last meeting in a challenging year. The hike last December looks like a mistake in hindsight, but at the time, the market itself was not convinced that the tightening cycle was complete. The drop in equities had pushed out the next move into H2 19. Instead, the Fed reversed gears and in a “midcourse correction” cut rates three times in H2 19 and now has once again signaled its comfort with the adjustment. |

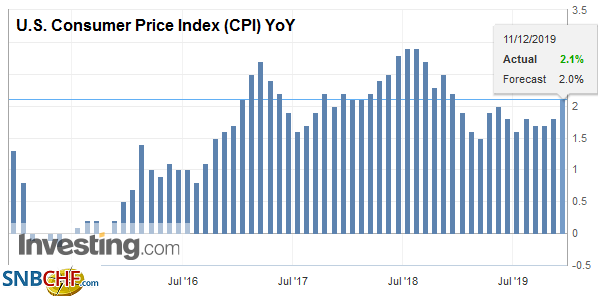

U.S. Consumer Price Index (CPI) YoY, November 2019(see more posts on U.S. Consumer Price Index, ) Source: investing.com - Click to enlarge |

| In September, the last time the Fed updated its forecasts, seven officials thought a rate above 2% would be appropriate at the end of 2020, and another two saw the proper range to be 1.75%-2.0%. These forecasts will likely be cut, and the median, which stood at 1.875%, will fall. No official anticipated a lower rate than the current range (1.50%-1.75%). In comments in which the risks are identified, the Fed’s leadership hardly cites a single upside risk. All the risks are to the downside.

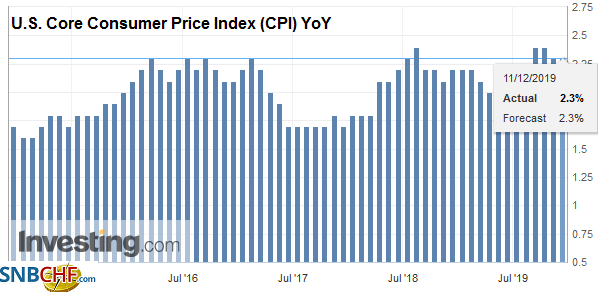

There does seem to be a near-term risk to the upside for CPI. Last month’s data is the economic highlight ahead of the FOMC statement. Recall that in November and December 2018 and January 2019, headline inflation did not rise on a monthly basis. This makes for comparisons easy and suggests headline inflation may drift higher, starting with today’s report. On the other hand, the core rate rose by 0.2% a month over that three-month stretch that began in November 2018.The base effect likely means the core rate is more stable and consistent with the long-term pattern whereby the headline will converge closer to the core. |

U.S. Core Consumer Price Index (CPI) YoY, November 2019(see more posts on U.S. Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

Outside of the US CPI and FOMC meeting, the other highlight is Brazil’s central bank’s rate decision. Recall that the Brazilian real’s fall to record lows against the dollar spurred intervention last month. That intervention helped spur its recovery, and on Monday, it traded near five-week highs before consolidating yesterday. The dollar tested chart support near BRL4.12. In October, the central bank indicated that it saw scope for another 50 bp rate cut, and the consensus expects it to be delivered today, bringing the Selic rate to 4.5%. This would be a new record low, and many think that the rate cut, the fourth in H2, may prove to be the last.

After rallying sharply at the end of last week amid divergent jobs report, the US dollar is consolidating its gains against the Canadian dollar and finding support ahead of CAD1.3220. Yesterday’s high was near CAD1.3250, and a move above it would suggest the consolidation is over. Last week’s high was set near CAD1.3320. The dollar bounced against the Mexican peso on news that the new NAFTA was not going to be passed by the US Senate this year, and it tested the 200-day moving average (a little above MXN19.28). Still, a delay is seen as just technical and Mexico’s high-interest rates, underscored by Brazil’s likely cut, is attracting flows. Psychological support near MXN19.20 was frayed yesterday, but we see the mid-November low in the MXN19.17-MXN19.18 area as more important.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Currency Movement,EUR/CHF,Featured,FX Daily,Japan Producer Price Index,NAFTA,New Zealand,newsletter,Trade,U.S. Consumer Price Index,U.S. Core Consumer Price Index,USD/CHF