Our scenario of ongoing global growth moderation and elevated political uncertainties should, we believe, support defensive currencies. We consider a currency ‘defensive’ if it is likely to remain resilient should global risk appetite falter. Among major currencies, the US dollar, the Japanese yen and the Swiss franc are usually considered as defensive. Indeed, the structural current account surplus and large net foreign assets of both Japan and Switzerland make them less vulnerable during periods of low risk appetite. By contrast, the defensive nature of the US dollar mostly stems from its wide international usage and its link to the world’s most liquid safe haven: US Treasury bonds. Overall, defensive currencies are very close to a safe haven and therefore

Topics:

Perspectives Pictet considers the following as important: 2.) Pictet Macro Analysis, 2) Swiss and European Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Our scenario of ongoing global growth moderation and elevated political uncertainties should, we believe, support defensive currencies. We consider a currency ‘defensive’ if it is likely to remain resilient should global risk appetite falter.

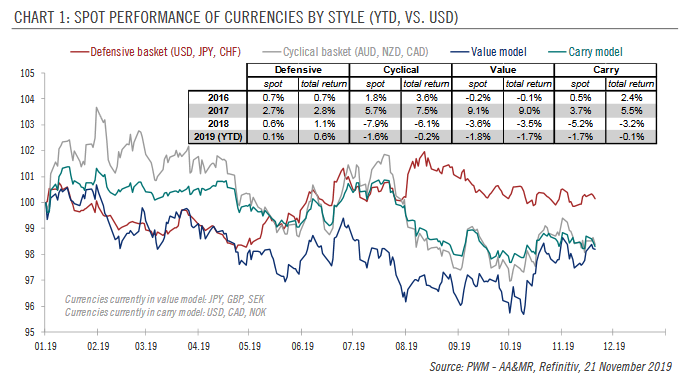

Among major currencies, the US dollar, the Japanese yen and the Swiss franc are usually considered as defensive. Indeed, the structural current account surplus and large net foreign assets of both Japan and Switzerland make them less vulnerable during periods of low risk appetite. By contrast, the defensive nature of the US dollar mostly stems from its wide international usage and its link to the world’s most liquid safe haven: US Treasury bonds. Overall, defensive currencies are very close to a safe haven and therefore usually offer a very low yield. Cyclical (or commodity) currencies tend to behave very differently from defensive ones. These currencies are usually from countries that are highly dependent on the global growth outlook (in particular because of their net commodity-exporter status) and usually offer elevated yield (or carry), notably to attract capital flows to finance their current-account deficits. Among major currencies, the Canadian, Australian and New Zealand dollar are prime examples of cyclical currencies. |

SPOT PERFORMANCE OF CURRENCIES BY STYLE (YTD, VS.USD) |

Another class of currencies can stem from their misalignment to their long-term fundamental equilibrium. Similar to value stocks, currencies that are deemed undervalued offer a relatively attractive risk-reward ratio for long positions. Unfortunately, convergence to ‘fair value’ can often take years. Currently, we consider the Japanese yen, the Swedish krona and the pound sterling as the most undervalued of major currencies.

Out baseline scenario of ongoing global growth moderation is unlikely to be supportive of cyclical currencies. But while the US dollar has benefitted from its defensive and high-yielding features, we are wary of the erosion of its carry advantage given its high fundamental valuation. The Japanese yen seems more attractive given its significant undervaluation. More precisely, we see scope for a move towards JPY100 per USD in the next 12 months.

Overall, next year is likely to feel a bit like 2019, with ongoing concerns about global growth, dovish central banks and elevated political uncertainties. Consequently, we favour a defensive bias ,which has already proved successful in the last two years. The current low-yielding environment and the weak global growth outlook suggest cyclical currencies may have to get cheaper before being more attractive.

Tags: Featured,newsletter