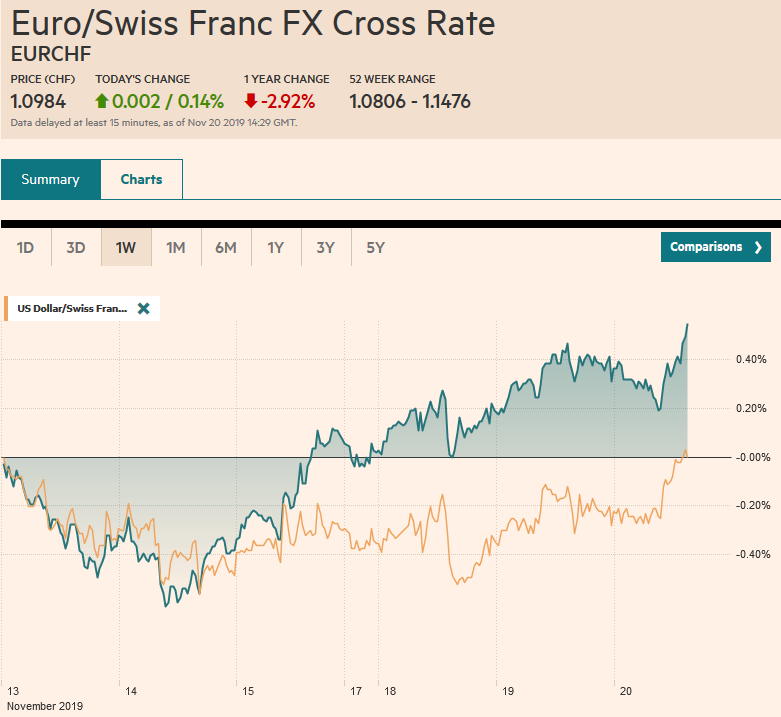

Swiss Franc The Euro has risen by 0.14% to 1.0984 EUR/CHF and USD/CHF, November 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The idea that a US-China trade deal is proving more elusive than the agreement in principle on October 11 implied is being seized upon to spur what we suspect is an overdue round of profit-taking in global equities. The MSCI Asia Pacific Index snapped a three-advance, with over 1% declines in South Korea and Australia. Europe’s Dow Jones Stoxx 600 set new multiyear highs yesterday before reversing lower and is extending the losses today, threatening the 20-day moving average for the first time in a month. US shares are trading heavily, and the gap (~3098.2-3104.6) created by last

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, Brexit, Currency Movement, EUR/CHF, Featured, FX Daily, Japan Trade Balance, newsletter, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.14% to 1.0984 |

EUR/CHF and USD/CHF, November 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

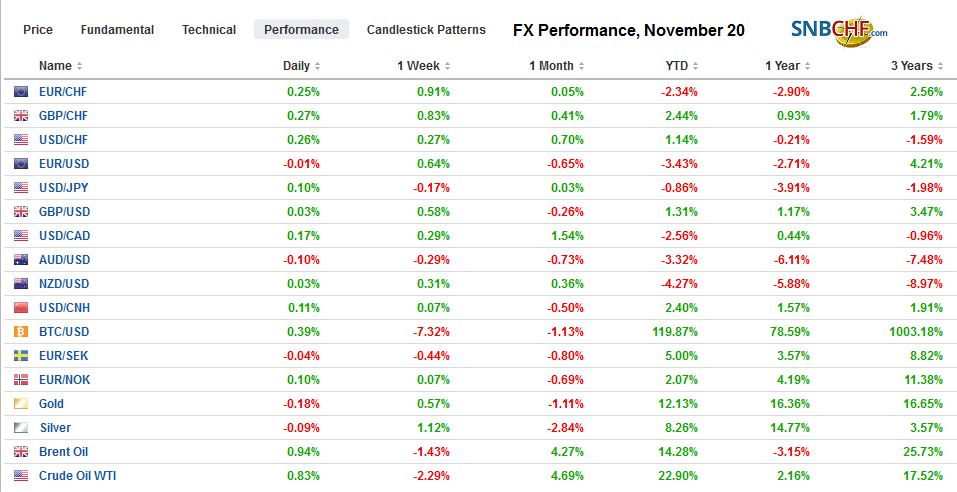

FX RatesOverview: The idea that a US-China trade deal is proving more elusive than the agreement in principle on October 11 implied is being seized upon to spur what we suspect is an overdue round of profit-taking in global equities. The MSCI Asia Pacific Index snapped a three-advance, with over 1% declines in South Korea and Australia. Europe’s Dow Jones Stoxx 600 set new multiyear highs yesterday before reversing lower and is extending the losses today, threatening the 20-day moving average for the first time in a month. US shares are trading heavily, and the gap (~3098.2-3104.6) created by last Friday’s sharply higher opening may draw prices today. Benchmark 10-year yields are three-to-five basis points lower. Consider that the 10-year US Treasury yield peaked on November 7, near 1.97%. Today, it tested 1.72%. The dollar is firm, rising against most of the major and emerging market currencies with the Japanese yen the main exception. The JP Morgan Emerging Market Currency Index is lower for the third consecutive session. Gold is edging higher for the sixth session of the past seven. Oil broke lower out of its consolidative range yesterday amid trade worries and an unexpectedly large rise in the US API inventory estimate (~5 mln barrels), and the 3.1% drop in WTI for January delivery was the largest in seven weeks. There was some follow-through selling of Brent and WTI today, but prices appear to be trying to stabilize. |

FX Performance, November 20 |

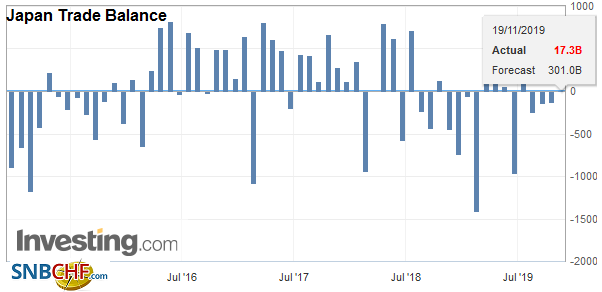

Asia PacificThe People’s Bank of China cut the one-year and five-year Loan Prime Rate by five basis points to 4.15% and 4.60%, respectively. This follows recent cuts of the same size in the Medium-Term lending facility and the seven-day repo rate. The signaling effect of the moves may be more important than the increased demand for borrowing or the actual stimulative impact. Australia announced it was fast-tracking a $3.8 bln infrastructure bill. The government is essentially bringing forward some of the A$100 bln decade-long program promised in the recent campaign. The recently disappointing jobs report with the cash rate at record lows boosted calls for fiscal support. Separately, the Australian stock market posted its largest loss (~1.3%) in seven weeks, led by the banking sector after Westpac was accused of violating money laundering and terrorism financing laws. Japan’s October trade figures disappointed. Exports were off 9.2% from a year ago, the most in three years. It is the 11th consecutive decline, and it was larger than economists projected. Imports held back by the typhoon and the sales tax increase, fell 14.8% year-over-year. The net result was to push the balance back into surplus for the first time in four months, though on a seasonally adjusted basis, it remained in deficit. Separately, as we try to assess the region, we note that Taiwan’s October export orders were off 3.5% year-over-year, which reflected sequential improvement and more than expected. Europe was the only region that Taiwan boosted exports year-over-year in October and its exports slightly more to Europe than to China (including Hong Kong). |

Japan Trade Balance, October 2019(see more posts on Japan Trade Balance, ) Source: investing.com - Click to enlarge |

After poking through JPY109 at the start of the week, the dollar is making new lows for the week today near JPY108.35. Last week’s low was about JPY108.25. There is an option for around $625 mln at JPY108.50 that expires today and another for $1.1 bln there that expires tomorrow. Weaker equities and lower yields are associated with a stronger yen. The Australian posted an outside up day yesterday by trading on both sides of Monday’s range and closing above Monday’s high. However, there has been no follow-through buying, and an inside day is being recorded. It is holding above $0.6800 so far today. A large option (A$525) at $0.6850 rolls off today, and an even larger one (A$1.1 bln) expires there tomorrow. The US dollar has edged higher against the Chinese yuan for the third consecutive session. It is the longest advancing streak since early September.

Europe

A YouGov poll after yesterday’s debate put it at a virtual draw of 51% to 49% favoring Johnson. The reviews suggested that Johnson did better in the first half and Corbyn in the second. It seems unlikely that the debate materially changed the outcome of next month’s election. The key is not whether the Tories get more votes than Labour, but does it secure a majority? If not, Brexit and the January 31 deadline are up in the air.

The ECB’s semi-annual report on financial stability appears to be part of its campaign to spur governments into action. It notes that the reliance on monetary policy has encouraged excessive risk-taking by investment funds, insurers, and in some property markets. It also recognizes that its newly launched asset purchase program could have unintended consequences creating a shortage of government bonds for investors and potentially disrupting the collateral market. It sees about a one-in-five chance of an economic contraction by the middle of next year.

The euro’s four-day advance is at risk. As was the case yesterday, it continues to trade within Monday’s range of roughly $1.1050 to $1.1090. At the upper end of that range, a 1.2 bln euro option expires tomorrow. It has not traded below $1.10 since last Thursday. There are options struck there that expire today and tomorrow (760 mln euro and 1.2 bln) but do not seem to be in play. Sterling made a marginal new low for the week, a little below $1.2890. Intraday resistance is now seen in the $1.2920-$1.2940 area. Large options may continue to cap the upside (~$1.2975-$1.3000). The euro bottomed against sterling on Monday near GBP0.8520. It needs to resurface above GBP0.8600 to be anything important.

America

The US Senate approved a bill yesterday that requires the State Department to annually certify that Hong Kong is sufficiently independent to justify the special trade relationship. This is an example of how the US Congress continues to defer to the executive branch its constitutional authority to regulate trade. Moreover, the Senate did not just pass the bill, it did so unanimously. This is truly a bipartisan effort. The House can take this bill up, or it can seek to reconcile its version with the Senate’s. The Senate also passed a bill that would ban sales of munitions, broadly understood, to Hong Kong. The President has not weighed in yet, but it is seen giving him another chit in negotiations with China. Beijing has threatened unspecified retaliation if the bill becomes a law. Separately, Trump’s rhetoric seems to have been dialed back on the US-China trade talks, but he has repeated his threat to raise tariffs higher if not agreement is struck. We have argued that the real deadline for the negotiations may be the middle of December when the next round of US levies on Chinese goods is threatened.

The FOMC minutes are the main US report today. So many Fed officials have spoken since the meeting, the minutes are unlikely to break new ground. However, given that Powell has only talked about downside risks, and NY Fed President Williams did the same yesterday, we suspect that the market idea that the October cut was somehow hawkish because the Fed signaled a pause may be challenged. Yes, the Fed’s “midcourse correction” like two in the 1990s consisted of three cuts. However, the next move is still likely to be a cut, and the bar may not be as high as the “hawkish cut” framing suggests.

Canada reports October CPI today. The headline is expected to rise by 0.3% after a 0.4% decline in September. The year-over-year rate should be unchanged at 1.9%. It was 2.0% at the end of last year. The Bank of Canada has several core measures, and they are also expected to be steady from September. Price pressures are not a problem in Canada. The Bank of Canada recently and Deputy Governor Wilkins yesterday underscored the risks from the global economy. Wilkins also recognized the risks that come from lower rates. The takeaway is that the Bank of Canada is not in a hurry to cut rates but will if the global headwinds strengthen.

After briefly slipping through CAD1.32 yesterday, the US dollar reversed higher and closed above Monday’s high, recording an outside up day. Follow-through buying today has pushed the greenback above CAD1.33 for the first time since October 10. The 200-day moving average, which stemmed last week’s rally (~CAD1.3275), has been overcome. The next important chart area is around CAD1.3350, where a double top in the first half of October was recorded. The drop in oil prices and the retreat in equities are the main drivers, we think. The intraday technicals are stretched, and initial support may be seen near CAD1.3280. The risk-off mood is helping to lift the greenback above MXN19.40, a new four-day high. Last week’s high was near MXN19.53, close to a key (61.8%) retracement of the decline since the October 10 high around MXN19.86. A move back below MXN19.35 would begin repairing the technical damage.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,Brexit,Currency Movement,EUR/CHF,Featured,FX Daily,Japan Trade Balance,newsletter,USD/CHF