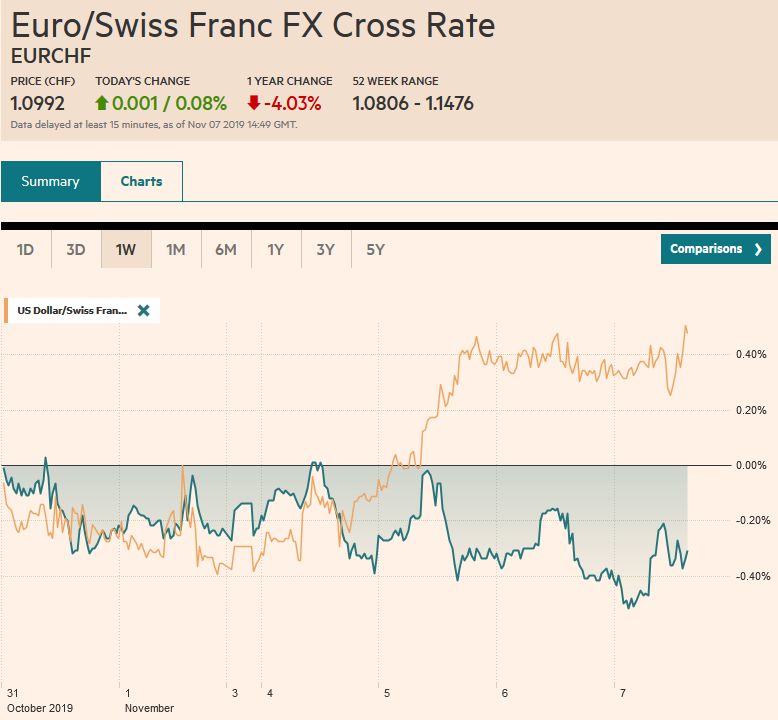

Swiss Franc The Euro has risen by 0.08% to 1.0992 EUR/CHF and USD/CHF, November 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Indications that a phase one agreement between the US and China would include rolling back some existing tariffs is boosting risking appetites, sending stocks higher, and pushing up yields. However, this appears to be simply a restating of China’s views rather than a new breakthrough. The dollar is paring its recent gains. The MSCI Asia Pacific Index rose for the fifth time in six sessions to reach its best level since August 2018. Europe’s Dow Jones Stoxx 600 is pushing higher and is at new four-year highs. The S&P 500 pulled back yesterday to fill the gap created by Monday’s

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, brl, EUR/CHF, Featured, FX Daily, Germany, Germany Industrial Production, Hong Kong, newsletter, trade, U.S. Initial Jobless Claims, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.08% to 1.0992 |

EUR/CHF and USD/CHF, November 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

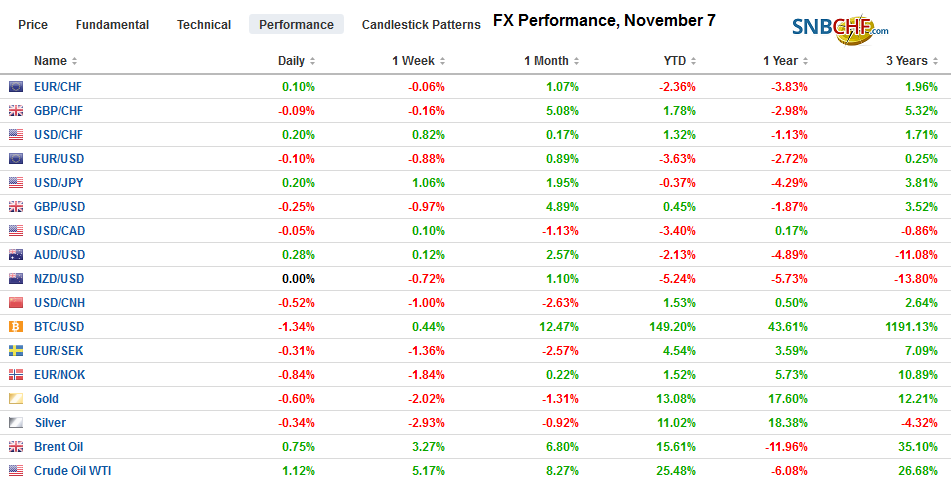

FX RatesOverview: Indications that a phase one agreement between the US and China would include rolling back some existing tariffs is boosting risking appetites, sending stocks higher, and pushing up yields. However, this appears to be simply a restating of China’s views rather than a new breakthrough. The dollar is paring its recent gains. The MSCI Asia Pacific Index rose for the fifth time in six sessions to reach its best level since August 2018. Europe’s Dow Jones Stoxx 600 is pushing higher and is at new four-year highs. The S&P 500 pulled back yesterday to fill the gap created by Monday’s higher opening but is set to make new record highs today. Benchmark 10-year bond yields are mostly 2-3 bp firmer, while the dollar is weaker against most of the major currencies, but the yen and Swiss franc. Most emerging market currencies are also trading firmer. Gold is holding below $1500 for the second day. Note that for the first time in eleven months, China did not accumulate gold in October. After reversing lower yesterday and the large US build and OPEC reluctant to cut output more, oil has steadied. |

FX Performance, November 7 |

Asia Pacific

The US and China apparently cannot agree on when or where to sign the preliminary agreement that officials have teased the markets with for several weeks. However, instead, the markets have responded positively to the signal that should such an agreement be reached, it would include unspecified but proportionate rolling back of existing tariffs. This has been a critical Chinese demand. That said, there has been no confirmation from US officials. The November timeframe for the two presidents to meet may be pushed back into November, and the US offer to have a signing ceremony in Alaska or Iowa has been rejected by China.

Reports indicate Beijing is supporting bolder action in Hong Kong. The attack on a pro-Beijing lawmaker in HK may prove too much for some of the professional class that has supported the demonstrations. Beijing wants HK to solve the social problems that it thinks lies behind the protests, such as unaffordable housing (partly as a result of wealthy mainlanders pushing up prices), and Hong Kong did announce housing and land reforms last month. HK is scheduled to hold District Council elections (450 seats) on November 24. There has begun to be speculation of a delay. More than a two-week postponement would seem to require another use of Emergency Powers.

There were two data reports to note from the region. First, Australia reported a larger than expected September trade surplus of A$7.18 bln. Economists had expected the surplus to decline from the A$5.93 bln surplus in August that was revised to A$6.62 bln. Australia’s improving trade balance has been a couple of years in the making. Note that the 12-month moving average is near A$5.28 bln. Last September, it stood a little above A$1 bln. Second, China’s October reserves edged up to $3.105 trillion from $3.092 trillion. At the end of last year, the reserve holdings stood near $3.073 trillion. It does not appear that China was directly intervening in the foreign exchange market. We suspect the increase largely reflects valuation adjustments.

The dollar has bounced off support near JPY108.65 to resurface above JPY109. There is a $415 mln option at JPY109.05 that expires today, which is also where the 200-day moving average is found. This week’s high is near JPY109.25 and was almost JPY109.30. The next upside target is around JPY110, which has not been seen for six months. The Australian dollar made new a new six-day low near $0.6860 before rebounding above $0.6900. A close above roughly $0.6910 would be a bullish development and suggest a bullish flag pattern may be in place. It would likely signal a test on the 200-day moving average (~$0.6950), which has held back rallies since last December. The PBOC set the dollar’s reference rate a little lower than the models suggested, and this gave the market the green light to extend the yuan’s advance for the eighth session, the longest streak since January. The dollar fell to near CNY6.97 as it enters the gap from early August.

Europe

The Bank of England meets today. No one expects a change in policy. However, there is some risk that both growth and inflation projections are shaved, even under the assumptions of a non-disruptive Brexit. Meanwhile, the Office of Budget Responsibility is likely to revise up the deficit projections based on electoral promises, and it means that the UK will not meet its self-imposed target to keep the deficit below 2% of GDP in 2020-2021. Although Labour is expected to discuss its spending plans later today, the resignation of the deputy head of the party (Watson) is stealing some of the thunder.

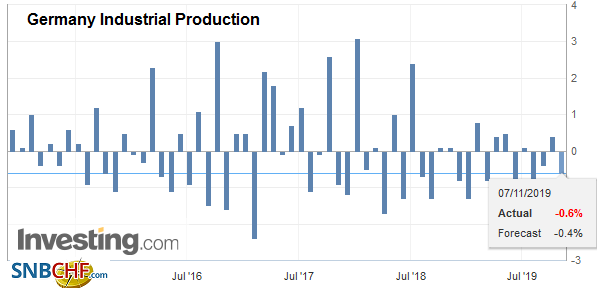

| The glimmer of optimism provided by yesterday’s news that German factory orders jumped 1.3% in September was squashed today by the disappointing industrial production report. Dragged down by manufacturing (-1.3%), industrial output fell 0.6%, slightly more than the median projection in the Bloomberg survey. Construction (1.8%) and energy (2.0%) blunted the impact of the contraction in manufacturing. A week from now, Germany will provide its first estimate of Q3 GDP. Today’s report solidifies expectations that the world’s fourth-largest economy recorded back-to-back declines in GDP despite negative interest rates across the curve. |

Germany Industrial Production, September 2019(see more posts on Germany Industrial Production, ) Source: investing.com - Click to enlarge |

The euro initially extended its recent pullback to $1.1055 in Asia but has come back better bid in Europe. It set a high yesterday a little below $1.1095, and a close above there would begin healing the technical tone. Sterling’s losses were also extended in Asia (~$1.2835) and recovered into the European morning. Yesterday’s high was near $1.2900. While both the euro and sterling can make new session highs, the intraday readings suggest they will likely be marginal.

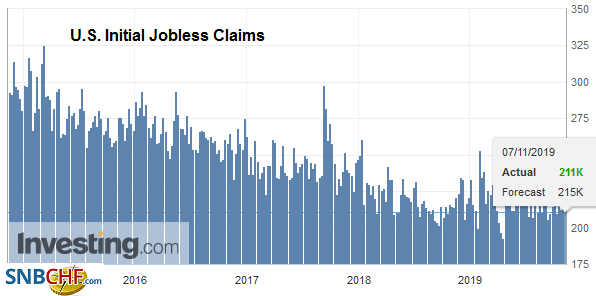

AmericaThe US economic calendar includes weekly jobless claims and the September consumer credit report. Given that it was just last week that the national employment report was issued, the weekly jobless claims will get short shrift today. On the other, consumer credit typically does not receive much attention. However, we think it is an important part of the late-cycle narrative. Through August, consumer credit has been growing by an average of $16.3 bln a month. In the first eight months of 2018, consumer credit rose by an average of $14.5 bln. Student loans and auto loans are part of this, but so is revolving credit, i.e., credit cards, and here stress levels, like delinquency rates are rising. Separately, the Fed’s Kaplan and Bostic speak today. |

U.S. Initial Jobless Claims, November 07, 2019(see more posts on U.S. Initial Jobless Claims, ) Source: investing.com - Click to enlarge |

Canada reports housing starts and permits today ahead of tomorrow’s employment report. Mexico reports October CPI figures. In September, CPI rose 0.26% for a 3% year-over-year rate. A gain of about 0.5% is expected in October, which due to the year-ago change, would keep the year-over-year rate steady. A weak report could spur speculation of a rate cut at next week’s central bank meeting (target rate stands at 7.75%). December appears to be a better bet for a rate cut.

The US dollar tested CAD1.3200 resistance today and is backing off. Initial support is seen near CAD1.3145. A break would signal a test on this week’s lows around CAD1.3115. The US dollar was turned back from MXN19.25 and the 200-day moving average yesterday. Monday’s low was set near MXN19.05, but that might be a bit too far today. Initial resistance is pegged near MXN19.14. The Brazilian real got thumped yesterday, selling off 2% after the poor reception to the oil field auction. Foreign participation was disappointingly light. Only two Chinese companies bid and took a combined 10% stake in one of the blocks. Petrobras picked up the other 90% and took all of another block. Two fields were not bought. The greenback finished near BRL4.0750, and given the risk-on sentiment may stabilize today. However, the risk seems to be for a retest on the triple top seen near BRL4.20 over the past three months.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,brl,EUR/CHF,Featured,FX Daily,Germany,Germany Industrial Production,Hong Kong,newsletter,Trade,U.S. Initial Jobless Claims,USD/CHF