There have been plenty of developments warning of a global economic slowdown. Yet, seemingly to justify the continued advance in equity prices, there has begun to be talk of possible cyclical and global rebound. That is the new constellation, connecting the better than expected Japanese, South Korean, and Chinese September industrial output figures, a slightly stronger than expected Q3 GDP reports from the US and the eurozone. Ahead of the weekend, China reported an unexpected increase in the Caixin manufacturing PMI and a sharp rise in the forward-looking new orders component. The US labor market, which helps drive consumption and 70% of the economy, is faring better than expected. Not only was the October job growth more than expected, but the past two

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of England, Brexit, Featured, Federal Reserve, newsletter, RBA, WTO

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

There have been plenty of developments warning of a global economic slowdown. Yet, seemingly to justify the continued advance in equity prices, there has begun to be talk of possible cyclical and global rebound.

That is the new constellation, connecting the better than expected Japanese, South Korean, and Chinese September industrial output figures, a slightly stronger than expected Q3 GDP reports from the US and the eurozone. Ahead of the weekend, China reported an unexpected increase in the Caixin manufacturing PMI and a sharp rise in the forward-looking new orders component. The US labor market, which helps drive consumption and 70% of the economy, is faring better than expected. Not only was the October job growth more than expected, but the past two months had under-counted by 95k.

The market sentiment is such that it will likely view the upcoming data through these optimistic framing. The main economic read will come from the non-manufacturing/service PMIs, which are unlikely to provide a sufficient counter in any event. Nevertheless, the pendulum of market sentiment swings hard and is prone to exaggerate. A few weeks ago, the buzz was about the possibility of a repeat of Q18 and the sharp decline in risk assets. Now it has swung in the other way that would support an extension of the equity markets rally, a grind higher in yields, and outperformance by the Antipodean and Scandinavian currencies. The Canadian dollar (only major currency that did not appreciate against the US dollar last week) may continue to lag as the market adjusts to the less neutral central bank posture.

Consumption, production, and trade figures later this month could pose a more formidable challenge to this optimism. Trade remains a risk. While the third and current tariff truce is holding, progress toward a partial agreement that President Trump indicated was around 60% of a bigger deal. However, phase one does not appear to include a rolling back of tariffs. It is more a case of arresting the escalation than reversing the damage and disruption.

Separate from the current US-China trade conflict, Beijing had objected to US anti-dumping calculations six years ago to the WTO. Through a circuitous route, a decision before the weekend affirmed in China’s favor. It found China was improperly hit with $3.6 bln in sanctions, which is about half of what Beijing alleged. China could now seek authorization to retaliate, or it could use it as a chit in negotiating. On the other hand, the US won a case against India, where the WTO found $7 bln in illegal subsidies on a range of products. Meanwhile, the appellate process, and therefore, the conflict resolution mechanism, is being blocked by Washington by preventing new appellate judges. Other countries have worked on some bilateral alternatives.

United KingdomA disruptive Brexit remains a risk. The deadline has been extended until the end of January, but half of that time will be spent campaigning for the December 12 election. There is Christmas and New Year’s, and the next brink is around the corner. If the vote is to be a referendum on Brexit and the Labour position cannot fit on the back of an old-fashion postage stamp, it may leave the Liberal Democrats as the main opposition party. In any event, the most likely scenario is the need for a coalition government. And that is particularly hard to fathom now. Moreover, before the weekend, Farage, the head of the Brexit Party, declared that unless Prime Minister Johnson repudiates the withdrawal agreement that was just negotiated, the Tories cannot count on his cooperation. Brexit Party candidates would run in as many constituencies as possible and against Tories, who refused to denounce Johnson’s withdrawal agreement. The potency of the threat is debatable, but there are enough districts that Farage’s tactics could be sufficient to split the Brexit vote, as has been the case in some recent by-elections. The Greens seem more willing to cooperate with Labour. In a reversal, the government has called a halt to fracking (shale extraction) amid fears of earthquakes. On the one hand, this seems to steal some of the thunder of Labour, Lib Dems, and the Greens. On the other hand, it appears to be a cynical election move as both Prime Minister Johnson and Business Secretary Leadsom have often praised fracking and embraced it as an important opportunity for the UK. Indeed, Leadsom acknowledged the ban may be temporary, lasting “until and unless” the process judged safe, which theoretically could be after the election. The other parties want a permanent ban. Outside of Brexit, two risks with Europe also remain. First is the US trade relations, which would take a significant turn for the worst if the Trump Administration were to announce auto tariffs on national security grounds. A decision is expected in the next few weeks. Second, the German government coalition is at risk. The Social Democrats will be choosing its new leaders, and at the same time, it will likely be deciding whether to remain in the coalition. |

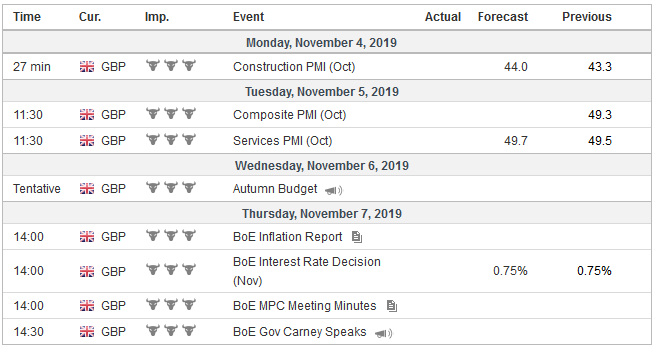

Economic Events: United Kingdom, Week November 4 |

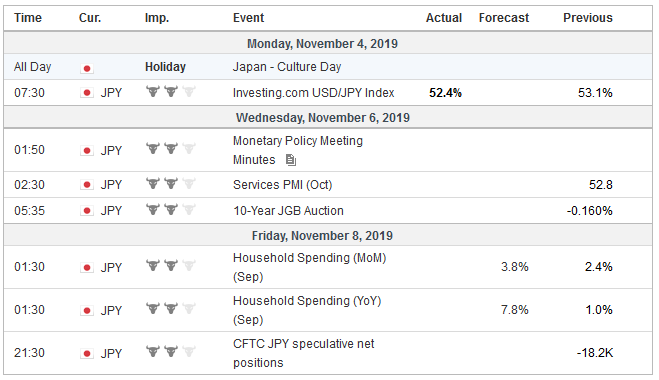

JapanJapan has been hit by two shocks: the typhoon and the retail sales tax increase. There is “before data,” such as the September household spending figures due out next week. The 7.1% surge in September retail sales (month-over-month) points to a solid gain. A sense of the kind the impact of the shock was provided by the pre-weekend news that vehicle sales tumbled 26.4% year-over-year in October after a 12.8% gain in September. |

Economic Events: Japan, Week November 4 |

The SPD has been a junior partner through most of Merkel’s years as Chancellor, and it has seen is public support and share of the votes steadily erode. This has happened in other European countries as well. There has been, to varying degrees, a disruption of the main parties. The Social Democrats often being challenged by the Greens. The center-right party is frequently challenged by a nationalistic/populist/anti-immigration party, like the AfD in Germany.

Hong Kong remains unsettled. Chinese officials appear to be threatening new measures after Hong Kong reported that Q3 GDP contracted by 3.2% (quarter-over-quarter). To put the magnitude of what is taking place in perspective, consider that in the worst of the Great Financial Crisis, the economy contracted by 3.4% (Q1 09).

The Reserve Bank of Australia meets on November 4. The cash rate is at 75 bp, and there is little chance of it being cut. The labor market remained resilient, and there are some preliminary signs that the housing market has begun responding favorably to the lower interest rate environment. The Australian dollar has been a beneficiary of the swing in sentiment. The Australian dollar rose from about $0.6670 lows seen at the start of October and finished the month a little below $0.6900 and met a ket retracement objective (68.2%) of its decline from the July high around $0.7080. It has also approached the 200-day moving average (~$0.6955).

The Bank of England meets on November 7. With the Brexit can having been kicked down the road, and an election called for December 12, the bar to a change in policy is very high. Sterling’s appreciation (~7%+) since mid-August on a trade-weighted basis may have done some of the work of a tightening bias. The Federal Reserve and the European Central Bank have both reduced rates. Businesses, investors, and officials have had a couple fire-drill like approaches to Brexit. Governor Carney has his own Brexit in play. His departure from the central bank has been delayed but insists that the end of January is the final deadline. The election outcome will also determine Carney’s successor. Some think the short period after the election would favor an insider, like one of the deputy governors (Broadbent?). Others see the position being a potential chit in the forming of a post-election coalition.

After the market digested the FOMC statement and Powell’s press conference and the employment data, its view of a December rate hike was virtually unchanged net-net as reflected in the fed funds futures. There were small net changes in the June and December 2020 contracts toward lower rates of 1.37% and 1.2450%, respectively. The Bank of Canada sought to use its economic assessment to secure some maneuvering room should it be needed. Canada reports trade, housing starts/permits, and employment data in the coming days. Just like the better US jobs made the Fed’s decision to signal a pause looks like the correct course, disappointing data will make the Bank of Canada’s dovish hold prescient.

Tags: Bank of England,Brexit,Featured,federal-reserve,newsletter,RBA,WTO