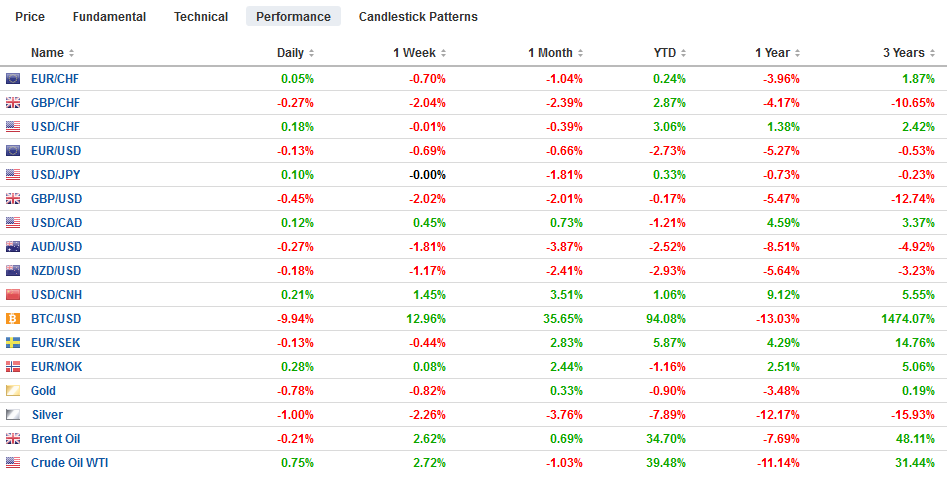

Swiss Franc The Euro has risen by 0.04% at 1.1285 EUR/CHF and USD/CHF, May 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Since the presidential tweets on May 3, the US had the initiative in the negotiations with China, but today, China has pushed back. It is cool to the idea promoted by the US that trade talks will resume shortly. Now it may take the Trump-Xi meeting at the end of next month to restart talks. This, coupled with US sanctions on Huawei banning imports from it and sales to it, threatens to disrupt business and this took a toll on Chinese, Taiwanese and Korean shares. The Nikkei gapped higher and recorded highs for the week only to

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, Australia, autos, Brexit, EUR/CHF and USD/CHF, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Featured, newsletter, trade, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.04% at 1.1285 |

EUR/CHF and USD/CHF, May 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

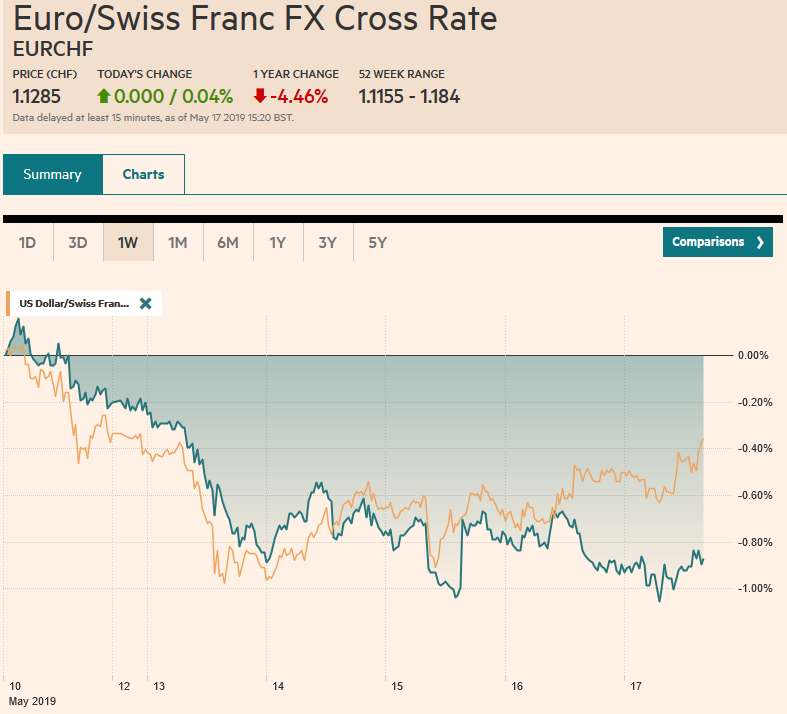

FX RatesOverview: Since the presidential tweets on May 3, the US had the initiative in the negotiations with China, but today, China has pushed back. It is cool to the idea promoted by the US that trade talks will resume shortly. Now it may take the Trump-Xi meeting at the end of next month to restart talks. This, coupled with US sanctions on Huawei banning imports from it and sales to it, threatens to disrupt business and this took a toll on Chinese, Taiwanese and Korean shares. The Nikkei gapped higher and recorded highs for the week only to settle on its lows. Ahead of the weekend election, Australia’s ASX 200 reached its highest level since late 2007. European shares are lower, and the Dow Jones Stoxx 600 is shedding about a third of this week’s gains, leaving it up a little less than 1%. The S&P 500 is off about 0.2% this week, after gaining the past three sessions. It looks poised to return to yesterday’s lows. Benchmark bond yields are lower and peripheral European bond yields, including Italy, are leading the way a 3-5 basis point pullback. The US dollar is firmer against most of the major and emerging market currencies. The yen and Swiss franc are firm and are up about 0.25% for the week. The biggest weekly advance in more than a month has left the Norwegian krone nonplussed, but the Russian rouble is one of the two emerging market currencies to gain against the dollar this week (~0.75%). The Argentine peso is the other exception with a 0.15% gain coming into today’s session. |

FX Performance, May 17 |

Asia Pacific

The stepped-up sanctions on Huawei may not be related to the trade dispute, as we have maintained, but from China’s point of view, it exemplifies the US efforts to contain it. Officials question US sincerity. The US has ended the tariff truce despite the on-going talks. Even if talks were successfully concluded, the US wants to keep tariffs in place, like it has done to Canada and Mexico. At the same time, officials signaled more stimulus will be forthcoming. The Shanghai Composite wiped out the small gains it had this week with a 2.5% decline today. It is the fourth consecutive weekly loss, the longest run in 10 months.

Australia holds national elections this weekend. The polls are close but show the opposition Labour with a small advantage. It poses event risk, but investors’ focus is on the central bank. Speculation has mounted that the Reserve Bank of Australia could cut rates as early as its next meeting (June 4). Interpolating from the derivatives market, a nearly 70% chance of a cut has been discounted. A follow-up move also appears to have largely been priced in as well.

Japan will report Q1 GDP to start the new week. It is expected to have contracted and the decline in the tertiary index in March (reported earlier today, -0.4% vs. expectations for a 0.1% increase) reinforce the view. Consumption and investment appear to have fallen. Although there is some speculation that a 0.2% contraction may prod the government into accepting another delay in the sales tax increase scheduled for October, but we see the bar being much higher. Not only will Q2 GDP be more important, but the collateral damage of the US-China trade conflict is another important consideration.

It was the first time in a week that the dollar poked above JPY110, where a $1.1 bln option expires today, but it was quickly sold and risk is for a return the week’s lows near JPY109. We see potential toward JPY108.65 next week. The Australian dollar cannot find a bid, despite the gains in the stock market. It closed a little above $0.7000 last week and is pushing deeper below $0.6900. A break below the $0.6870 area would set sights on the flash crash low (January 3) near $0.6740. The dollar surged against the Chinese yuan, setting up a test on CNY7.0 next week, where officials had seemed to defend in the past.

EuropePrime Minister May’s signal that she will announce her departure plans following a new and fourth vote on the Withdrawal Bill after the European Parliament elections has begun the leadership contest. Johnson, Raab, and Mordaunt (Defense Minister) have made their intentions known. Meanwhile, reports suggest Labour is moving toward embracing a second referendum more formally. Labour says the cross-party talks have gone as far as they can, which does not seem particularly much. The prospects of a no deal exit weigh on sterling. |

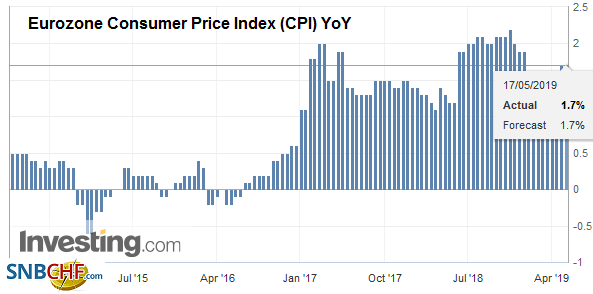

Eurozone Consumer Price Index (CPI) YoY, April 2019(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

| A year ago, Trump and Juncker worked out a deal which precluded auto tariffs while negotiations were being held. Yet, the US willingness to hike tariffs on China during negotiations sent a warning shot to Europe just as walking away from North Korean negotiations was understood as a cautionary talk by China. Moreover, it is not merely no auto tariffs during talks but that Europe (and Japan) are being required to provide a plan to restrict auto and part exports to the US. The US position seems that European (and Japanese) auto exports to the US decline either through tariffs or export restraint. Many observers and investors seem to have a collective sigh of relief when they read the 180-day suspension in Trump’s decision on auto tariffs, but the real story is more complicated and warns that tensions will likely rise. |

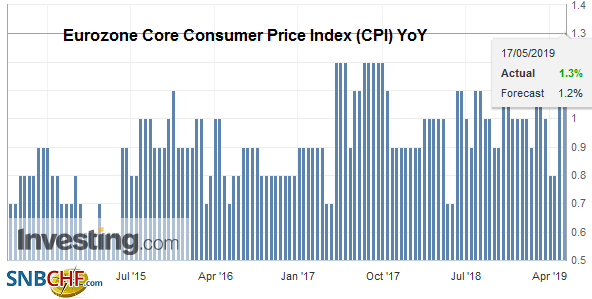

Eurozone Core Consumer Price Index (CPI) YoY, April 2019(see more posts on Eurozone Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

The euro has fallen to new lows for the week in the European morning, below $1.1160. Recall that low from last month was just above $1.1100. There is a 1.6 bln euro option at $1.1175 that expires today and a roughly 740 mln euro option at $1.1100 that will also be cut. Sterling is lower for the sixth consecutive session against the dollar. Its 1.85% loss this week (with sterling near $1.2760) is the largest since last October. The next area of support is seen near $1.2660. Sterling is off against the euro as well. It is the 10th consecutive losing session, the longest since the advent of the euro. The next target is near GBP0.8840.

America

The Fed’s Clarida and Williams speak today, and the US reports the April Leading Economic Indicators and the University of Michigan’s preliminary May consumer confidence and inflation expectations. US companies that supply Huawei are coming under pressure but will have time to adjust to the new protocols. The implied yield of the January fed funds futures contract has fallen seven basis points this week after nine last week for a 16 bp move since the end of the tariff truce announced in tweets.

The economic calendar for Canada and Mexico is light. Brazil reports trade figures. The Canadian dollar is more sensitive to the risk environment (S&P 500 proxy) than the interest rate differentials (where the two-year differential is at its narrowest since last November) and the rally in oil prices (biggest in six weeks). The US dollar held support at CAD1.34 yesterday and is challenging the upper end of its narrow range (~CAD1.35). There is a nearly $860 mln option struck at CAD1.3500 that expires today. Mexico’s central bank left rates on hold yesterday, as widely expected, but peso drew little comfort. The risk-off mood could see the greenback return to the MXN19.25 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Australia,autos,Brexit,EUR/CHF and USD/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,newsletter,Trade