Despite a disappointing equity market performance this year, M&A activity remains buoyant.Mergers and acquisitions (M&A) activity has proven resilient so far this year, despite higher volatility and lower equity returns. However, the derating of equities has neither depressed target valuations nor premiums paid by acquirers, particularly in Europe. The acceleration of M&A in 2018 could even approach the previous peak reached in 2015, at around USD 1.2 trillion in the US.Since January, 84 deals above USD 1bn have been announced in the US, 47 in Europe and 35 in emerging markets (EM). The aggregate value of deals has been even more impressive—USD 706bn in the US, USD 374bn in Europe and USD 118bn in EM. Annualising figures shows that in terms of market capitalisation, M&A so far this year

Topics:

Jacques Henry considers the following as important: Equity Markets, M&A, Macroview, Private Equity

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Despite a disappointing equity market performance this year, M&A activity remains buoyant.

Mergers and acquisitions (M&A) activity has proven resilient so far this year, despite higher volatility and lower equity returns. However, the derating of equities has neither depressed target valuations nor premiums paid by acquirers, particularly in Europe. The acceleration of M&A in 2018 could even approach the previous peak reached in 2015, at around USD 1.2 trillion in the US.

Since January, 84 deals above USD 1bn have been announced in the US, 47 in Europe and 35 in emerging markets (EM). The aggregate value of deals has been even more impressive—USD 706bn in the US, USD 374bn in Europe and USD 118bn in EM. Annualising figures shows that in terms of market capitalisation, M&A so far this year account for 5% of the S&P 500, 6.4% of the Stoxx Europe 600 and nearly 4% of the MSCI EM Index.

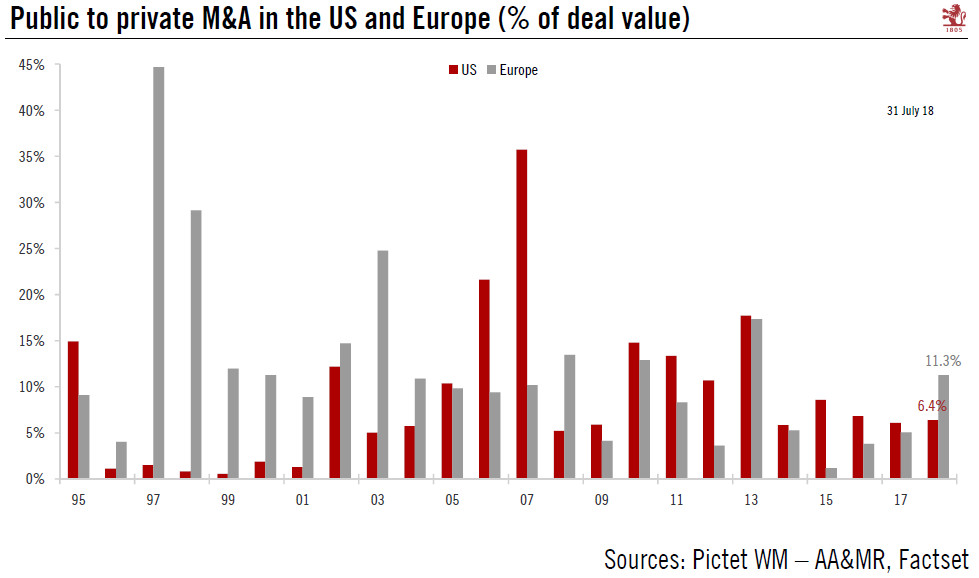

Public-to-private transactions have risen over the past two years and now account for 6.4% of total M&A by value in the US and 11.3% in Europe. In terms of absolute number of deals, these figures rise to 16% in the US and nearly 27% in Europe. This shows that public-to-private activity is concentrated among small deal values. These calculations do not include rumoured deals (like Tesla), nor deals under the USD 1bn threshold.

The premiums paid by acquirers have been high, at around 22% of market value in the US and over 40% in Europe. Target EV/EBITDA currently stands at 11x in the US and Europe. Mega deals above USD40bn are rare but account for 38% of 2018 M&A values. Cash offers have increased over last year, particularly in Europe, where financing conditions remain attractive.

All in all, amidst ongoing trade war concerns, M&A and earnings have been supportive of equity markets this year. Public-to-private is becoming more popular in Europe but remains a relatively small portion of total M&A.