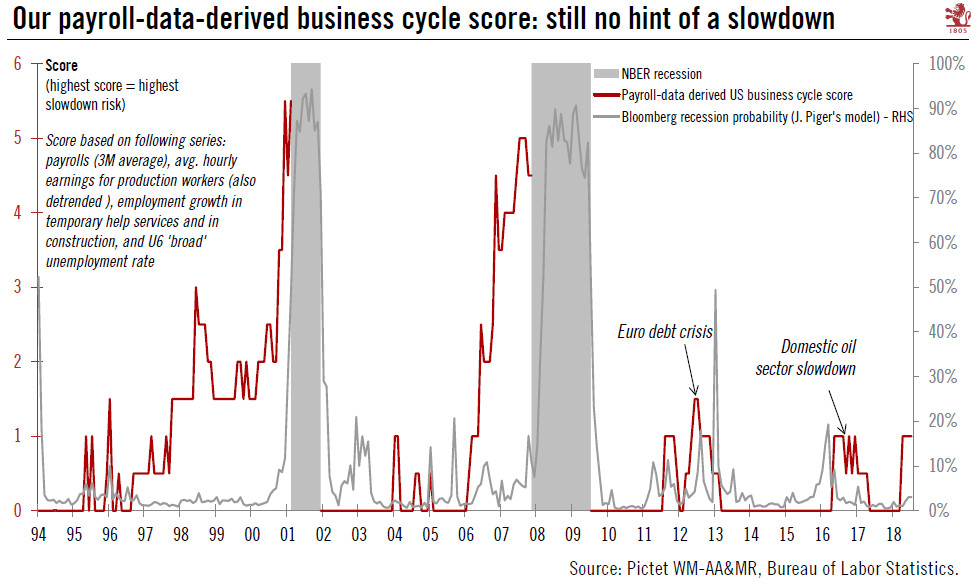

The July employment report confirmed that the US economy is in great shape, and still unaffected by international trade tensions.The US labour market remains in fine fettle, as the three-month average in job growth up to July was 224,000. The unemployment rate dropped to 3.9%, while the ‘broader’ unemployment rate (U6) fell to 7.5%, its lowest level since May 2001.Wage growth remained relatively tame (especially in light of the low unemployment rate), with average hourly earnings growth at 2.7% y-o-y, unchanged from June’s annual gain.Signals about the US business cycle remain broadly positive, with solid employment growth in cyclically sensitive sectors such as manufacturing and construction. This means there should be more room for the U6 broad unemployment rate to go down before a

Topics:

Thomas Costerg considers the following as important: Fed rate hikes, Macroview, US employment, US labour market, US payrolls

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The July employment report confirmed that the US economy is in great shape, and still unaffected by international trade tensions.

The US labour market remains in fine fettle, as the three-month average in job growth up to July was 224,000. The unemployment rate dropped to 3.9%, while the ‘broader’ unemployment rate (U6) fell to 7.5%, its lowest level since May 2001.

Wage growth remained relatively tame (especially in light of the low unemployment rate), with average hourly earnings growth at 2.7% y-o-y, unchanged from June’s annual gain.

Signals about the US business cycle remain broadly positive, with solid employment growth in cyclically sensitive sectors such as manufacturing and construction. This means there should be more room for the U6 broad unemployment rate to go down before a slowdown strikes.

We still expect two further Fed rate hikes this year (with the next in September) and two in 2019.