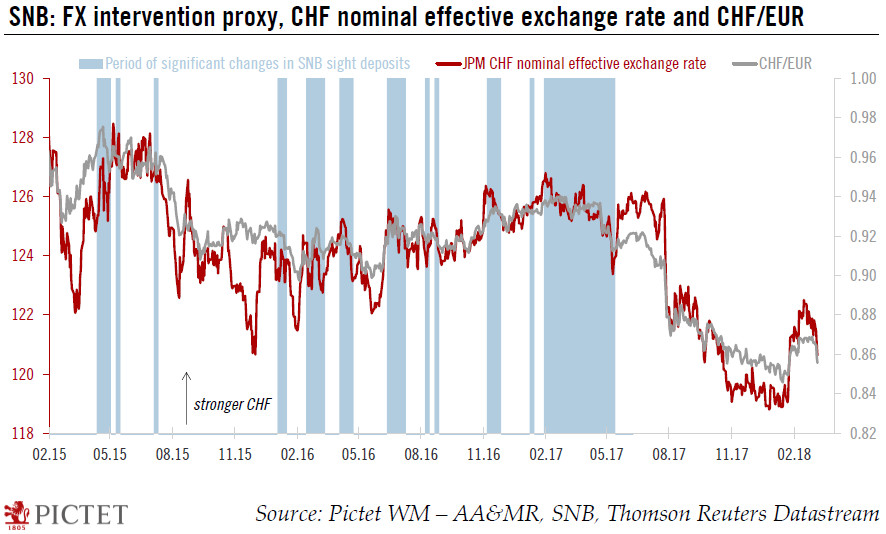

Despite tensions since the beginning of the year, there is no evidence of FX market interventions by the Swiss central bank. SNB FX Intervention In the wake of the financial crisis, the Swiss National Bank (SNB) increased massively the monetary base to provide liquidity and limit the Swiss franc’s appreciation. The expansion in the monetary base can essentially be seen in the form of an increase in sight deposits held by domestic Swiss banks at the SNB. The SNB does not communicate on its interventions in the foreign exchange (FX) market (except in its annual report). One way to estimate when the SNB has intervened is to look at the weekly variations in sight deposits it holds. Since summer 2017, weekly variations

Topics:

Nadia Gharbi considers the following as important: Featured, Macroview, newsletter, Pictet Macro Analysis, SNB FX interventions, SNB monetary policy, SNB rate hike, Swiss and European Macro

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Despite tensions since the beginning of the year, there is no evidence of FX market interventions by the Swiss central bank.

SNB FX InterventionIn the wake of the financial crisis, the Swiss National Bank (SNB) increased massively the monetary base to provide liquidity and limit the Swiss franc’s appreciation. The expansion in the monetary base can essentially be seen in the form of an increase in sight deposits held by domestic Swiss banks at the SNB. The SNB does not communicate on its interventions in the foreign exchange (FX) market (except in its annual report). One way to estimate when the SNB has intervened is to look at the weekly variations in sight deposits it holds. Since summer 2017, weekly variations show no evidence of FX market intervention by the SNB (see Chart). On March 15, the SNB will publish its quarterly monetary policy review. While we do not expect any significant change in the press statement, there are several reasons for believing that the SNB may soon start to normalise its monetary policy (see our previous Flash Note). A change of communication about future monetary policy is likely to come during H2 2018. The SNB will want to wait for sure signs that the ECB is ending its quantitative easing (QE) programme and that an ECB deposit rate hike is on the cards in 2019. Regarding rates, we expect the SNB to hike its policy rate by 25bp for the first time in December 2018 (under our assumption that the ECB announce a gradual tapering of QE in June or July). This would still leave the SNB’s policy rate below the ECB’s current deposit rate of -0.40%. We forecast a second SNB hike for Q3 2019, when we also expect the ECB to start to raise policy rates. |

SNB FX Intervention, Feb 2015 - Feb 2018(see more posts on SNB FX interventions, ) |

Tags: Featured,Macroview,newsletter,SNB FX interventions,SNB monetary policy,SNB rate hike