Swiss Franc The Euro has risen by 0.07% to 1.1406 CHF. EUR/CHF and USD/CHF, September 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Reports suggesting that North Korea is moving an ICBM missile toward launch pad in the western part of the country at night to minimize detection, while South Korea is escalating its military preparedness and the US seeks new sanctions, keep investors on edge. Risk assets are mixed. Gold is slightly lower. While the yen is stronger, the Swiss franc is heavier. Asia equities slipped, and European shares are recouping much of yesterday’s 0.5% loss. The Korean story is likely to continue to provide the main geopolitical backdrop to the

Topics:

Marc Chandler considers the following as important: AUD, CAD, CHF, China Caixin Services PMI, EUR, EUR/CHF, Eurozone Retail Sales, Eurozone Services PMI, Featured, France Services PMI, French Markit Composite Purchasing Managers Index, FX Trends, GBP, Germany Composite PMI, Germany Services PMI, Italy Services PMI, JPY, Korea, newsletter, Spain Services PMI, U.K. Services Purchasing Managers Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

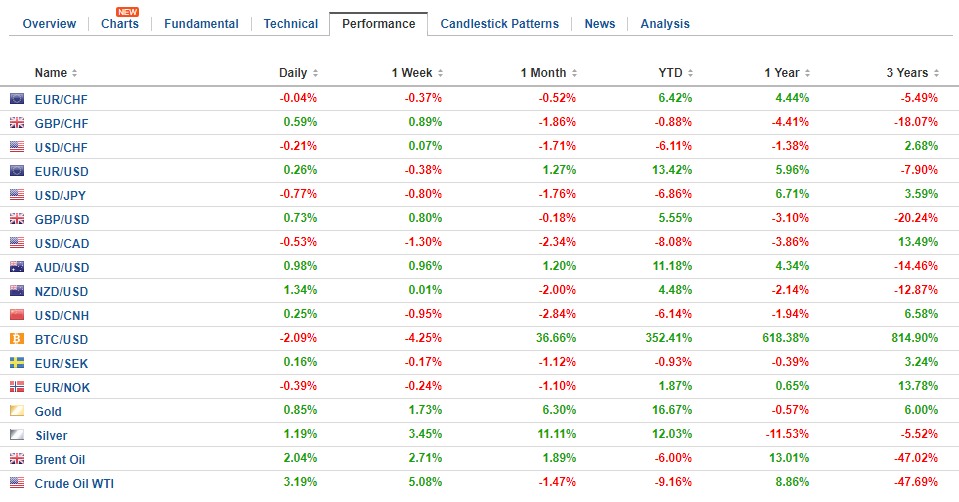

Swiss FrancThe Euro has risen by 0.07% to 1.1406 CHF. |

EUR/CHF and USD/CHF, September 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

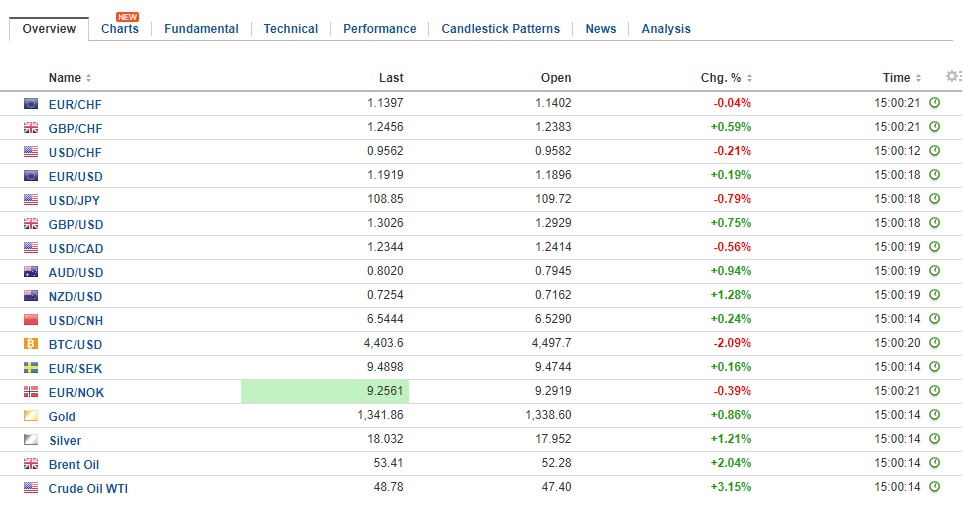

FX RatesReports suggesting that North Korea is moving an ICBM missile toward launch pad in the western part of the country at night to minimize detection, while South Korea is escalating its military preparedness and the US seeks new sanctions, keep investors on edge. Risk assets are mixed. Gold is slightly lower. While the yen is stronger, the Swiss franc is heavier. Asia equities slipped, and European shares are recouping much of yesterday’s 0.5% loss. The Korean story is likely to continue to provide the main geopolitical backdrop to the investment climate. There is some thought that North Korea may launch its ICBM as early as September 9, National Foundation Day. South Korean shares moved lower for the fourth session, and fifth in the past six. It fell nearly 0.9% last week and is off another 1.3% this week. Foreign investors, who had been small buyers of Korean shares in the past two sessions, sold the most Korean shares today in three weeks (~$237 mln). The Korean won edged slightly higher against the dollar (~0.15%). It has risen against the dollar for the past three weeks (~1.8%). |

FX Daily Rates, September 05 |

| The euro is trading in about half a cent range within yesterday’s range, which was within the range seen before the weekend. Support is seen ahead of last week’s low (~$1.1825), and the 20-day moving average is found near $1.1830. The $1.1850-$1.1875 range houses about 1.4 bln euros in options that expire today.

Sterling is in a tighter range than the euro. It is holding above the pre-weekend low just above $1.29, but it cannot make it back to yesterday’s high near $1.2965. There is a GBP200 mln option that expires today struck at $1.2940 and an option for 1.5 bln euros struck at GBP0.9200. |

FX Performance, September 05 |

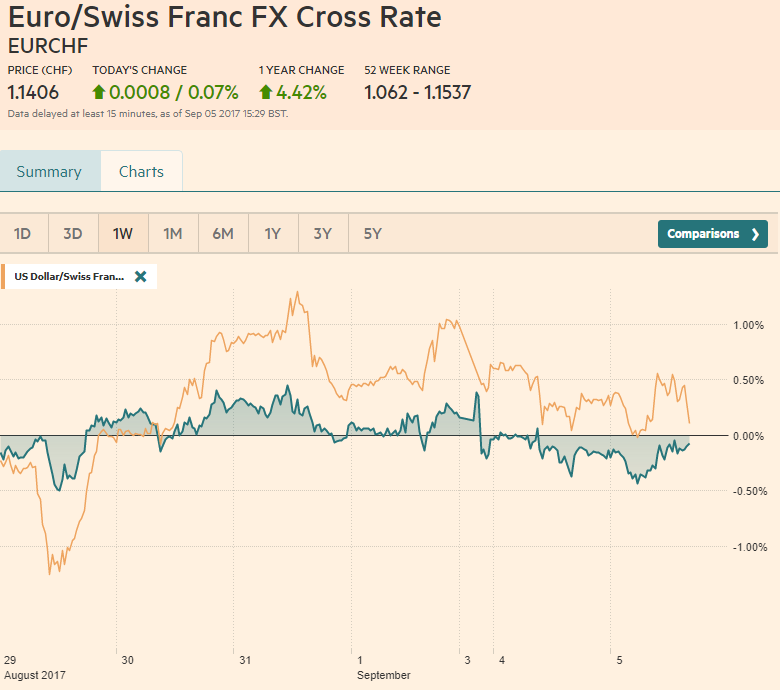

| China

News that China’s Caixin services and composite PMI firmed may have also helped the Australian dollar. The services PMI rose to 52.7 from 51.5. It averaged 52.2 last year and this year, through July. The composite rose to 52.4 from 51.9. It averaged 51.4 last year and 52.1 through July. China is expected to report it latest reserve and trade figures this week. The August CPI and PPI may be reported before the weekend. Reserves are expected to have risen for the seventh month, and the trade surplus is expected to increase, though both imports and exports may have slipped. |

China Caixin Services Purchasing Managers Index (PMI), Aug 2017(see more posts on China Caixin Services Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

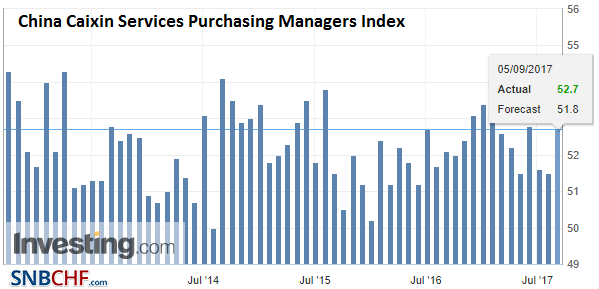

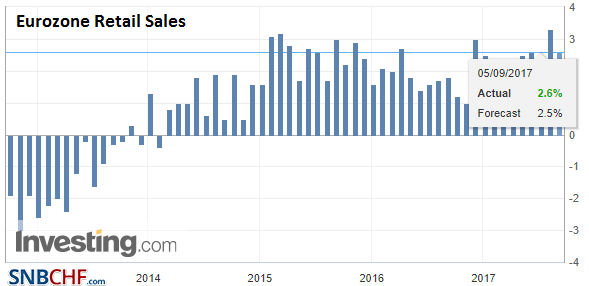

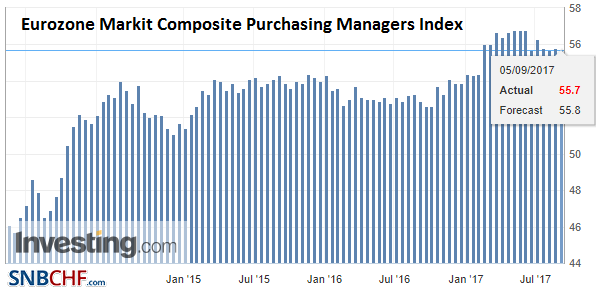

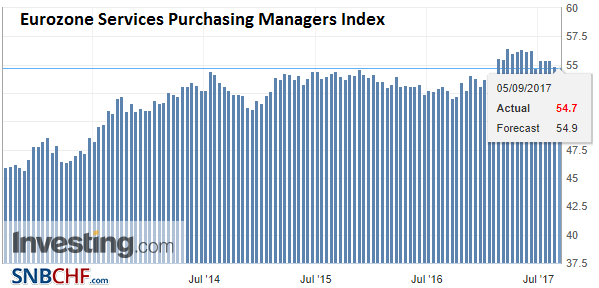

EurozoneThe eurozone services and composite PMI was a little lower than the flash readings. |

Eurozone Retail Sales YoY, Jul 2017(see more posts on Eurozone Retail Sales, ) Source: Investing.com - Click to enlarge |

| This is consistent with the recent string of data suggesting that while growth remains at elevated levels, the momentum has slowed a tough in Q3. |

Eurozone Markit Composite Purchasing Managers Index (PMI), Sep 2017(see more posts on Eurozone Markit Composite Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

| The aggregate services PMI eased to 54.7 from the 54.9 flash estimate and 55.4 in July. It is the lowest reading since January. It averaged 53.1 last year year and 55.5 through July. |

Eurozone Services Purchasing Managers Index (PMI), Sep 2017(see more posts on Eurozone Services Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

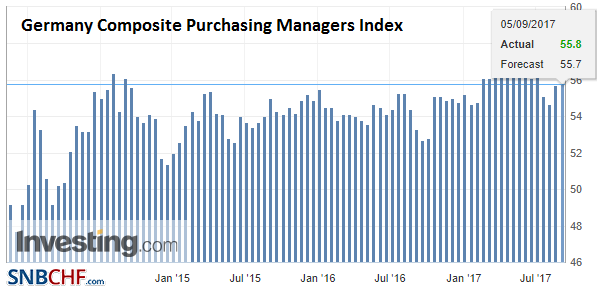

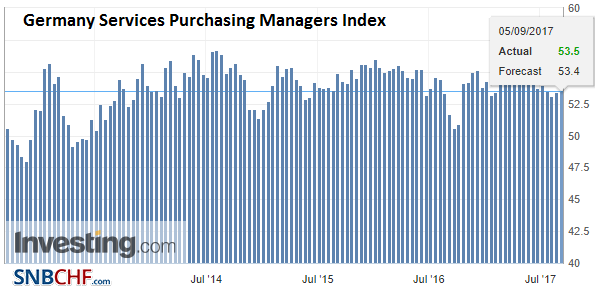

GermanyThe composite reading slipped to 55.7 from the 55.8 flash estimate. It was unchanged from July, which was it lowest reading since January as well. |

Germany Composite Purchasing Managers Index (PMI), Sep 2017(see more posts on Germany Composite Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

| It averaged 53.3 last year and 56.1 through July. The source of the revision was not Germany.Its services and composite reading were tweaked higher from the flash reading. |

Germany Services Purchasing Managers Index (PMI), Sep 2017(see more posts on Germany Services Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

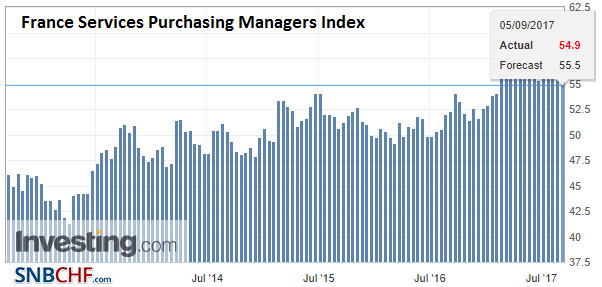

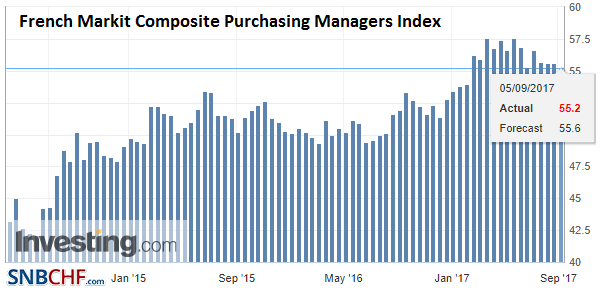

FranceFrench figures were revised lower (54.9 from the flash services of 55.5, and 55.2 for the composite after the flash showed 55.6). |

France Services Purchasing Managers Index (PMI), Sep 2017(see more posts on France Services Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

French Markit Composite Purchasing Managers Index (PMI), Sep 2017(see more posts on French Markit Composite Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

|

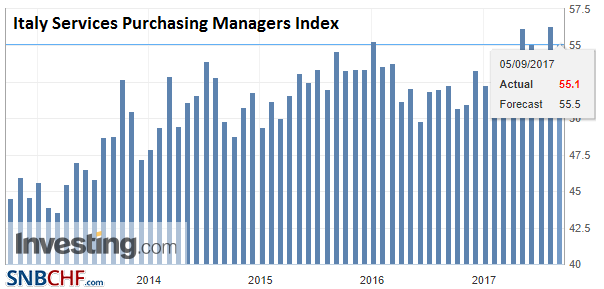

ItalyItaly and Spain were drags. The Italian services reading fell to 55.1 from 56.3 in July. |

Italy Services Purchasing Managers Index (PMI), Aug 2017(see more posts on Italy Services Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

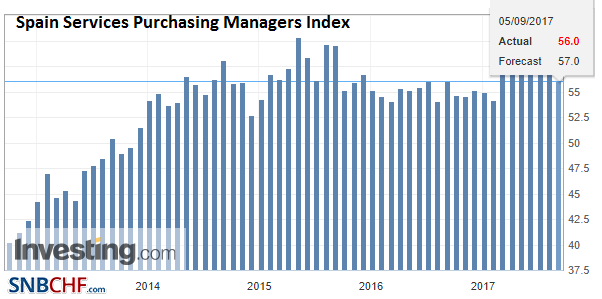

SpainSpain services fell to 56.0 from 57.6 in July, while the composite fell to 55.3 from 56.7. Italy’s figures remain near recent highs, while the pullback in Spain is back to levels last seen in January. |

Spain Services Purchasing Managers Index (PMI), Aug 2017(see more posts on Spain Services Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

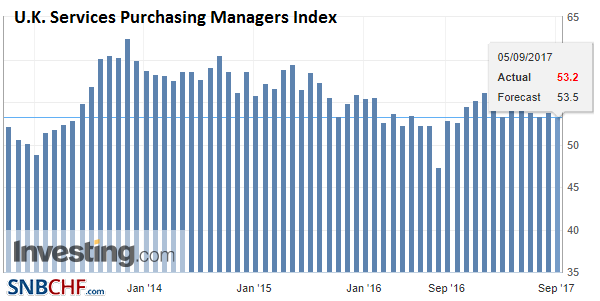

United KingdomThe UK economic data included a rise in the BRC sales, but apparently due mostly to the increase in food prices, and a softer than expected services PMI. The services PMI slipped to 53.2 from 53.8. It is the lowest reading since last September. It averaged 53.2 last year and 54.2 through July this year. The composite PMI was at 54.0, in line with expectations and down slightly from the 54.1 reading in July. Separately, several reports are tipping September 21 as the date of an important speech by Prime Minister May regarding Brexit. |

U.K. Services Purchasing Managers Index (PMI), Aug 2017(see more posts on U.K. Services Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

Elsewhere the main economic data today consists of the outcome of the Reserve Bank of Australia meeting and the service sector PMI and composite reports. In the North American session, Fed Governor Brainard speaks early and later factory goods orders. The Bank of Canada meets tomorrow. Strong data, especially the Q2 GDP (4.5% annualized) has spurred a reassessment of the central bank’s trajectory. A month ago (August 4) the market had discounted a little more than a one in three chance of a hike this week. Now, interpolating from the OIS, the odds are about 55% in favor of a hike.

The RBA meeting left rates decisively on hold, as widely expected. Like other central bankers, Governor Lowe is expected that continued improvement in the labor market will lift wages and inflation. Separately, Australia reported improved net exports for Q2 (0.3% vs. -0.7% in Q1) and this had spurred speculation that tomorrow’s Q2 GDP may surprise on the upside. The median forecast is for a little less than 1% quarter-over-quarter growth. The Australian dollar is firm but within the range seen before last weekend (~$0.7920-$0.7795). Copper prices continued to rise and now are at their best level in three years. Other industrial metal prices are lower after yesterday’s surge.

Lastly, the Swiss reported disappointing GDP and CPI data today. Growth in Q2 was 0.3%, not the 0.5% the median forecast in the Bloomberg survey suggested, and adding insult to injury, Q1 growth was revised to 0.1% from 0.3%. As if this weren’t enough, Switzerland reported that its EU harmonized CPI fell for the first time since May. The 0.1% decline in August brought the year-over-year rate to 0.5% from 0.6%. The franc is flat against the euro today after falling about 0.8% over the past two weeks. It reinforces our sense that the SNB will lag behind other central banks in the normalization process, while the slower growth of Japanese money supply and balance sheet may raise questions of the BOJ’s commitment going forward, especially if Kuroda is not reappointed when his term ends next year.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CHF,$EUR,$JPY,China Caixin Services PMI,EUR/CHF,Eurozone Retail Sales,Eurozone Services PMI,Featured,France Services PMI,French Markit Composite Purchasing Managers Index,Germany Composite PMI,Germany Services PMI,Italy Services PMI,Korea,newsletter,Spain Services PMI,U.K. Services Purchasing Managers Index,USD/CHF