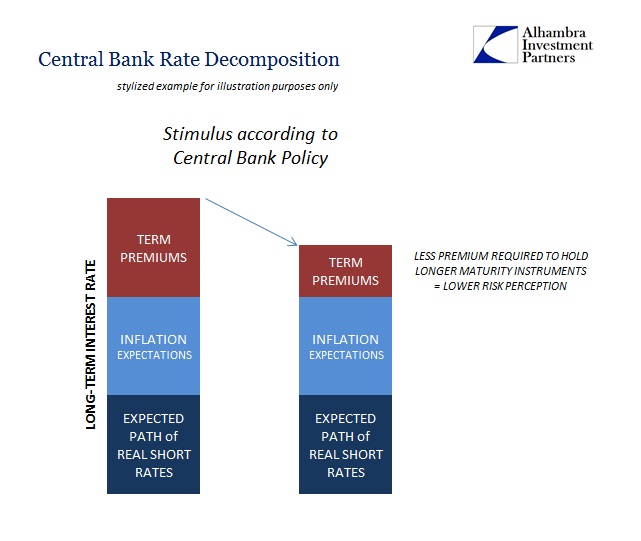

According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that much longer (more return to entice an investor to buy a 5-year UST rather than a 4-year, or a 10-year as opposed to a 2-year). Central Bank Rate Decomposition - Click to enlarge This is, of course, backwards. Lower term premiums would relate to curve dynamics. It is not risk that applies here but

Topics:

Jeffrey P. Snider considers the following as important: bond market, currencies, decomposition, economy, eurodollar curve, eurodollar futures, Featured, Federal Reserve/Monetary Policy, Interest rates, Irving Fisher, liquidity preferences, Markets, newslettersent, Reflation, term premiums, The United States, treasury yields, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that much longer (more return to entice an investor to buy a 5-year UST rather than a 4-year, or a 10-year as opposed to a 2-year). |

Central Bank Rate Decomposition |

| This is, of course, backwards. Lower term premiums would relate to curve dynamics. It is not risk that applies here but opportunity; or, in the parlance of John Maynard Keynes, liquidity preferences. The greater the opportunity in the real economy, the more term premiums demanded for investors to forego that opportunity and hold a liquid substitute. It is why yield curves steepen in recovery.

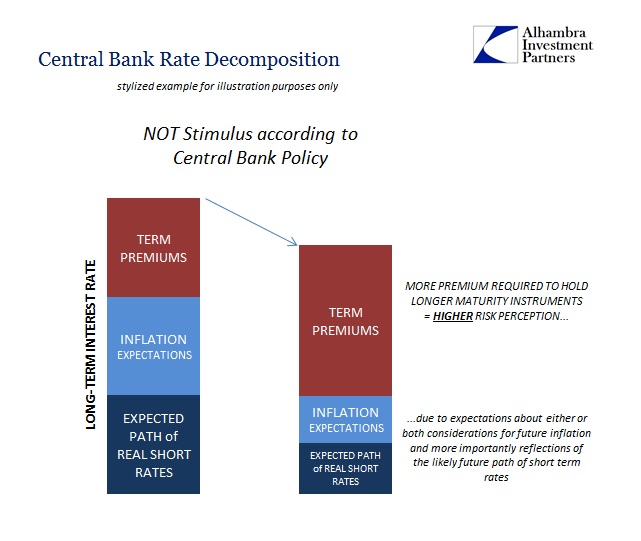

The compartment or categorizing of these elements doesn’t really matter. If perceptions of reduced future opportunities affect the expected path of real short term interests rates or inflation expectations, does it really matter what we call them? In many ways they are the same thing. They are given different boxes because economists think the central bank is what matters (especially for the future path of money rates). Term premiums are therefore helpful only in the respect that they might force academic economists to realize the bond market is not now and has not been their friend. They can fantasize, as they often did in 2014, that interest rates were falling at the time because term premiums as they saw them were, but that wasn’t ever really the case. In other words, in their own terms and using their own language the bond market was telling them what they refused to hear. It is doing so again. |

Central Bank Rate Decomposition |

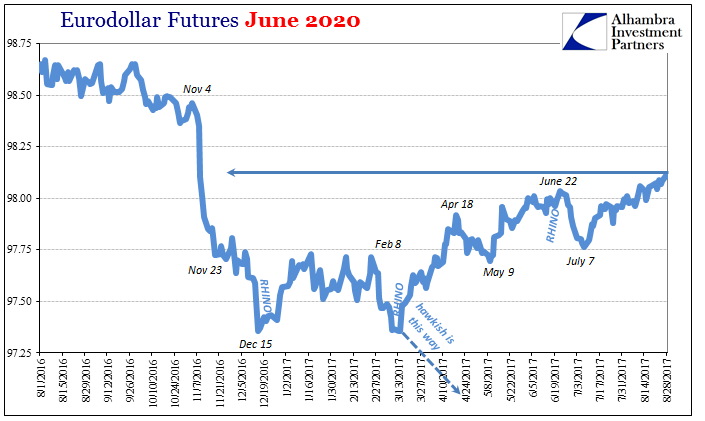

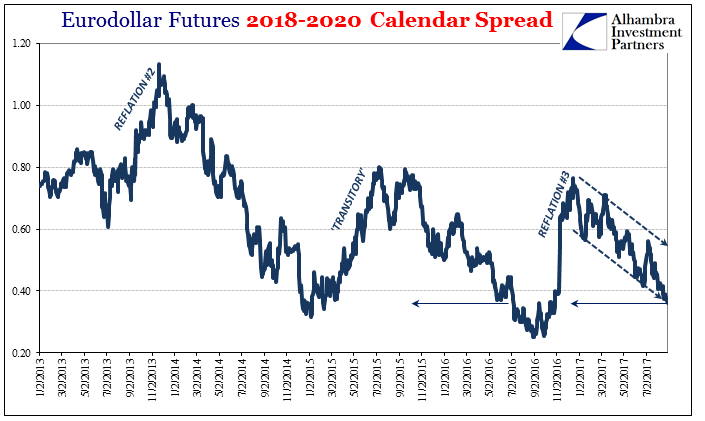

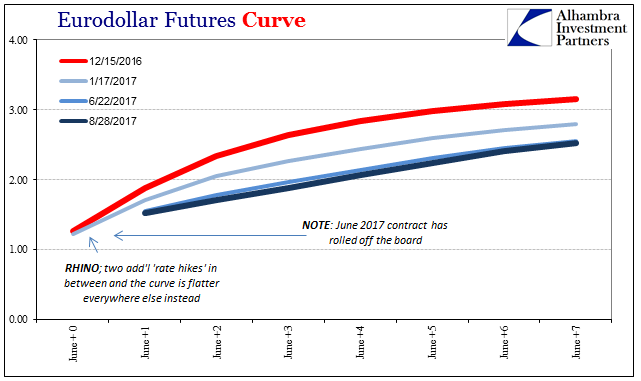

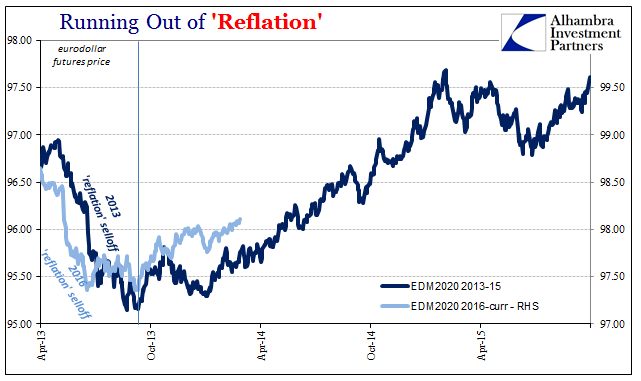

| We have proxies for both inflation expectations as well as the expected path of short rates (if not fully in real terms). Inflation expectations never gained much during “reflation” last year, and neither did money rate expectations. |

Eurodollar Futures June 2020, Aug 2016 - Aug 2017 |

| Now both are suggesting conditions more like last summer than summer 2013. Using Fisherian decomposition, then, term premiums would have to be rising (if they existed). |

Eurodollar Futures 2018-2020 Calendar Spread, Jan 2013 - Jul 2017 |

| Therefore by economists’ own terms the bond market is not suggesting further “stimulus” but further lack of opportunity (rising liquidity preferences as the true substitute for term premiums). |

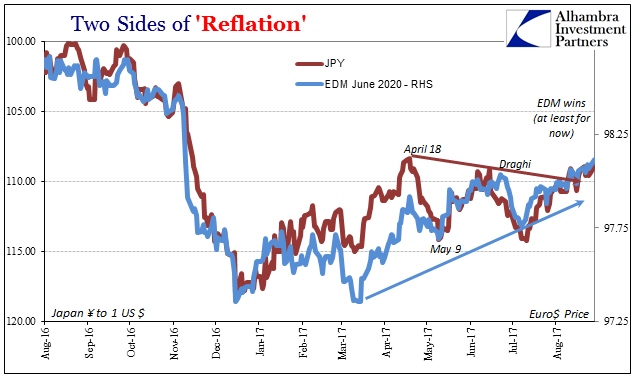

Two Sides of 'Reflation', Aug 2016 - Aug 2017 |

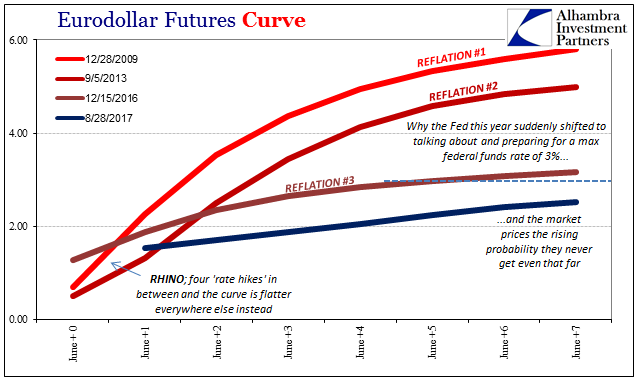

| It proves for a third time (2011-12, 2014-16, 2017-??) that interest rates aren’t what they are made to be. To claim that they have nowhere to go but up misses the crucial information where curves all agree. |

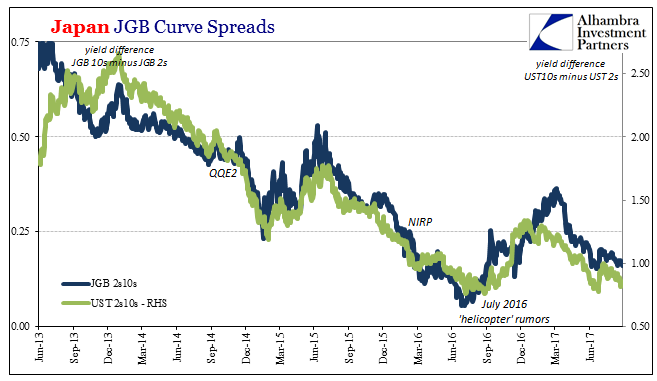

Japan JGB Curve Spreads, Jun 2013 - Jun 2017 |

| The June 2020 eurodollar futures contract (EDM refers to the June series) closed today at the highest price since the November selloff. |

Eurodollar Futures Curve |

| That rising price means incrementally lower expectations for future money rates. JPY is as (almost) always not far behind, though as of today remains still less than mid-April. |

Eurodollar Futures Curve |

| And it’s not just here in UST’s, it is a global impulse reborn as “reflation” slowly fades in 2017, just as it slowly faded throughout 2014 (German 2s closed at the lowest yield, most negative, since April before the French election). |

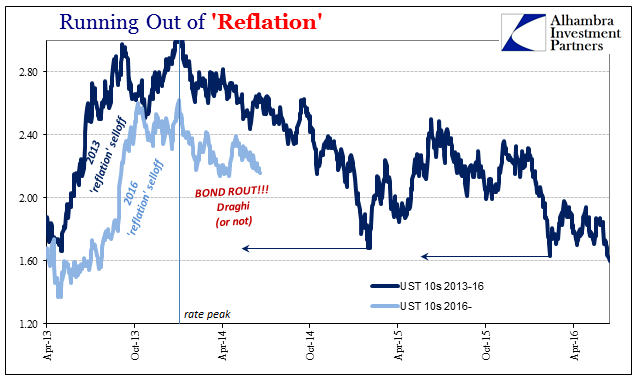

Running Out of 'Reflation', Apr 2013 - 2016 |

| It’s not term premiums but reborn pessimism. With good reason. We’ve seen this movie before. |

Running Out of 'Reflation', Apr 2013 - 2015 |

Tags: bond market,currencies,decomposition,economy,eurodollar curve,eurodollar futures,Featured,Federal Reserve/Monetary Policy,Interest rates,Irving Fisher,liquidity preferences,Markets,newslettersent,Reflation,term premiums,treasury yields,Yield Curve