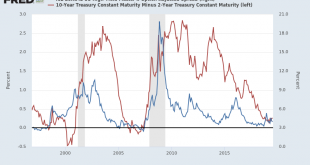

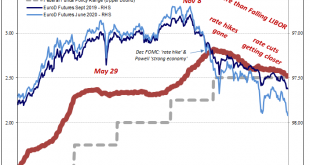

This is a companion piece to last week’s Monthly Macro report found here. The Treasury market continues to price in lower nominal and real growth. The stress, the urgency, I see in some of these markets is certainly concerning and consistent with what we have seen in the past at the onset of recession. The move in Treasuries is by some measures, as extreme as the fall of 2008 when we were in a full blown panic. That to me, is evidence that this move is overly...

Read More »Monthly Macro Monitor: Does Anyone Not Know About The Yield Curve?

The yield curve’s inverted! The yield curve’s inverted! That was the news I awoke to last Wednesday on CNBC as the 10 year Treasury note yield dipped below the 2 year yield for the first time since 2007. That’s the sign everyone has been waiting for, the definitive recession signal that says get out while the getting is good. And that’s exactly what investors did all day long, the Dow ultimately surrendering 800 points on the day. I don’t remember anyone on CNBC...

Read More »FX Daily, August 15: Animal Spirits Lick Wounds

Swiss Franc The Euro has risen by 0.18% to 1.0859 EUR/CHF and USD/CHF, August 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It took some time for investors to recognize that the scaling back of US tariff plans was not part of a de-escalation agreement. There was an explicit acknowledgment by US Commerce Secretary Ross that there was no quid pro quo. The US tariff split was more about the US than an overture...

Read More »Why You Should Care Germany More and More Looks Like 2009

What if Germany’s economy falls into recession? Unlike, say, Argentina, you can’t so easily dismiss German struggles as an exclusive product of German factors. One of the most orderly and efficient systems in Europe and all the world, when Germany begins to struggle it raises immediate questions about everywhere else. This was the scenario increasingly considered over the second half of 2018 and the first few months of 2019; whether or not recession. Over the past...

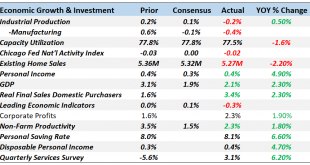

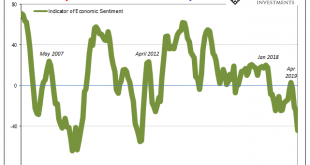

Read More »Monthly Macro Monitor: We’re Not There Yet

It’s been a slow turnin’ From the inside out A slow turnin’ But you come about Slow learnin’ But you learn to sway A slow turnin’ baby Not fade away Now I’m in my car I got the radio on I’m yellin’ at the kids in the back ‘Cause they’re bangin’ like Charlie Watts Slow Turning by John Hiatt “How did you go bankrupt?” Bill asked. “Two ways”, Mike said. “Gradually and then suddenly.” The Sun Also Rises, By Ernest...

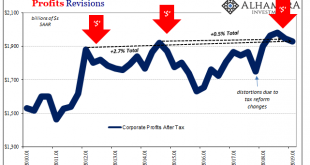

Read More »More What’s Behind Yield Curve: Now Two Straight Negative Quarters For Corporate Profit

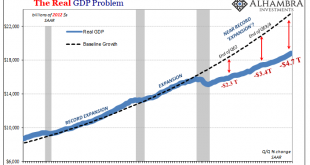

The Bureau of Economic Analysis (BEA) piled on more bad news to the otherwise pleasing GDP headline for the first quarter. In its first revision to the preliminary estimate, the government agency said output advanced just a little less than first thought. This wasn’t actually the substance of their message. Accompanying this first revision was the first set of estimates for corporate profits. For the second straight...

Read More »Europe Comes Apart, And That’s Before #4

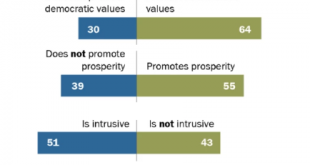

In May 2018, the European Parliament found that it was incredibly popular. Commissioning what it calls the Eurobarameter survey, the EU’s governing body said that two-thirds of Europeans inside the bloc believed that membership had benefited their own countries. It was the highest showing since 1983. Voters in May 2019 don’t appear to have agreed with last year’s survey. For the first time since 1979, Social Democrats...

Read More »The Transitory Story, I Repeat, The Transitory Story

Understand what the word “transitory” truly means in this context. It is no different than Ben Bernanke saying, essentially, subprime is contained. To the Fed Chairman in early 2007, this one little corner of the mortgage market in an otherwise booming economy was a transitory blip that booming economy would easily withstand. Just eight days before Bernanke would testify confidently before Congress, the FOMC had met to...

Read More »Proposed Negative Rates Really Expose The Bond Market’s Appreciation For What Is Nothing More Than Magic Number Theory

By far, the biggest problem in Economics is that it has no sense of itself. There are no self-correction mechanisms embedded within the discipline to make it disciplined. Without having any objective goals from which to measure, the goal is itself. Nobel Prize winning economist Ronald Coase talked about this deficiency in his Nobel Lecture: This neglect of other aspects of the system has been made easier by another...

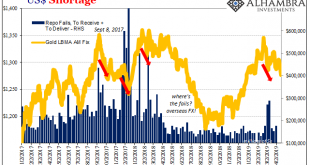

Read More »COT Blue: Distinct Lack of Green But A Lot That’s Gold

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge. Corroboration and consistency are paramount. Gold had been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org