Summary India Prime Minister Modi has started a cabinet shuffle. Freeport McMorAn ceded control of the world’s second largest copper mine to the Indonesian government. Central Bank of Russia took over Bank Otkritie, once Russia’s largest private bank. Kenya’s top court nullified last month’s presidential election. Fitch cut Qatar’s rating by one notch to AA- with negative outlook. Chile’s economic team saw a big...

Read More »Emerging Market: Preview of the Week Ahead

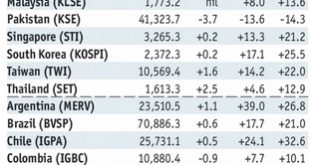

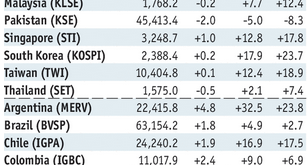

Stock Markets EM FX ended last week on a strong note, buoyed by perceived dovishness from Yellen at the Jackson Hole symposium. However, US jobs data this Friday could test the market’s convictions. Within EM, data are likely to support our view that EM central banks can retain their largely dovish posture into 2018. Stock Markets Emerging Markets, August 23 Source: economist.com - Click to enlarge Mexico...

Read More »Emerging Markets: What has Changed

Summary: Tensions on the Korean peninsula are still rising. Hong Kong boosted its 2017 growth forecast. S&P affirmed Israel’s A+ rating but moved the outlook from stable to positive. The corruption investigation against Israeli Prime Minister Netanyahu has intensified. South Africa’s parliament voted down the no confidence motion against President Zuma. Argentina officials are taking steps to support the peso. ...

Read More »Emerging Markets: The Week Ahead

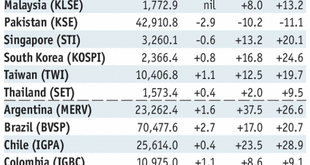

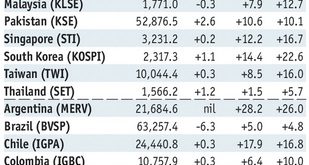

Stock Markets EM FX appears to be rolling over (see our recent piece “Is EM FX Finally Turning?”). Technical indicators are stretched as many EM currencies bump up against strong resistance levels. Strong US jobs data is bringing Fed tightening back into focus. We think ZAR could be shaping up to be the canary in a coalmine. It was -3% vs. USD last week and by far the worst in EM. Stock Markets Emerging Markets,...

Read More »Emerging Markets: What has Changed

Summary The Reserve Bank of India started an easing cycle by cutting all policy rates 25 bp. Bank Indonesia has tilted more dovish after signaling earlier this year that the easing cycle was over. Czech National Bank became the first in Europe to hike. Political risk is rising in Israel. President Trump signed the Russia sanctions bill. Nigeria is trying to unify its system of multiple exchange rates. Brazil President...

Read More »Emerging Markets: What has Changed

Summary South Korea proposed resuming military and humanitarian exchanges with North Korea. The European Union may sanction Poland over its controversial judicial overhaul. Turkish Prime Minister Yildirim announced a cabinet shuffle after meeting with President Erdogan. Turkey’s worsening relations with Germany will come with economic costs. South African Reserve Bank surprised markets by starting the easing cycle with...

Read More »Emerging Markets: Preview of the Week Ahead

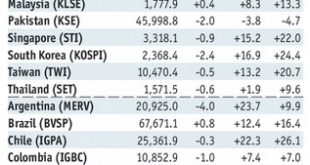

Stock Markets EM FX ended the week on a firm note, helped by softer than expected US data. Indeed, EM FX was up across the board for the entire week and was led by BRL, MXN, and ZAR. The ECB meeting this week will draw some interest, especially after the BOC last week became the second major central bank to hike rates. Stock Markets Emerging Markets, July 05 Source: economist.com - Click to enlarge Hungary...

Read More »Emerging Markets: What has Changed

Summary: The Reserve Bank of India cut its inflation forecast for FY2017/18. South Korean President Moon suspended the installation of the remaining components of the THAAD missile shield. S&P cut Qatar one notch to AA-. Turkey looks likely to get caught up in yet another regional conflict. Brazil’s structural reform agenda has been delayed as President Temer remains on the ropes. Stock Markets In the EM equity...

Read More »Emerging Markets: What has Changed

Summary The Indonesian cabinet is discussing revisions to the 2017 state budget. The Thai central bank plans to reform some FX rules. South African President Zuma survived the no confidence vote within his own ANC. Brazil’s central bank signaled a slower pace of easing ahead after it cut 100 bp again. Moody’s cut the outlook on Brazil’s Ba2 rating from stable to negative. Stock Markets In the EM equity space as...

Read More »Emerging Markets: Week Ahead Preview

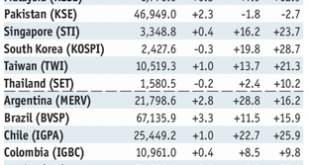

Stock Markets EM FX closed last week on a mixed note, with markets struggling to find a compelling investment theme. The US jobs data this week could provide some more clarity on Fed policy. We still think markets are still underestimating political risk in the big EM countries, including Brazil (Moody’s outlook moved to negative), Mexico (election in state of Mexico), South Africa (ANC debates Zuma’s fate), and Turkey...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org