Summary: Part of the US Republican tax reforms call for a border adjustment. It will tax imports fully and not exports. This will likely be challenged at the WTO. Many economists say the dollar will automatically appreciate by 20%. WE are bullish the dollar but skeptical of the logic here. While hearings on US President-elect Trump’s nominees will begin this week, the Republicans are preparing dramatic changes...

Read More »FX Daily, January 09: Sterling Pounded by May’s Hard Brexit

Swiss Franc EUR/CHF - Euro Swiss Franc, January 09(see more posts on EUR/CHF, ) - Click to enlarge I am reading a lot about the pound in 2017 which is likely to be as volatile as in 2016. But the Franc is a harder beast to predict. Loosely tracking the euro but subject to its own rules and trends GBPCHF could be an interesting pair to watch in 2017. There are numerous global events which can shape the...

Read More »FX Weekly Preview: Macro Forces Underpin Dollar, Equities and Yields

Summary: Odds of a March Fed hike edged up last week, and Q4 GDP figures were revised higher. Many continue to expect the new US Administration to pursue pro-growth tax reform, deregulation and infrastructure spending. Although many other high income countries are growing, near trend divergence of monetary policy continues. United States The major US equity indices reached record highs before the weekend even...

Read More »US Jobs Details Better than the Headline

United States The dollar and US yields are recouping more of yesterday’s decline. A break of $1.0480-$1.05 would suggest the euro’s upside bounce is exhausted. A dollar move above JPY116.80-JPY117.25 would also hint that the greenback was going to make an other run toward JPY118.30-JPY118.60. Sterling support is seen in the $1.2285-$1.2310 area. The Canadian dollar is struggle to sustain it upward momentum. A US dollar...

Read More »FX Daily, January 06: Dollar Consolidates Losses, Peso Firms while Yuan Reverses

Swiss Franc EUR/CHF - Euro Swiss Franc, January 06(see more posts on EUR/CHF, ) - Click to enlarge I am reading a lot about the pound in 2017 which is likely to be as volatile as in 2016. But the Franc is a harder beast to predict. Loosely tracking the euro but subject to its own rules and trends GBP/CHF could be an interesting pair to watch in 2017. There are numerous global events which can shape the...

Read More »A Few Thoughts Ahead of the US Jobs Report

Summary ADP and Non-Manufacturing ISM lend credence to our fear of a disappointing national jobs report. Economists estimate only a small part of the manufacturing jobs loss can be traced to trade policy. 19 states increased min wage at the start of the year, but the impact on the nation’s average weekly earnings will likely be too small to detect. We have suggested the risk of disappointment with the US...

Read More »FX Daily, January 05: Dollar Slide but Resilience Demonstrated while Yuan Squeezed Higher

Swiss Franc EUR/CHF - Euro Swiss Franc, January 05(see more posts on EUR/CHF, ) - Click to enlarge The Swiss Franc has limited data releases to note for the upcoming weeks therefore I expect news from the Brexit story and UK economic data to influence exchange rates this month. At present we are awaiting the decision from the Supreme Court in regards to if UK Prime Minister Theresa May needs to seek Government...

Read More »FX Daily, January 04: Consolidation in Capital Markets

Swiss Franc EUR/CHF - Euro Swiss Franc, January 04(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF rates have jumped during the first official day of trading in 2017, with the pair hitting 1.2657 at today’s high. The Pound gained support this morning following positive UK Manufacturing data, which came in well above market expectation. This increased market confidence in the UK economy and the Pound has...

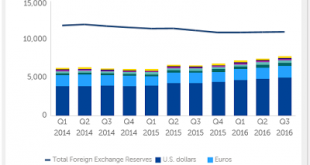

Read More »A Few Takeaways from the Latest IMF Reserve Figures

Summary: Overall reserve holdings hardly changed in Q3. China continues to bleed its reserves from unallocated to allocated. Sterling’s share of new reserves warns it may be losing some allure. The IMF is the most authoritative source for reserve holdings of central banks. It reports the data at the end of each quarter with a quarter lag. At the end of last year, the IMF published the Q3 16 reserve figures. ...

Read More »FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

Swiss Franc Switzerland SVME PMI, December 2016(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge FX Rates The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling’s earlier losses were recouped following news that the manufacturing PMI jumped to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org