Swiss Franc Switzerland Consumer Price Index (CPI) YoY, April 2017(see more posts on Switzerland Consumer Price Index, ) Source: investing.com - Click to enlarge FX Rates The US dollar has been mostly confined to about a 30 pip range against the euro and yen in Asia and the European morning. Sterling is under a little pressure after a series of poor data, including larger than expected falls in manufacturing and...

Read More »FX Daily, May 10: Markets Adjust to North Korean Threat, Fifth Fall in US Oil Inventories and Trump Drama

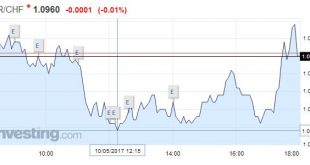

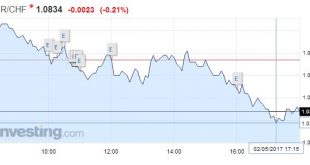

Swiss Franc EUR/CHF - Euro Swiss Franc, May 10(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea’s ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula. The Dollar...

Read More »FX Daily, May 09: Dollar Firms amid Position Adjustments

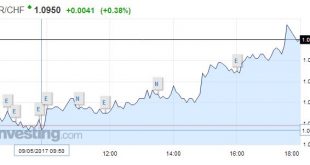

Swiss Franc EUR/CHF - Euro Swiss Franc, May 09(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The election of Macron as French President has set off a bout of position adjustment that has seen the euro push back into the $1.0850-$1.0950 range that had confined activity for the two weeks between the first and second rounds of the French presidential election. The euro fell a cent yesterday after...

Read More »FX Daily, May 08: Euro Bought on Rumor, Sold on Fact

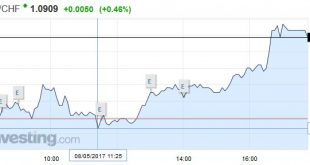

Swiss Franc EUR/CHF - Euro Swiss Franc, May 08(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates The US Dollar Index initially fell to its lowest level since mid-November to 98.50. It rebounded but stalled in front of the pre-weekend high near 99.00. This area must be overcome to lift the tone. Sterling stretched to a marginal high but faded in front of $1.30. Initial support is seen...

Read More »FX Weekly Preview: Dollar Drivers

Summary: US retail sales and CPI should help bolster confidence that the Fed was right about the transitory nature of Q1 slowdown. Bank of England meets; Forbes will likely continue with her dissent, but likely failed to convince her other colleagues of the merit of an immediate rate hike. French politics are center stage, but German state election and South Korea’s national election are also important....

Read More »FX Daily, May 05: Mixed Dollar Ahead of US Jobs Data and Fed Talk

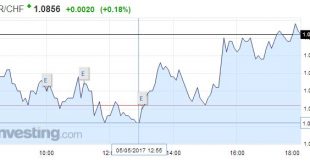

Swiss Franc EUR/CHF - Euro Swiss Franc, May 05(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is narrowing mixed as the employment data, and Fed speeches are awaited. Six Fed officials speak today, including Yellen and Fischer. Regional Presidents Williams, Rosengren Evans and Bullard also speak. It will be the first flurry of speeches since the FOMC meeting. Lastly, we note some chunky...

Read More »FX Daily, May 04: Greenback Struggles to Sustain Upticks, Though Odds of June Hike Rise

Swiss Franc EUR/CHF - Euro Swiss Franc, May 04(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is struggling to maintain even modest upticks against the euro and sterling despite the recognition of the increased likelihood of a June Fed hike. Bloomberg sees current pricing in the Fed funds as making a hike in June a near certainty (97.5%), while the CME and our own calculation...

Read More »FX Daily, May 03: Marking Time

Swiss Franc EUR/CHF - Euro Swiss Franc, May 03(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The global capital markets are relatively calm. Japan, South Korea, and Hong Kong markets are closed for national holidays. Investors await the FOMC statement, though expectations could not be much lower. The disappointing US auto sales, and poor Apple sales figures reported yesterday have had little impact...

Read More »FX Daily, May 02: Dollar and Yen Heavy, Equities Trade Higher and Bonds Lower

Swiss Franc EUR/CHF - Euro Swiss Franc, May 02(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is sporting a softer profile against most of the major and emerging market currencies. The Japanese yen is the main exception. The greenback is rising against the yen for the fourth session and the sixth of the past seven. The dollar’s gains against the yen coincide with the 10-12 bp recovery...

Read More »FX Daily, May 01: May Day Calm

Swiss Franc Switzerland Retail Sales YoY, March 2017(see more posts on Switzerland Retail Sales, ) Source: Investing.com - Click to enlarge FX Rates Many financial centers are closed for May. Japanese markets were open today, but will be closed for three sessions beginning Wednesday for the Golden Week celebrations. The US dollar is narrowly mixed. The yen is the weakest of the majors, off about 0.3% as the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org