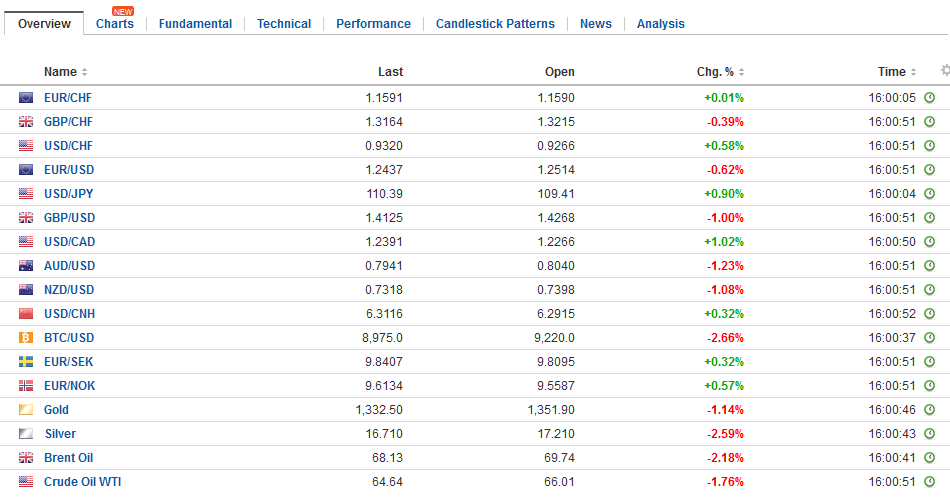

Swiss Franc The Euro unchanged at 1.1585 CHF. EUR/CHF and USD/CHF, February 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is sporting a firmer profile against all the major currencies after weakening yesterday. Frequently, it seems the Australian dollar leads the other currencies, and we note that it is making a new low for the week today. Briefly, in Europe, it slipped below its 20-day moving (~%excerpt%.7985) average for the first time since December 13. The US dollar is also recording new highs for the week against the Japanese yen. Many observers have been speculating that the BOJ is tapering or moving closer to the exit. A week ago, BOJ Governor Kuroda

Topics:

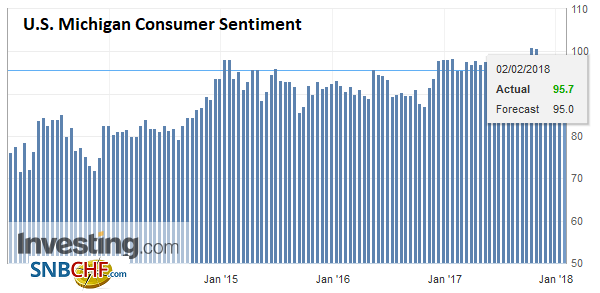

Marc Chandler considers the following as important: AUD, EUR/CHF, Eurozone Producer Price Index, Featured, FX Trends, Italy Consumer Price Index, JPY, newslettersent, U.K. Construction PMI, U.S. Michigan Consumer Sentiment, U.S. Nonfarm Payrolls, U.S. participation rate, U.S. unemployment rate, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro unchanged at 1.1585 CHF. |

EUR/CHF and USD/CHF, February 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

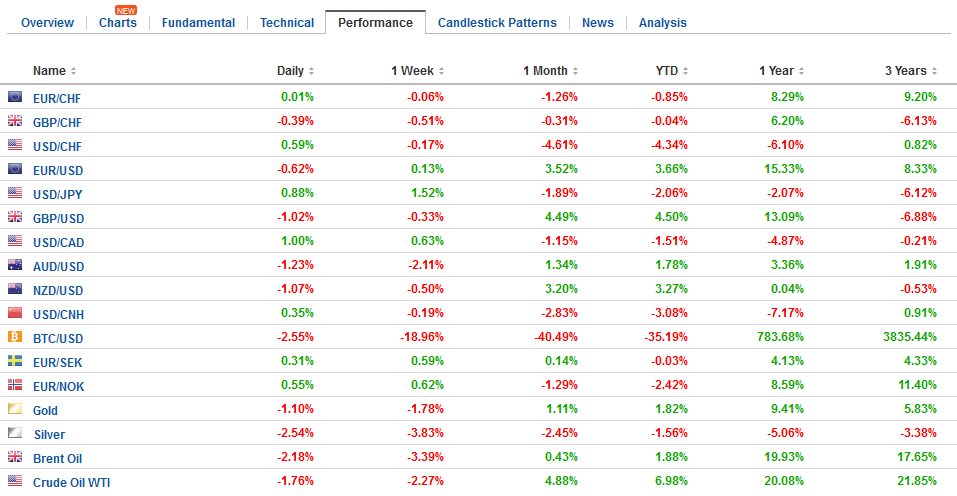

FX RatesThe US dollar is sporting a firmer profile against all the major currencies after weakening yesterday. Frequently, it seems the Australian dollar leads the other currencies, and we note that it is making a new low for the week today. Briefly, in Europe, it slipped below its 20-day moving (~$0.7985) average for the first time since December 13. The US dollar is also recording new highs for the week against the Japanese yen. Many observers have been speculating that the BOJ is tapering or moving closer to the exit. A week ago, BOJ Governor Kuroda told a Davos audience that the inflation target is getting closer. Many participants bought the yen. We took the BOJ’s word that it had not changed policy. The fewer JGBs it was buying was a consequence of the shift to “yield curve control” in 2016. |

FX Daily Rates, February 02 |

| The BOJ’s actions today should help reinforce its message and this appears to be responsible for the dollar getting closer to JPY110 after have approached JPY108.25 a week ago. The BOJ did two things today. First, as the 10-year yield was approaching 10 bp, the upper end of its acceptable range, the BOJ offered to buy an unlimited amount of 10-year bonds at 11 bp. It did this twice last year.

Second, it increased the amount of 5-10 year bonds it bought in its normal operation to JPY450 bln (~$4.1 bln), an increase of JPY40 bln from its last offering. Recall that in the middle of the middle of the week, the BOJ increased the amount of 3-5 year bonds it was purchasing. It is also noteworthy that no one was willing to sell their 10-year bonds to the BOJ. The signaling impact and the willingness to buy unlimited amounts steadied the market (generic 10-year yield is off 1.4 bp to 8.6 bp, slightly below yesterday’s low). The reason the BOJ’s balance sheet is not expanding as much as it did prior to the adoption of the “yield curve control” strategy, which is effective primarily through moral suasion and the signaling impact. It requires few purchases. |

FX Performance, February 02 |

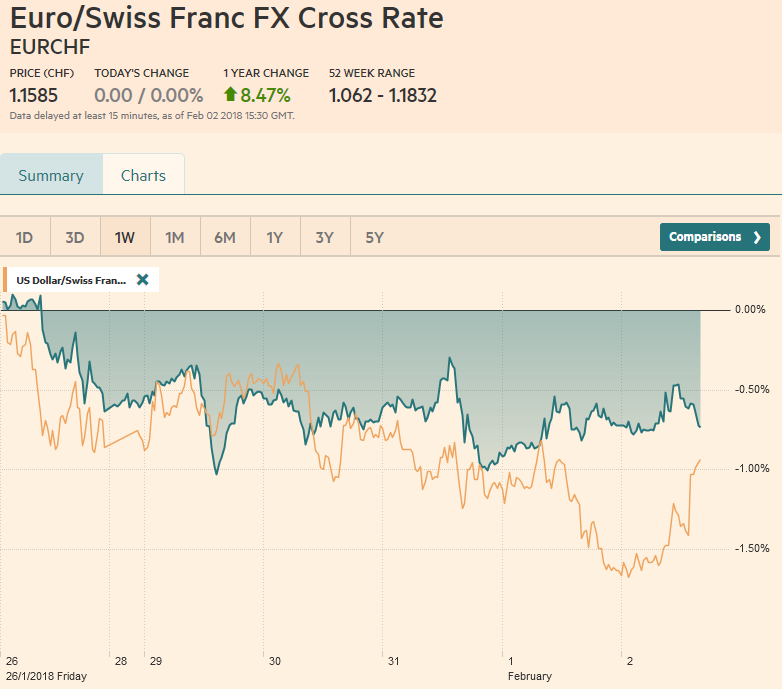

United KingdomThe news stream otherwise is light, and largely limited to the UK’s construction PMI. Like the manufacturing report that was released yesterday, today’s report also disappointed. The 50.2 reading is a three-month low. The median forecasts were looking for something closer to 52.0 after 52.2 in December. Last year’s average was 52.3. The service sector PMI, which of course covers the largest sector of the UK economy will be reported on Monday. Most are looking for little change from the 54.2 in December, though the risk seems to be on the downside. |

U.K. Construction Purchasing Managers Index (PMI), Jan 2018(see more posts on U.K. Construction PMI, ) Source: Investing.com - Click to enlarge |

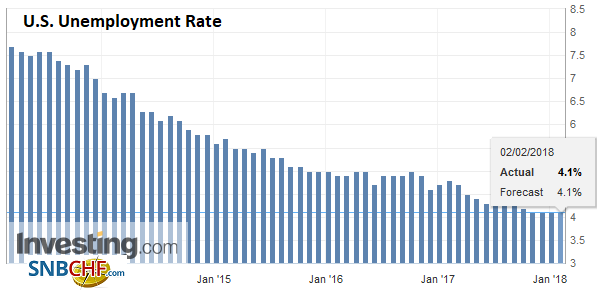

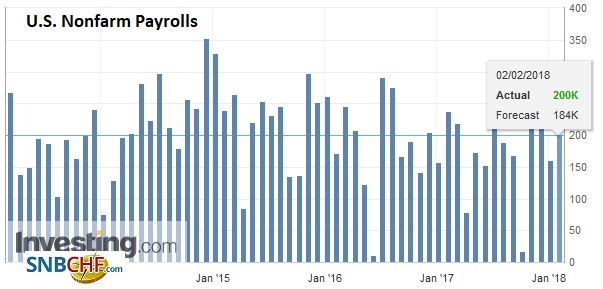

United StatesThe US jobs report contains important economic data that is used by economists to help forecast other data over the course of the month. However, the net new jobs the US economy is creating is somewhat less significant than earlier in the cycle. With the focus more on price pressures, the average hourly earnings, is the most important part of the report, barring a significant shock. |

U.S. Unemployment Rate, Jan 2018(see more posts on U.S. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

| That said, the 12-month moving average of non-farm payrolls is an important cyclical indicator. It peaked three-year ago (February 2015) at 261k. In 2015 the US created an average of 226k jobs a month. In 2016, it slipped to 187k and 171k last year. Perhaps skew by some weather distortions, in Q4 17, the US created an average of 204k net new jobs a month. As the cycle matures, slower job growth is by definition inevitable. |

U.S. Nonfarm Payrolls, Jan 2018(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge |

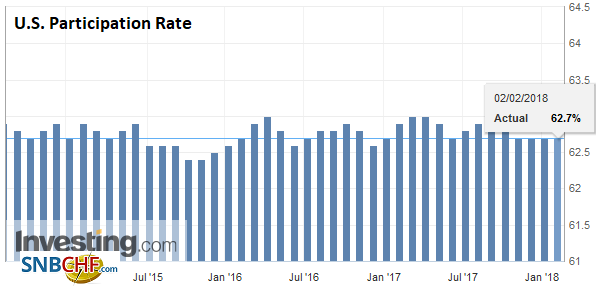

| The jobs report is one part of what appears to be accumulating evidence of late-cycle symptoms. It does not mean an economic downturn this year. It can be gradual barring a new negative shock, and on the other hand, the tax cuts may provide a late cycle boost. Still, the late cycle aspects should not be dismissed. The weaker than expected auto sales reported yesterday are part of this too. |

U.S. Participation Rate, Jan 2018(see more posts on U.S. Participation Rate, ) Source: Investing.com - Click to enlarge |

| Rising labor costs, which were seen yesterday in the Q4 unit labor costs (2.0% vs. Bloomberg survey median of 0.9% ) are also taking place late in the cycle. In January 2017, average hourly earnings to rose 0.2% for a 2.6% year-over-year pace. A 0.3% rise last month would lift the year-over-year rate back to 2.6% from 2.5%. The average annual pace in 2017 was 2.6% and in 2016 the average was 2.5%. |

U.S. Michigan Consumer Sentiment, Feb 2018(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

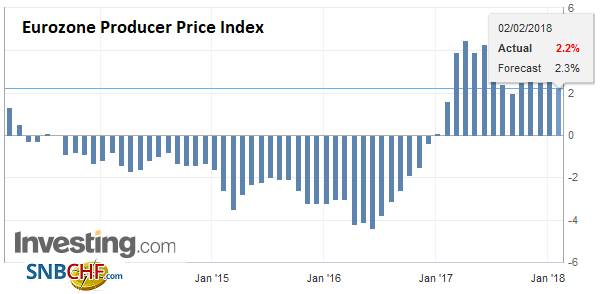

Eurozone |

Eurozone Producer Price Index (PPI) YoY, Dec 2017(see more posts on Eurozone Producer Price Index, ) Source: Investing.com - Click to enlarge |

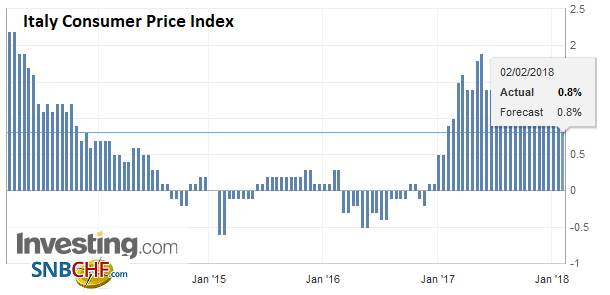

Italy |

Italy Consumer Price Index (CPI) YoY, Jan 2018(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

There are a few expiring options that may be of interest. There are 837 mln euros struck at $1.25 that will be cut today. There are also $937 mln struck at JPY110 and another $370 mln struck at JPY109.35 that will expire. There are GBP561 mln struck at $1.42 and another GBP223 mln struck at $1.4250 that will be cut today.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$JPY,EUR/CHF,Eurozone Producer Price Index,Featured,Italy Consumer Price Index,newslettersent,U.K. Construction PMI,U.S. Michigan Consumer Sentiment,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Unemployment Rate,USD/CHF