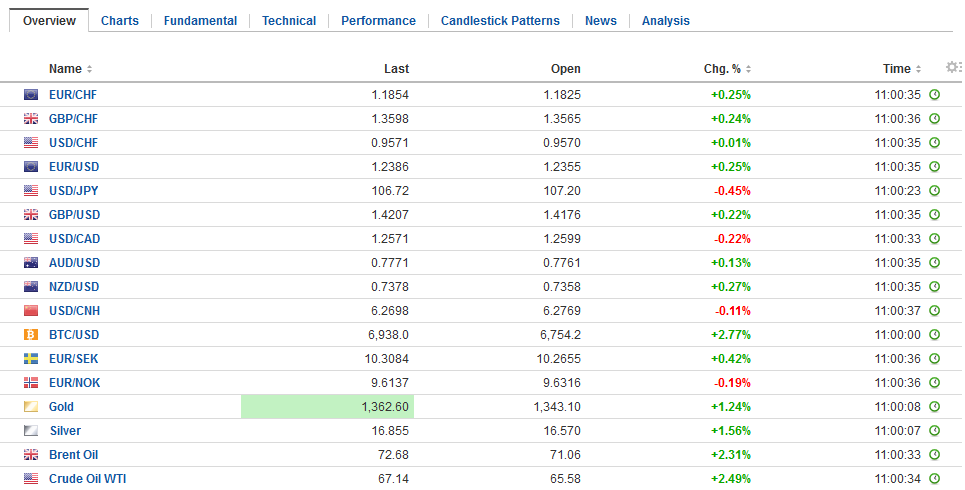

Swiss Franc The Euro has risen by 0.20% to 1.1846 CHF. EUR/CHF and USD/CHF, April 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Between Syria, trade tensions, and the US special investigator into Russia’s attempt to influence the US election, market participants are cautious as they wait for another shoe to drop. The US equity market recovery yesterday has short coattails as markets in Asia and Europe struggle. Bond yields are mostly softer, and the US 10-year note yield is dipping back below 1.80%. The US dollar is mixed, with small gains against the dollar bloc and small losses against the euro, yen, and sterling. The sense is that whichever shoes drop; the

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, China Consumer Price Index, China Producer Price Index, EUR/CHF, Featured, newslettersent, SPY, U.S. Consumer Price index, U.S. Core Consumer Price Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.20% to 1.1846 CHF. |

EUR/CHF and USD/CHF, April 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesBetween Syria, trade tensions, and the US special investigator into Russia’s attempt to influence the US election, market participants are cautious as they wait for another shoe to drop. The US equity market recovery yesterday has short coattails as markets in Asia and Europe struggle. Bond yields are mostly softer, and the US 10-year note yield is dipping back below 1.80%. The US dollar is mixed, with small gains against the dollar bloc and small losses against the euro, yen, and sterling. The sense is that whichever shoes drop; the headline risk is dollar negative. The euro closed above CHF1.18 yesterday for the first time since January 15 and is at its best level since the SNB gave up its franc-cap. Elsewhere the Russian ruble continues to fall (~-1.3%), but the Russian bond yields are little changed. According to central bank figures, foreign investors owned a record 34% of Russian bonds. The sanctions announced before the weekend spurred the sales of the bonds and currency. |

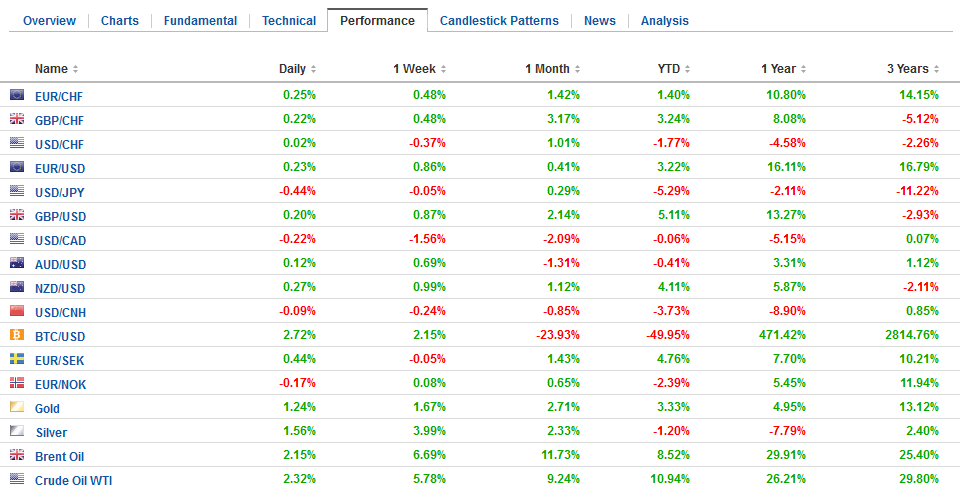

FX Daily Rates, April 11 |

| The FOMC minutes are drawing more attention than usual. The March meeting was Powell’s first and a rate hike was delivered. However, ideas that the minutes will reveal much insight into what officials were thinking about the rising trade tensions or the thrust of fiscal policy, which the CBO estimated this week would produce a $1 trillion deficit in 2020, two years earlier than previously expected, may be disappointed.

The minutes of central bank meetings should not be confused with an objective record of the meetings. They are purposefully crafted as part of the official communication to help shape investor expectations. This is to say that they are a policy tool. Increased protectionism poses a downside risk to the economy. Not much more can be said at this juncture. The same thing is true of the fiscal position. It poses risks, and it is too early to judge the economic consequences in full, but it will likely bring the Fed closer to its mandates of full employment and price stability (at it defines it). |

FX Performance, April 11 |

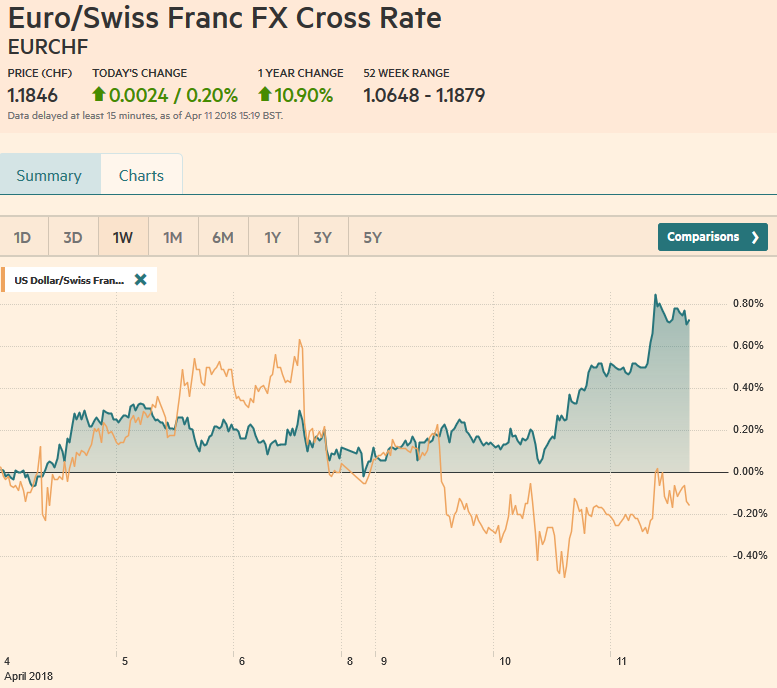

Untied StatesThe US reports March CPI, and the Fed releases its minutes from the March FOMC meeting. The risk is on the upside of the market expectation for a flat CPI, which due to base effects, would rise by 2.4% from a year ago, up from 2.2%. |

U.S. Consumer Price Index (CPI) YoY, Apr 2013 - 2018(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

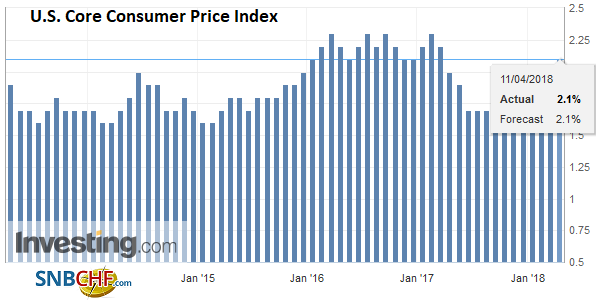

| The core rate is expected to have increased by 0.2%, and this would lift the year-over-year rate above 2.0% for the first time in a year as some factors that the Fed has suggested were transitory are proving so. |

U.S. Core Consumer Price Index (CPI) YoY, Apr 2013 - 2018(see more posts on U.S. Core CPI, ) Source: Investing.com - Click to enlarge |

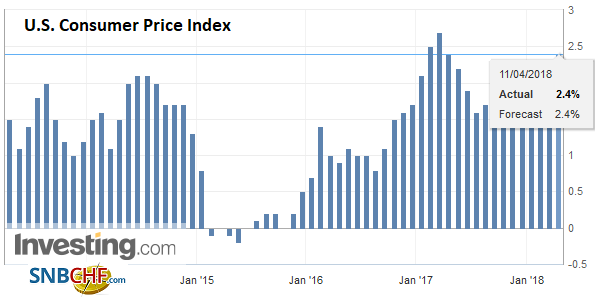

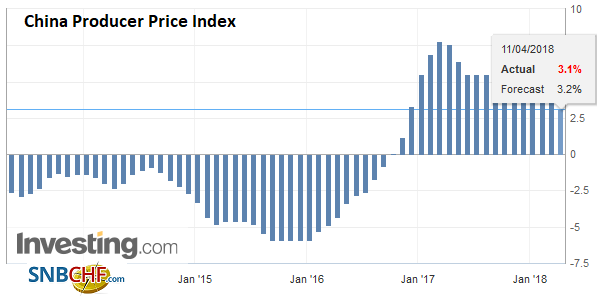

ChinaThe yuan both on and offshore was little changed. Chinese shares edged higher (0.5%). The MSCI Asia Pacific Index was fractionally lower, as is the MSCI Emerging Markets Index. China reported softer than expected inflation. March PPI rose 3.1% year-over-year, down from 3.7% in February. |

China Producer Price Index (PPI) YoY, May 2013 - Apr 2018(see more posts on China Producer Price Index, ) Source: Investing.com - Click to enlarge |

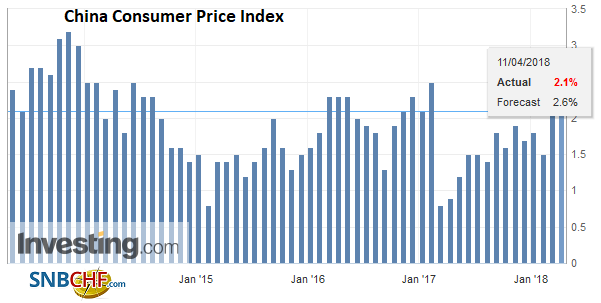

| Consumer price inflation slowed to 2.1% from 2.9%. This is the fifth month; producer price inflation has slowed. The slowing of consumer price inflation seems to be largely unwinding of the Lunar New Year-related jump. The quarterly average has edged higher for the third consecutive quarter, but the pace in Q1 was exaggerated. |

China Consumer Price Index (CPI) YoY, May 2013 - Apr 2018(see more posts on China Consumer Price Index, ) Source: Investing.com - Click to enlarge |

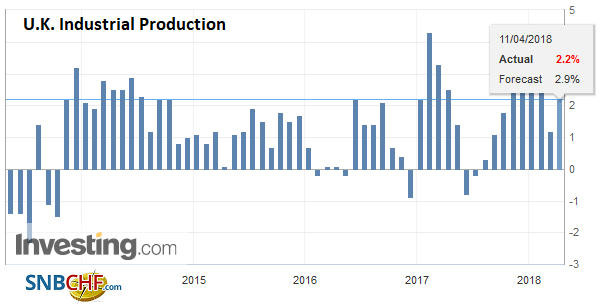

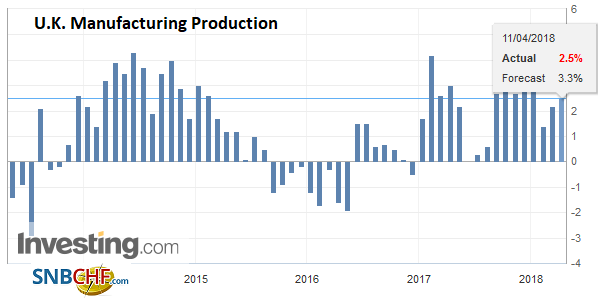

United KingdomLike other countries in Europe, the UK’s industrial output figures disappointed in February. UK output rose 0.1%. The market was looking for something closer to 0.4%. It follows a 1.3% rise in January. However, this overstates the strength. |

U.K. Industrial Production YoY, May 2013 - Apr 2018(see more posts on U.K. Industrial Production, ) Source: Investing.com - Click to enlarge |

| Manufacturing output itself fell 0.2% in February following a revised flat report in January (initially 0.1%). Separately, construction spending fell 1.6% after January’s 3.1% slide. Economists had expected an increase. |

U.K. Manufacturing Production YoY, May 2013 - Apr 2018(see more posts on U.K. Manufacturing Production, ) Source: Investing.com - Click to enlarge |

As the forum continues in China, the new PBOC Governor wasted no time, following President Xi’s speech yesterday to flesh out more details of the reforms. These include quadrupling the Shanghai-Hong Kong stock connect as of May 1. Limits on foreign insurers and ownership of securities firms will be reduced. Yi Gang pushed against “big bang” ideas, noting that it is not China’s way, which is cautious and gradual.

Even if Xi offered old wine in new skin yesterday, the specifics today reinforce our sense that China is pursuing a three-prong strategy in dealing with the US trade stance. First, it flexes some of its considerable economic heft. Second, it challenges the unilateral US actions at the WTO, perhaps in concert with others. Third, there are several economic and financial reforms that are in China’s own immediate interest, and it will enact these.

There have been a few economic reports, even if there is little impact in the markets. Japan reported stronger than expected core machine orders (2.1% vs. expectations -2.5%) and followed the 8.2% rise in January. Officials will find encouragement in the data, which suggest the underlying economic dynamics are still intact. The capital spending cycle is supported by exports and the semiconductor fabrication facilities being build abroad (e.g., China).

France’s Industry Sentiment Indicator edged lower, consistent with other survey data. In March it stood at its lowest level since January 2017. Italy reported a slightly better than expected February retail sales, which rose 0.4% after a 0.5% decline in January.

The EU announced that it would add to its major data reports a new measure that excludes the UK from aggregates. This is in preparation for the UK leaving the EU at the end of next March. UK data today mostly disappointed, but the February trade deficit fell. The overall trade balance fell to GBP965 mln. It has been rarely smaller than this since 2000, and it is usually a spike.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,China Consumer Price Index,China Producer Price Index,EUR/CHF,Featured,newslettersent,SPY,U.S. Consumer Price Index,U.S. Core Consumer Price Index,USD/CHF