- Click to enlarge The global head of Fitch’s sovereign ratings warned that the continued US government shutdown could jeopardize the AAA-status the rating agency grants America. It spurred little market reaction (and for good reason). First, the rating cut is not imminent, though some of the headlines suggest otherwise. Fitch’s McCormack though was clear: ” If the shutdown continues to March 1 and the debt ceiling...

Read More »FX Daily, January 8: Dollar Steadies, but Weakly for Turn-Around Tuesday

Swiss Franc The Euro has fallen by 0.15% at 1.1222 EUR/CHF and USD/CHF, January 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets remain calm after the surge in volatility seen over the last couple of weeks. Asian equities were mixed, with the Japanese, Australia and Indian shares gaining, but other large regional markets, like China,...

Read More »Apple, China, Yen, and US Jobs: Welcome to 2019

The New Year is off to an auspicious start. The Japanese yen, the third most actively traded currency behind the dollar and euro, got caught in a vortex of a retail short squeeze, algos, and who knows what else. The US dollar plunged from around JPY109 to a slightly below JPY105 in a few minutes a little more than an hour after US markets closed yesterday. Japanese markets were still closed for the holiday, which may...

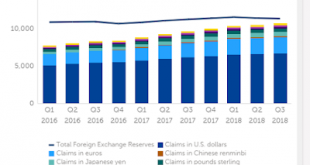

Read More »A Word on Q3 COFER-It Might not be What You Think

The IMF offers the most authoritative report on central bank reserves on a quarterly basis with a quarter lag. The report, the Currency Composition of Official Foreign Exchange Reserves (COFER), covering Q318 has been released. It may be have been overlooked during the holidays, but if and when the pundits see it, the leading takeaway is that the dollar’s share of global reserves fell below 62% for the first time five...

Read More »Technical Musings about the Euro and Dollar Anchored by Macro

The $1.1475-$1.1550 is an important area for the euro. Many bulls see a rounded bottom being carved and a break above it would be embraced as a confirmation. The lower-end corresponds to the 100-day moving average. Such a bottom pattern, if confirmed, would project toward $1.1800 the high in H2 18. On the downside, the low from H2 18 was near $1.1200. This is just above a key (61.8%) retracement of the January...

Read More »Forex Forensics: The Case of the Yen

Over the past five sessions, the yen is the strongest of the major currencies, appreciating about 1.7% against the US dollar, eclipsing the Swedish krona, which rallied strongly today after the Riksbank’s surprise rate hike. Given the sell-off in equities and the decline in markets, the yen’s strength is not surprising. What was surprising though was the dollar’s resilience against the yen earlier this month as equities...

Read More »FX Daily, December 21: Markets Stumble into the Weekend

Swiss Franc The Euro has risen by 0.04% at 1.1308 EUR/CHF and USD/CHF, December 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is little reprieve from the equity meltdown ahead of the weekend. Major markets in the Asia-Pacific region, including Japan, China, India, and Australia pushed lower. The MSCI index of the region is near 15-month lows. The Dow...

Read More »FX Daily, December 19: The Fed’s Paws may Still Unsettle Investors

Swiss Franc The Euro has risen by 0.43% at 1.1325 EUR/CHF and USD/CHF, December 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The failure of the S&P 500 to sustain even modest upside momentum yesterday is keeping traders on edge today, though another attempt on the upside is likely. Asian equities were mixed, with Chinese and Japanese shares lower. The...

Read More »FX Daily, December 18: Stock Rout Deepens, Casts Shadow over Holiday Spirit

Swiss Franc The Euro has risen by 0.12% at 1.1277 EUR/CHF and USD/CHF, December 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 2% slide in the S&P 500 to new lows for the year yesterday hit Asian and European equities today. Bond yields are lower, and the dollar is softer against most major currencies. The dramatic equity losses and some disappointing...

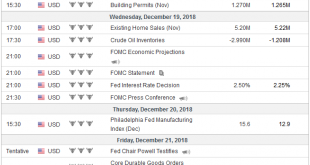

Read More »FX Weekly Preview: FOMC Dominates Week Ahead Calendar

The last FOMC meeting of 2018 is at hand. After hiking rates three times in 2017, the Fed signaled that four hikes were likely this year and with a widely expected move on December 20, it would have fully delivered, though many steps along the way, skeptical investors had to be led by the nose, as it were, to minimize the element of surprise. The famous dot plot of the Summary of Economic Projections has long shown that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org