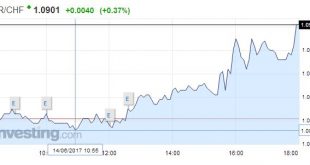

Swiss Franc The Euro has risen by 0.37% to 1.0901 CHF. This is a typical movement ahead of the SNB meeting tomorrow. This movement is probably unrelated to the Fed rate hike, given that the USD/JPY has fallen. It makes sense to go long CHF against JPY, if you bet on an inactive SNB. Inactive SNB would mean that the central bank will not speak about stronger FX Interventions or about lower rates. EUR/CHF - Euro Swiss...

Read More »FX Daily, May 12: Markets Becalmed Ahead of US data and Weekend

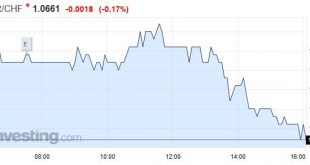

Swiss Franc EUR/CHF - Euro Swiss Franc, May 12(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc rate has broken 1.30 this week as sterling has risen and investors confidence over the outlook for politics in the Eurozone increased. The election of Emmanuel Macron has removed the uncertainty over the increase in Europe of right-wing parties which could have threatened the...

Read More »FX Daily, April 14: Holiday Markets Remain on Edge

Swiss Franc EUR/CHF - Euro Swiss Franc, April 14(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates The holiday-induced calm in the capital markets conceals a high degree of anxiety. The investment climate has been challenged by heightened geopolitical risk and unusual complaints about the US dollar’s strength from the sitting US President. While sending an “armada” toward the Korean...

Read More »U.S. CPI after the energy push

The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise...

Read More »FX Daily, January 19: Dollar Gives Back Most of Yellen-Inspired Gains

Swiss Franc EUR/CHF - Euro Swiss Franc, January 19(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF GBP/CHF has been range bound in recent weeks but anything but predictable! Of course one of the main, if not the main driver on this rollercoaster is the pound which has been much weaker and stronger according to the sentiments over the Brexit. On the whole the market is predicting the pound will be weaker...

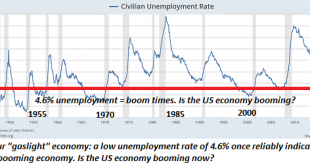

Read More »Our “Gaslight” Economy

If you don’t like what these charts are saying, please notify The Washington Post to add the St. Louis Federal Reserve to its list of Russian propaganda sites. Yesterday I described our gaslight financial system. Today we’ll look at our gaslight economy. Correspondent Jason H. alerted me to the work of author Thomas Sheridan ( Puzzling People: The Labyrinth of the Psychopath), who claims to have coined the...

Read More »End Of The Bond Bull – Better Hope Not

It’s been really busy as of late to cover all of the topics I have wanted to address. One topic, in particular, is the bond market and the ongoing concerns of a “bond bubble” due to historically low interest rates in the U.S. and, by direct consequence, historically high bond prices. Bob Bryan, via Business Insider, recently penned the following note: “Bond yields are low. Historically low. Yields on government bonds...

Read More »FX Daily, October 18: Dollar Slips Broadly but not Deeply

Swiss Franc and Sterling (Tom Holian) According to Bank of England deputy governor Ben Broadbent the drop in the value of Sterling has helped to stop the UK economy from falling further since the shock of the Brexit vote. He went on to say ‘in the shape of the referendum, we’ve had exactly one of those shocks’ and added that the Bank of England would not interfere with monetary policy to boost the Pound’s value....

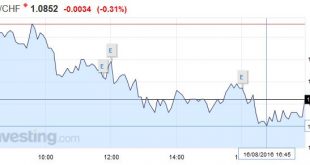

Read More »FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

Swiss Franc Click to enlarge. FX Rates The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think. However, we are a bit skeptical. It is not that the US data has been strong, or that...

Read More »Real vs. Nominal Interest Rates

Calculation Problem What is the real interest rate? It is the nominal rate minus the inflation rate. This is a problematic idea. Let’s drill deeper into what they mean by inflation. You can’t add apples and oranges, or so the old expression claims. However, economists insist that you can average the prices of apples, oranges, oil, rent, and a ski trip at St. Moritz. This is despite problems that prevent them from...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org