On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found. It’s confounding even central bankers who up...

Read More »FX Daily, November 15: Dollar Slides

Swiss Franc The Euro has fallen by 0.07% to 1.1661 CHF. EUR/CHF and USD/CHF, November 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro and yen are extending their gains, casting a pall over the US dollar. The euro is extending its advance into a sixth consecutive session, which is the longest streak since May. It is approaching last month’s highs in the...

Read More »FX Daily, October 13: Sterling Extends Yesterday’s Recovery; US Data Awaited

Swiss Franc The Euro has fallen by 0.03% to 1.1533 CHF. EUR/CHF and USD/CHF, October 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The EU’s leading negotiator whipsawed sterling yesterday. The net effect was to ease fears that the UK would leave the EU without the agreement Initial concerns that the negotiations had stalled sent sterling to nearly $1.3120. The...

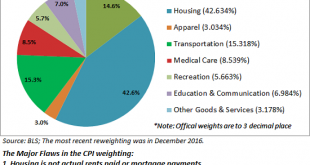

Read More »Be Careful What You Wish For: Inflation Is Much Higher Than Advertised

What the Federal Reserve is actually whining about is not low inflation–it’s that high inflation isn’t pushing wages higher like it’s supposed to. It’s not exactly a secret that real-world inflation is a lot higher than the official rates–the Consumer Price Index (CPI) and Personal Consumption Expenditures PCE). As many observers have pointed out, there are two primary flaws in the official measures of inflation: 1....

Read More »Federal Reserve President Kashkari’s Masterful Distractions

The True Believer How is it that seemingly intelligent people, of apparent sound mind and rational thought, can stray so far off the beam? How come there are certain professions that reward their practitioners for their failures? The central banking and monetary policy vocation rings the bell on both accounts. Today we offer a brief case study in this regard. Photo credit: Linda Davidson / The Washington Post -...

Read More »FX Daily, September 14: New Trump Tactics Help Greenback and Rates

In the face of much cynicism and pessimism about the outlook for the Trump Administration’s agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative...

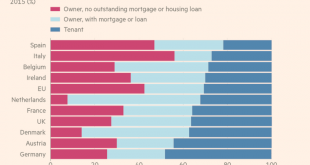

Read More »Great Graphic: Home Ownership and Measuring Inflation

Summary Home ownership varies throughout the EU but is overall near US levels. Germany has the lowest home ownership, and Spain has the most. Italy has the least amount of mortgages. US include owner equivalent rents in CPI, the EU does not. This Great Graphic was in the Financial Times recently. It shows home ownership rates several EU countries. The useful chart also shows those who own (red bar) and those...

Read More »FX Daily, August 11: Geopolitical Tensions Remain Elevated into the Weekend

Swiss Franc The euro is up by 0.19% to 1.1348 CHF EUR/CHF and USD/CHF, August 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The downward pressure on US yields, with the 10-year slipping to 2.18%, nearly a two-month low, coupled drop in equities helped underpin the Japanese yen. The dollar traded below JPY109 for the first time since the middle of June. The greenback...

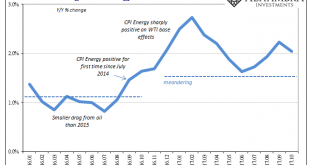

Read More »U.S. Consumer Price Index, Oil Prices: Why It Will Continue, Again Continued

Part of “reflation” was always going to be banks making more money in money. These days that is called FICC – Fixed Income, Currency, Commodities. There’s a bunch of activities included in that mix, but it’s mostly derivative trading books forming the backbone of math-as-money money. The better the revenue conditions in FICC, the more likely banks are going to want to do more of it, perhaps to the point of reversing...

Read More »FX Daily, July 14: Aussie Scales New Highs for the Year, as the Greenback Remains on the Defensive

Swiss Franc The Euro has fallen by 0.02% to 1.1031 CHF. EUR/CHF - Euro Swiss Franc , July 14(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The Australian dollar has taken over leadership in the dollar bloc from the Canadian dollar. The Aussies are up about 0.35% today to extend this week’s gains to more than 2% and reach a new high for the year a little more than $0.7760. The Canadian dollar is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org