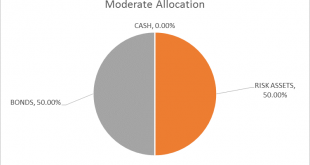

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a...

Read More »Bi-Weekly Economic Review: Waiting For Irma

This update will be a bit shorter than usual. I’m in Miami awaiting Hurricane Irma. As of now, it looks like the eye of the storm will make landfall near Key West and continue west of us with the Naples/Ft. Myers area at risk. Or at least that’s the way it looks right now. I’ve done a lot of these storms though – I lost a house in Andrew in ’92 – and you never know what these things will do. We are secure in a house...

Read More »Bi-Weekly Economic Review: Attention Shoppers

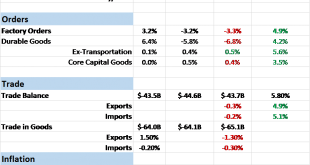

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels. Even the positive reports were clouded by negative undertones. So far though our market...

Read More »Great Graphic: Yen and Yuan Connection

The US dollar has rallied against both the Japanese yen and Chinese yuan since the end of September. Through today, the yen has fallen 9.8% and the yuan has fallen by 3.5%. What they have in common is the rise in US interest rates relative to their own. Since September 30, the US 10-year yield has from below 1.60% to above 2.40% at the end of last week. Japan’s 10-year yield has risen from minus nine basis points...

Read More »Weekly Speculative Positions: More Bearish Euros and CHF, Less Bullish the Yen

With the strong ISM non-manufacturing PMI last week, long positions on the dollar are increasing, while speculators increase their euro and Swiss Franc shorts. CHF net shorts increased to 9.4 K positions. That the euro has depreciated against CHF, is possibly caused by real, non-speculative money into CHF, i.e. money in the form of cash and stock purchases. We will get more information tomorrow when the SNB sight...

Read More »The Brexit Effect: What’s Next for Markets

To say that the Brexit vote on June 23 took financial markets by surprise would be an understatement. The pound, British stocks, and Gilt yields had all risen sharply in the week leading up to the vote, only to crash once the results started coming in. Broadly speaking, strategists on Credit Suisse’s Global Markets and Investment Solutions and Products (IS&P) teams expect markets to remain volatile in the coming days and for investors to prefer safe assets to risky ones. Below, we...

Read More »Status of 9/11 Bill and the Saudi Threat

There continues to be much discussion among investors of New York Times report last weekend in which a Saudi official threatened to sell $750 bln of US Treasuries and assets if a bill that would allow families of victims to sue the Saudi government for involvement in the 9/11 terrorist strike. The bill, formally known as the Justice Against Sponsors of Terrorism Act, enjoys bipartisan support. The bill is cosponsored by two Republicans but is also supported, for example, by the two...

Read More »Government bond yields by country and maturity

We provide a quick starter with links to Bloomberg and Investing.com to find out bond yields and bond future price for the most important government bonds. Read also: Is the Safe-Haven Government Bond Bubble finally Bursting? What Drives Government Bond Yields? See more for Government Bonds

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org