It’s official, I’m calling a banking crisis in Europe. Things didn’t go well the last time I did this. Of course, many will say, “But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks are close to going bust, right?!!!”. Yeah, right! Reference our past research note on so-called trusted parties in private blockchains for banks. Those interested in purchasing the 22 page report on what is likely the first major bank to fall...

Read More »Panama Tax Haven Scandal: The Bigger Picture

A Huge Leak The “Panama Papers” tax haven leak is big … After all, the Prime Minister of Iceland resigned over the leak, and investigations are taking place worldwide over the leak. But Why Is It Mainly Focusing On Enemies of the West? But the Panama Papers reporting mainly focuses on friends of Russia’s Putin, Assad’s Syria and others disfavored by the West. Former British Ambassador Craig Murray notes: Whoever leaked the Mossack Fonseca papers appears...

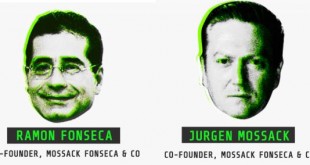

Read More »“The Cat Is Out Of The Bag” – In Interview Mossack Fonseca Founders Admit It’s Over… To Rothschild’s Delight

Days before the ICIJ released this weekend's trove of "Panama Papers" international tax haven data involving Panamaian law firm Mossack Fonseca, Bloomberg conducted an interview on March 29 with the two founding lawyers. In it, it found that even before the full leak was about to be made semi-public (any of the at least 441 US clients are still to be disclosed), the Panama law firm knew that the game was already largely over. As Bloomberg reports, "during a four-hour interview last week,...

Read More »With Wall Street Bitten by the Blockchain Bug, How Do We Admit the Truth About the Technology’s Disruptive Potential?

I attended a panel discussion on private blockchains in banking at UBS in NYC last night. There were two overarching misconceptions that appeared to permeate the discussions: Counterparties can be trusted, hence you can build reliable systems with trusted parties, and; Capital markets are, and always will be predicated upon the legacy, highly centralized hub and spoke model that we know today. Basically, the influential gatekeepers that control access to a centralized, authoritative...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org