Submitted by Judith Bergmann via The Gatestone Institute, Swiss authorities are currently investigating 480 suspected jihadists in the country. "Radical imams always preached in the An-Nur Mosque... Those responsible are fanatics. It is no coincidence that so many young people from Winterthur wanted to do jihad." — Saïda Keller-Messahli, president of Forum for a Progressive Islam. Switzerland is the answer to those who claim that Islamic terrorism is reserved for those...

Read More »European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

Submitted by Ronan Manly, BullionStar.com The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB...

Read More »Central Bank Austria Claims To Have Audited Gold at BOE. Refuses To Release Audit Report

Submitted by Koos Jansen from BullionStar.com After years of gradually securing its official gold reserves (unwinding leases) the central bank of Austria claims to have completed the audits of its 224 tonnes of gold stored at the BOE. However, it refuses to publish the audit reports and the gold bar list. What could possibly be so sensitive to hide from public eyes? After the Germans had activated a program to...

Read More »Pawn Shops, Information Insensitivity, and Debt-on-Debt

In a BIS working paper (January 2015), Bengt Holmstrom summarizes some of the implications of the research on information insensitive debt. He cautions against moves to increase transparency in debt markets and defends the shadow banking system. He explains why opacity and information insensitivity are valuable and argues that debt-on-debt arrangements are (privately) optimal. It all started with pawn shops: The beauty lies in the fact that collateralised lending obviates the need to...

Read More »Secret Swiss Military Bunkers Filled With Gold: Alternatives To Bank Deposits

For decades, Switzerland had a reputation for bank secrecy that made it the most sought after tax haven for billionaires from around the globe. But, after more than 80 years of secrecy, a series of bilateral agreements with countries around the world, including America’s Foreign Account Tax Compliance Act (FATCA), have forced the private-banking industry in Switzerland to embrace an entirely new era of transparency...

Read More »“The IMF and the Crises in Greece, Ireland, and Portugal”

The Independent Evaluation Office of the International Monetary Fund released a critical report on IMF supported policies in Greece, Ireland and Portugal. It questions the legitimacy of certain decisions. The executive summary states that [t]he IMF’s pre-crisis surveillance mostly identified the right issues but did not foresee the magnitude of the risks … missed the build-up of banking system risks … shared the widely-held “Europe is different” mindset … Following the onset of the...

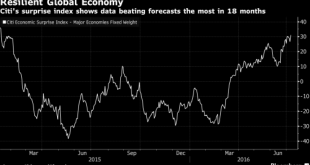

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

Read More »FATCA in Reverse?

The Greens/EFA group in the European Parliament wants the European Union to exert more pressure on the United States: the US should no longer serve as a “tax haven” for European tax dodgers. Proposed measures include blacklisting and a FATCA-type 30% withholding tax on EU-sourced payments. From the executive summary of the report commissioned by the group: Two global transparency initiatives are underway that could help tackle financial crimes including tax evasion, money laundering and...

Read More »Treasury Introduces New Rules To Stop Tax Evasion, Kind Of

In the wake of the Panama Papers being released, the U.S.Treasury announced that it will use existing powers in order to make two rule changes that are intended to stop tax evasion. First, in a rule which amends the US Bank Secrecy Act, the Treasury said it will require financial institutions to verify the identity of the real people, or “beneficial owners”, who control companies opening accounts with them. The aim is to prevent true owners of the account from being masked by the names...

Read More »ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It’s official, I’m calling a banking crisis in Europe. Things didn’t go well the last time I did this. Of course, many will say, “But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks are close to going bust, right?!!!”. Yeah, right! Reference our past research note on so-called trusted parties in private blockchains for banks. Those interested in purchasing the 22 page report on what is likely the first major bank to fall...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org