This Great Graphic from Bloomberg shows the net large speculative positioning in the 10-year note futures over the past five years. They began last year with a huge next short position of more than 400k contracts. By May-June, the speculators had reversed themselves and were net long over 350k contracts. In the middle of December 2017, the net position was short again and peaked in early February near 327.5k contracts....

Read More »FX Daily, February 26: Dollar Slides as Equities Extend Recovery

Swiss Franc The Euro has risen by 0.14% to 1.1529 CHF. EUR/CHF and USD/CHF, February 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has begun the new week on heavy footing. It is being sold against virtually all the currencies, major and emerging market currencies. There is one exception, and although the local market is not open, the Mexican peso is...

Read More »FX Daily, February 23: Dollar Firms; VIX Set to Close Lower for Second Week

Swiss Franc The Euro has risen by 0.20% to 1.152 CHF. EUR/CHF and USD/CHF, February 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates A light economic schedule in North America may help the markets close the week on a quiet note. Perhaps if there is one number that captures this sense, it may be the VIX. It is soft and barring a new disruption today, it is poised to...

Read More »FX Daily, February 22: All Eyes on Equities

Swiss Franc The Euro has fallen by 0.13% to 1.1515 CHF. EUR/CHF and USD/CHF, February 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dramatic reversal of US shares yesterday in the last hour of trading has once again pulled the proverbial rug beneath the feet of investors. The turn down, moreover, occurred near important technical levels, seemingly adding to the...

Read More »FX Daily, February 21: Markets Mark Time

Swiss Franc The Euro has fallen by 0.02% to 1.1544 CHF. EUR/CHF and USD/CHF, February 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The economic data stream is picking up, but there is an uneasy calm in the markets. It is almost as if the dramatic drop in stocks has left many with a sense of incompleteness, like waiting for another shoe to drop. The price action has...

Read More »Cool Video: Bloomberg Interview-Rates, Dollar, and Equites

- Click to enlarge In large gatherings of people, from airplanes to theater to conferences, we are often told to know the closest exit. The same is true for investing. No matter one’s confidence when they buy a security, someone is just as convinced on the other side who is selling the security. Well into this 4.5-minute interview (click here for the link) on Bloomberg’s “What’d You Miss” show, Lisa Abramowicz...

Read More »FX Daily, February 20: Dollar Trades Higher, but Stocks Challenged at Key Chart Point

Swiss Franc The Euro has risen by 0.13% to 1.154 CHF. EUR/CHF and USD/CHF, February 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar is finding better traction today, building on the upside reversal seen before the weekend. The news stream has been light and it seems like primarily an issue of positioning rather than a change in sentiment or the consensus...

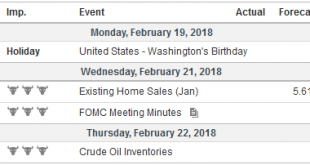

Read More »FX Weekly Preview: Four Key Numbers in the Week Ahead

The US markets are closed on Monday, and many parts of Asia will continue to celebrate the Lunar New Year. The economic schedule is fairly light, and market psychology appears fragile after the dramatic activity in equities and what appears to be shifting macro-relationships. To help navigate the challenging investment climate, we identify four “numbers” that can illuminate the path ahead. The equity market is center...

Read More »FX Daily, February 16: Worst Week for the Dollar since 2015-2016, While Stocks Continue to Recover

Swiss Franc The Euro has fallen by 0.13% to 1.1513 CHF. EUR/CHF and USD/CHF, February 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Nearly all the major currencies have risen at least two percent against the US dollar this week. The Canadian dollar is an exception. It has risen one percent this week ahead of today’s local session. Sterling is becoming another...

Read More »Great Graphic: Bears Very Short US 10-Year Ahead of CPI

Summary: Speculators have a large net short 10-year Treasury position. The gross short position is a record. CPI is likely to be softer, while retail sales may show a still robust consumer. The US reports January CPI figures tomorrow. The market seems especially sensitive to it. The main narrative is that it is an inflation scare spurred by the jump in January average hourly earnings that pushed yields higher...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org