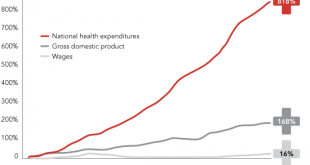

Welcome to debt-serfdom, the only possible output of the soaring cost of living. Long-time readers may recall the Burrito Index, my real-world measure of inflation. The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016). The Burrito Index tracks the cost of a regular burrito since 2001. Since we keep detailed records of expenses (a necessity if you’re a self-employed free-lance writer), I can...

Read More »How Systems Collapse

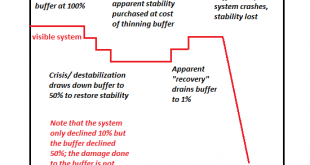

This is how systems collapse: faith in the visible surface of abundance reigns supreme, and the fragility of the buffers goes unnoticed. I often discuss systems and systemic collapse, and I’ve drawn up a little diagram to illustrate a key dynamic in systemic collapse. The key concepts here are stability and buffers. Though complex systems are never static, but they can be stable: that is, they ebb and flow within...

Read More »America 2018: Dicier by the Day

Scrape all this putrid excrescence off and we’re left with a non-fantasy reality: everything is getting dicier by the day. If we look beneath the cheery chatter of the financial media and the tiresomely repetitive Russian collusion narrative (that’s unraveling as the Ministry of Propaganda’s machinations are exposed), we find that America in 2018 is dicier by the day. The more you know about the actual functioning of...

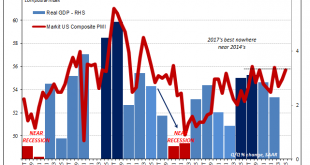

Read More »The Currency of PMI’s

Markit Economics released the flash results from several of its key surveys. Included is manufacturing in Japan (lower), as well as composites (manufacturing plus services) for the United States and Europe. Within the EU, Markit offers details for France and Germany. Given the nature of sentiment surveys, we tend to ignore these most months unless they suggest either pending changes or extremes. Beginning with the US,...

Read More »Globally Synchronized Asynchronous Growth

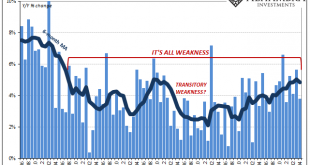

Industrial Production in the United States rose 3.5% year-over-year in April 2018, down slightly from a revised 3.7% rise in March. US Industrial Production, Jan 2006 - May 2018(see more posts on U.S. Industrial Production, ) - Click to enlarge Since accelerating to 3.4% growth back in November 2017, US industry has failed to experience much beyond that clear hurricane-related boost. IP for prior months,...

Read More »Tax Cuts And (Less) Spending

After being rumored and talked about for over a year, at the end of last year the tax cuts were finally delivered. The idea had captured much market attention during that often anxious period of political flirtation. Prices would rise or fall by turn based on whether or not it seemed a realistic possibility. Public Law #115-97 or An Act to provide for reconciliation pursuant to titles II and V of the concurrent...

Read More »Watching Imports

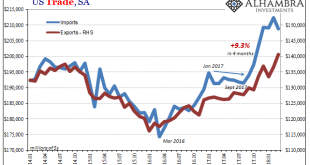

The US trade deficit, a sensitive political topic these days, declined sharply in March. It had expanded significantly (more deficit) in January and February, reaching nearly -$76 billion (seasonally adjusted) in the latter month, before posting -$68 billion in the latest figures. Exports rose while imports fell in March, making for the largest single month change in the trade condition in many years. That may mean...

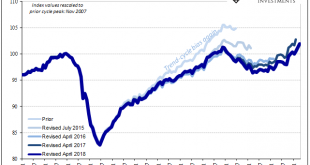

Read More »Why The Last One Still Matters (IP Revisions)

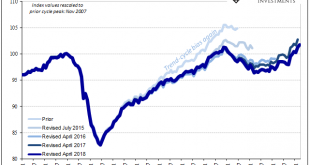

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of...

Read More »The Retail Sales Shortage

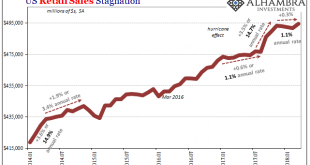

Retail sales rose (seasonally adjusted) in March 2018 for the first time in four months. Related to last year’s big hurricanes and the distortions they produced, retail sales had surged in the three months following their immediate aftermath and now appear to be mean reverting toward what looks like the same weak pre-storm baseline. Exactly how far (or fast) won’t be known until subsequent months. US Retail Sales, Jan...

Read More »US Stock Market: Happy Days Are Here Again? Not so Fast…

A “Typical” Correction? A Narrative Fail May Be in Store Obviously, assorted crash analogs have by now gone out of the window – we already noted that the market was late if it was to continue to mimic them, as the decline would have had to accelerate in the last week of March to remain in compliance with the “official time table”. Of course crashes are always very low probability events – but there are occasions when...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org