This systemic vulnerability is largely invisible, and so the inevitable contagion will surprise most observers and participants. The conventional definition of a Bear is someone who expects stocks to decline. For those of us who are bearish on fake fixes, that definition doesn’t apply: we aren’t making guesses about future market gyrations (rip-your-face-off rallies, dizziness-inducing drops, boring melt-ups, etc.),...

Read More »America Needs a New National Strategy

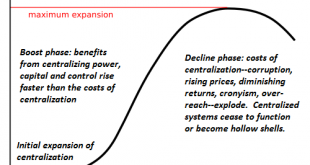

A productive national Strategy would systemically decentralize power and capital rather than concentrate both in the hands of a self-serving elite. If you ask America’s well-paid punditry to define America’s National Strategy, you’ll most likely get the UNESCO version: America’s national strategy is to support a Liberal Global Order (LGO) of global cooperation on the environment, trade, etc. and the encouragement of...

Read More »Monthly Macro Monitor – November 2018

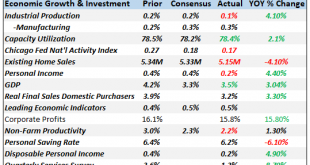

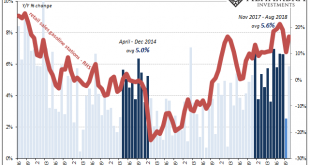

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral. Clarida last week said the FF rate was close to neutral and that future hikes should be “data...

Read More »The Direction Is (Globally) Clear

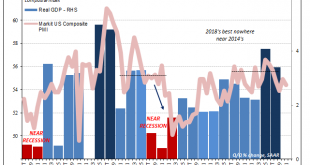

It is definitely one period that they got wrong. Still, IHS Markit’s Composite PMI for the US economy has been one of the better forward-looking indicators around. Tying to real GDP, this blend of manufacturing and services sentiment has predicted the general economic trend in the United States pretty closely. The latter half of 2015 was the big exception. For November 2015, the composite index jumped to 56.1 from 55.0...

Read More »Does the Market Need a Heimlich Maneuver?

For all we know, the panic selling is Wall Street’s way of forcing the Fed’s hand: stop with the rates increases already or Mr. Market expires. Markets everywhere are gagging on something: they’re sagging, crashing, imploding, blowing up, dropping and generally exhibiting signs of distress. Does the market need a Heimlich Maneuver? Is there some way to expel whatever’s choking the market? So what’s choking the market?...

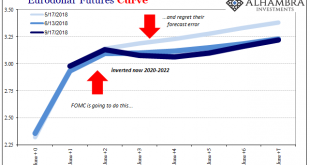

Read More »Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

For Janet Yellen, during her somewhat brief single term she never made the same kind of effort as Ben Bernanke had. Her immediate predecessor, Bernanke, wanted to make the Federal Reserve into what he saw as the 21st century central bank icon. Monetary policy wouldn’t operate on the basis of secrecy and ambiguity. Transparency became far more than a buzzword. Way back in 2012, under Bernanke’s direction officials would...

Read More »Does Any of This Make Sense?

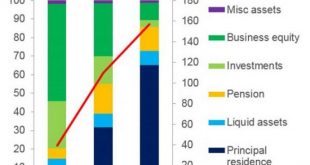

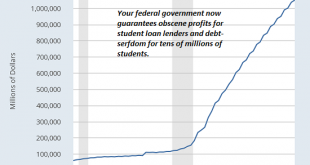

Does any of this make sense? No. But it’s so darn profitable to the oligarchy, it’s difficult to escape debt-serfdom and tax-donkey servitude. We rarely ask “does this make any sense?” of things that are widely accepted as beneficial – or if not beneficial, “the way it is,” i.e. it can’t be changed by non-elite (i.e. the bottom 99.5%) efforts. Of the vast array of things that don’t make sense, let’s start with borrowing...

Read More »Retail Sales Marked By Revisions

Retail sales rebounded 0.8% in October 2018 from September 2018, but it’s the downward revisions to the prior months that are cause for attention. The estimates for particularly September were moved sharply lower. Total retail sales two months ago had been figured last month at $485.8 billion (unadjusted) originally, but are now believed to have been just $483.0 billion. The difference takes the growth rate underneath...

Read More »The Implicit Desperation of China’s “Social Credit” System

Other governments are keenly interested in following China’s lead. I’ve been pondering the excellent 1964 history of the Southern Song Dynasty’s capital of Hangzhou, Daily Life in China on the Eve of the Mongol Invasion, 1250-1276 by Jacques Gernet, in light of the Chinese government’s unprecedented “Social Credit Score” system, which I addressed in Kafka’s Nightmare Emerges: China’s “Social Credit Score”. The scope of...

Read More »Understanding the Global Recession of 2019

Isn’t it obvious that repeating the policies of 2009 won’t be enough to save the system from a long-delayed reset? 2019 is shaping up to be the year in which all the policies that worked in the past will no longer work. As we all know, the Global Financial Meltdown / recession of 2008-09 was halted by the coordinated policies of the major central banks, which lowered interest rates to near-zero, bought trillions of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org