Many attribute the saying “a rising tide lifts all boats” to President John Kennedy. He may have been the man who brought it into the mainstream but as his former speechwriter Ted Sorenson long ago admitted it didn’t originate from his or the President’s imagination. Instead, according to Sorenson, it was a phrase borrowed from the New England Chamber of Commerce or some such. Before implying the benefits of broad economic growth, as Kennedy would use it, the cliché was almost common in use among Northeastern spiritualists. Its practice has perhaps stuck in the common American lexicon because of the simplicity of its implications. Good things in society generally benefit everyone if left alone long enough. It’s not

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, 80%, currencies, economy, Featured, Federal Reserve/Monetary Policy, Labor market, Markets, newsletter, participation problem, The United States, unemployment rate, wages, workers

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Many attribute the saying “a rising tide lifts all boats” to President John Kennedy. He may have been the man who brought it into the mainstream but as his former speechwriter Ted Sorenson long ago admitted it didn’t originate from his or the President’s imagination. Instead, according to Sorenson, it was a phrase borrowed from the New England Chamber of Commerce or some such.

Before implying the benefits of broad economic growth, as Kennedy would use it, the cliché was almost common in use among Northeastern spiritualists. Its practice has perhaps stuck in the common American lexicon because of the simplicity of its implications. Good things in society generally benefit everyone if left alone long enough.

It’s not always so easy to see. In any economy, there will always be variability. Even under the most robust, gangbuster condition there will be those who aren’t keeping up. That proportion left out will inevitably be better off, but that’s not the comparison most people make on an intuitive level.

Nor should it be the full measure of legitimate economic growth. If the economy is the rising tide, how far it rises matters given how many boats are lifted in its ebbs and flows. In other words, if there are too many people outside the class doing well then its not growth at all. Defining “too many” isn’t an exact science, but the rise of populism and general distrust of institutions suggests there is something going on here.

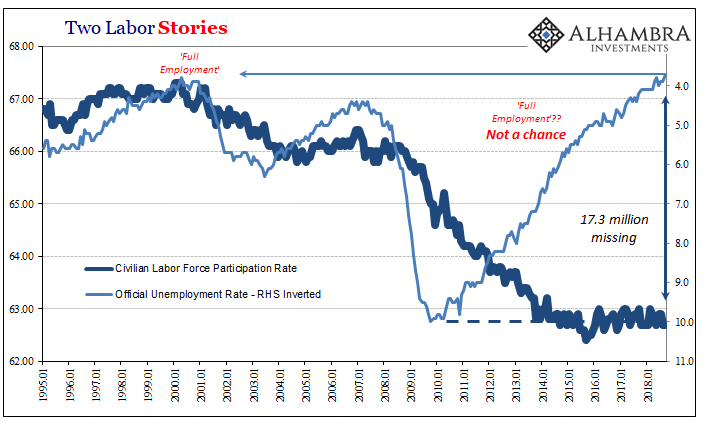

In general, that’s why we have economic statistics to try and measure when this happens. In the past, these were uncontroversial. There was still poor and unemployed Americans during the late nineties, but there weren’t very many at least when compared to other points in economic history. The unemployment rate, as one major statistic, seemed quite able to capture common perception.

This stands in stark contrast to the last decade. The unemployment rate falls and then falls again. Many have claimed based on this one number alone that the tide must be absolutely swimming on in, a boom we haven’t seen in a very long time.

| But the unemployment rate is itself uniquely susceptible to just this problem. It only counts the part of the economy that is “alive”, and in its modern definition it quite purposefully leaves out that which isn’t. The main assumption by which all this turns is the definition of “voluntary.” Those who are outside the labor force by their own choice.

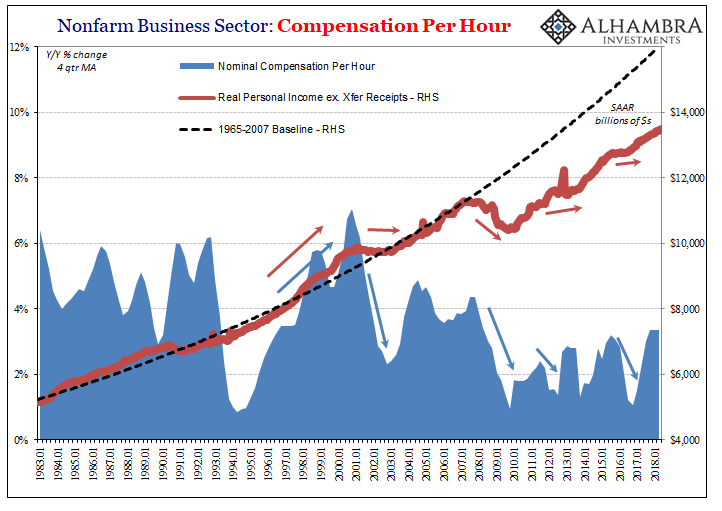

The participation problem isn’t something new, and it has been debated over and over the last ten years as it confounds especially central bankers desperately seeking vindication after year upon year of constant, excruciating failure. In the US, Federal Reserve officials like Jay Powell would love nothing more than to point to an unambiguously strong economy if for no other reason than to shortcut around their own fundamental incompetence. And yet, the unemployment rate remains uncorroborated especially by all the wage and income data. Quite the contrary, the income figures in particular tell us a very different story especially since the last downturn three years ago. The labor market slowed rather than accelerated. |

Payrolls LF Participation, Jan 1995 - 2018 |

| If the economy were a single factory spanning five assembly lines, one of them was shutdown, and the workers on it laid off, in 2008. There was every intention to restart the line after the recession and hire most if not all the workers back, but over time there wasn’t enough business (recovery) to justify the risk (especially ongoing liquidity risk). The capacity remains available, the workers, too, but the facility now running just four is characterized at 100% usage anyway simply because so much time has passed since it used all five.

All those workers just dropped out of the statistics showing capacity and growth, employment and labor force. The unemployment rate only applies to the workers working the four lines still running, unable to tell you about how the factory’s business actually shrunk on a permanent basis. It’s as if #5 just vanished in number though it’s still there in fact and nobody wishes to talk about this enormous discrepancy. |

|

| The 80% that’s left is booming, and perhaps that’s true, but it still doesn’t mean there is a general boom for the whole system – potential and all. You cannot just ignore the other 20%, but it sure has been convenient.

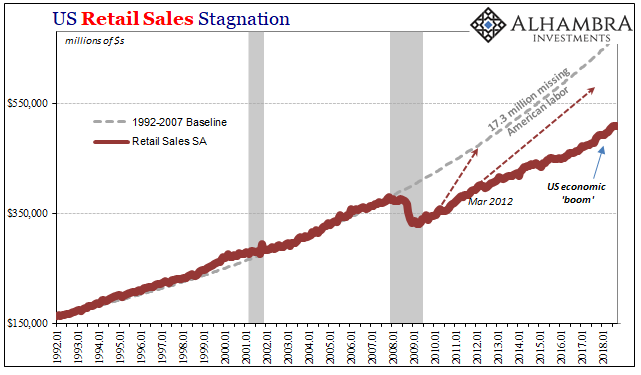

The economic problem, however, doesn’t remain one just for that unlucky fifth; it actually extends into a good deal of those who are still working. You might be happy you have continued to be gainfully employed on one of the four assembly lines left, but quite nervous seeing and being reminded everyday that the other continues to be idled without the slightest chance of being restarted. There is palpable nervousness for those times where 80% = 100% offers no confidence, such as when business for the factory may start to soften. The limited tide raises some of the boats, and a more limited tide leaves another segment of the workforce wholly exposed. And workers know it, maybe to the point they refuse to sell their houses or spend more of their incomes. |

US Retail Sales SA, Jan 1992 - 2018(see more posts on U.S. Retail Sales, ) |

| Even though you are in the 80%, you aren’t very confident about the boom regardless. This has been, contrary to all mainstream assessments, the case over the last three almost four years. The labor market in the US, as many other places around the world, has slowed. Despite the often-heated rhetoric about this boom, assuming there is one (a big assumption) it can only have been extremely limited at best.

To wit (thanks M. Simmons):

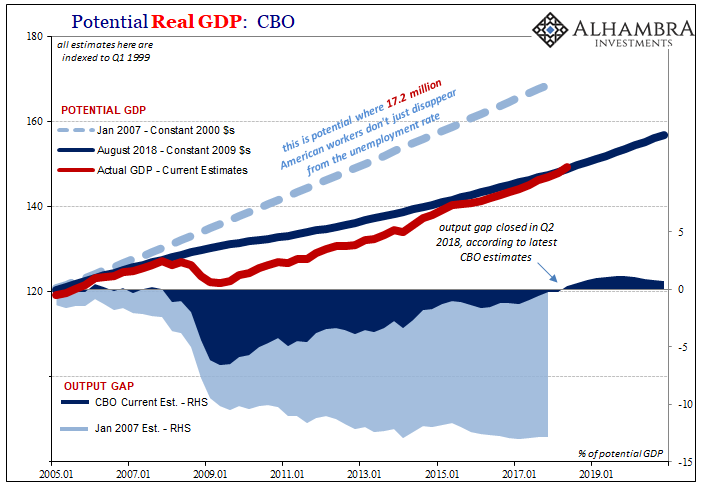

The unemployment rate does not, for the first time, accurately capture those who are on the outside. By its very construction, it cannot reflect the enlarged parts of the economy left out from growth – because it is not actually growth. GDP may be positive, but it’s not positive enough or consistent enough. A quarter or two every four years at 4% is an indictment, not cause for celebration. It does nothing, obviously, for those in the 20%, but it also does not reassure the nervous workers in the 80%, either. They can sense the vulnerability left for them by the shrunken economy they see all-too-well that the single number cannot. |

US Real GDP, Jan 2005 - Oct 2018 |

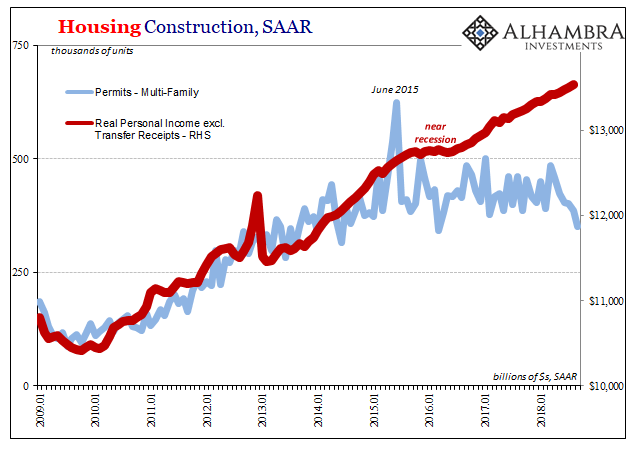

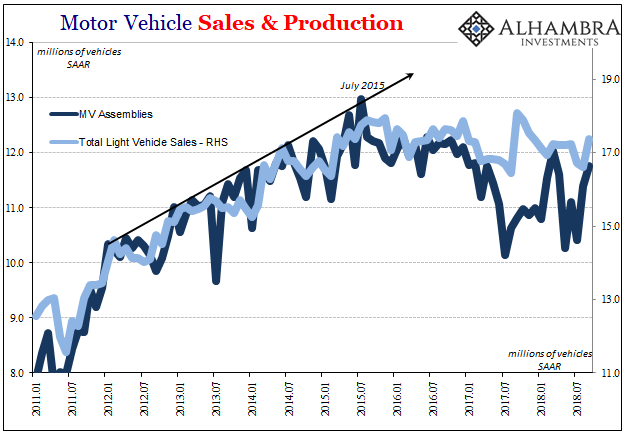

| In non-linear terms, which is what matters, the economy falls further and further behind. We see this in so many places and in a lot of data outside the unemployment rate. As noted earlier today, why aren’t there more apartments being constructed? Or cars being produced and sold? There would be if the boom was anything other than imagined. |

Housing Permits Multi Real Personal Income, Jan 2009 - Oct 2018 |

Motor Vehicle Sales and Production, Jan 2011 - Oct 2018 |

|

| Kennedy’s maritime analogy fails here on every level. There is just no such thing as a partial tide lifting some of the boats, leaving far too many grounded on the inexplicably exposed dry beach. That’s what we find, however, especially the last two and three years.

Too many people are failing to see benefits of this boom because the economy isn’t booming. It isn’t even really growing (non-linear). If it was, those 20% on the outside would be lined up and ready to go for the restart of #5. They’ve given up on the idea, and aren’t even contemplating the possibility because unlike Economists, central bankers, and politicians they and the exposed workers in the 80% know after eleven years there’s no chance. It’s a very different world. |

Nonfarm Business Sector: Compensation Per Hour, Jan 1983 - 2018 |

Tags: 80%,currencies,economy,Featured,Federal Reserve/Monetary Policy,Labor Market,Markets,newsletter,participation problem,unemployment rate,wages,workers