Overview: The market sentiment remains fragile. Equities are mostly lower. Japan was a notable exception, and concerns about China's economy after a sharp decline in imports took mainland and Hong Kong listed companies sharply lower. Europe's Stoxx 600 is giving back yesterday's 0.35% gain plus more. Bank shares are off 0.65% after rallying 4.20% over the past two sessions. US equity futures are heavier. Benchmark 10-year yields are mostly a couple basis points...

Read More »Bank Stress Hobbles the Dollar, while Dissents Make the 50 bp Hike by Sweden less than Hawkish

Overview: The re-emergence of bank stress reverberated through the US markets yesterday, downgrading the perceived chances of a Fed hike next week and sending the US 2-year yield sharply lower. The yield settled 13 bp lower, the largest drop in three weeks. The risk-off sent the US dollar higher against most of the major and emerging market currencies. Follow-through US dollar gains today has been mostly limited to the Australian dollar, where after today's CPI...

Read More »Swiss Central Bank Payment Vision Outlining Focus on DLT, Tokenization and Instant Payments

The Swiss National Bank (SNB) has shared how it intends to “future-proof” the domestic payment ecosystem, outlining its ambition to leverage technologies and processes including tokenization and distributed ledger technology (DLT) to establish an “efficient, reliable and secure ecosystem” that’s geared towards “the future of cashless payments in Switzerland,” SNB governing board member, Andréa Maechler, said during an event on March 30, 2023. The payment system is...

Read More »Credit Suisse and the War Against Swiss Culture

I hope you will enjoy my latest interview with Maneco64. [embedded content] Claudio Grass, Hünenberg See, Switzerland This work is licensed under a Creative Commons Attribution 4.0 International License. Therefore please feel free to share and you can subscribe for my articles by clicking here

Read More »Firmer Rates and Higher Bank Stocks Give the Greenback Little Help

Overview: Financial strains eased yesterday, and short-term yields jumped. The two-year US yield jumped 25 bp to pierce 4%. Yet, the dollar fell against most of the major currencies yesterday and is mostly softer today. Banking stress is ebbing. The Topix bank index snapped a three-day decline and jumped nearly 2% today to recoup the lion's share of its three-day decline. The Stoxx 600 index of EMU banks is extending yesterday's 1,7% advance. The AT1 ETF up about...

Read More »“Finanzplatz steuert auf eine Verstaatlichung der UBS zu (Switzerland on its Way to Nationalizing UBS),” NZZ, 2023

Neue Zürcher Zeitung, March 22, 2023. PDF. How to respond? Nationalization now rather than later? Breaking UBS up? Placing government representatives on the supervisory board? Illiquidity crises and the lender of last resort. Vollgeld, higher reserve requirements, and CBDC as partial solutions to TBTF problems.

Read More »Yields Pull Back to Start the New Week

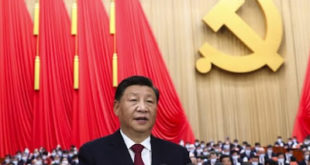

Overview: The modest economic goals announced as China's National People's Congress starts was seen as a cautionary sign after growth disappointed last year. It seemed to weigh on Chinese stocks, though others large bourses in the region advanced, led by Japan's Nikkei and South Korea with gains of more than 1%. Europe's Stoxx 600 is little changed after rising for the past two sessions. US index futures are slightly softer. Strong gains were seen before the...

Read More »Markets Catch Collective Breath

Overview: On the heels of a dramatic jump in US job creation and firmer than expected year-over-year CPI, the US reported a larger than expected jump in retail sales and a strong recovery in manufacturing output. Few think that economic momentum that the recent data implies can be repeated, the "no landing" camp has gained adherents. We suspect that says more about psychology than the economy. The US two-year note is threatening to snap a five-day 20 bp advance...

Read More »Poor US Data Cast Doubts on New Found Hopes of a Soft-Landing

Overview: Yesterday's string of dismal US economic data delivered a material blow to those still thinking that a soft-landing was possible. Retail sales by the most in the a year. Manufacturing output fell by nearly 2.5% in the last two months of 2022. Bad economic news weighed on US stocks. The honeymoon of New Year may have ended yesterday. The US 10-year yield fell below 3.40% for the first time since the middle of last September. The Atlanta Fed's GDPNow...

Read More »Gold is money – everything else is credit!

What physical precious metals investors can expect 2023 and beyond Throughout the better part of 2022 there has been one question that has consistently, and predictably, popped up in conversations with my friends, clients and readers. Those who know me and are familiar with my ideas are well aware of my position on precious metals and the multiple roles they serve, so I can’t blame them for them for being curious whether I still “stick to my guns” in this...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org