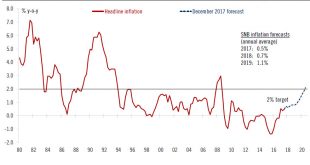

At its December meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. More specifically, the SNB maintained the target range for the three-month Libor at between – 1.25% and-0.25% and the interest rate on sight deposits at a record low of – 0.75%. The SNB also reiterated its commitment to intervene in the foreign exchange market if needed, taking into account the “overall currency...

Read More »Increasingly optimistic on Swiss outlook

The SNB left its monetary policy unchanged, and sees the Swiss franc as highly valued. However, we expect a first rate hike to open in Q4 2018.At its December meeting, the SNB left its accommodative monetary policy unchanged. The interest rate on sight deposits was maintained at a record low of -0.75% and the SNB reiterated its willingness to intervene in the foreign exchange market if needed.The SNB’s monetary policy assessment reflected an improvement in the outlook since its September...

Read More »The SNB still in wait-and-see mode

The SNB is unlikely to pre-empt the ECB in normalising monetary policy. We are keeping our baseline scenario unchanged and expect the interest on sight deposit to stay at -0.75%.The SNB’s 14 September meeting could be one of the most interesting in a while, as it comes just after a period when the Swiss franc has witnessed significant depreciation, mainly against the euro.The key focus of the SNB’s September 14 meeting will be its assessment of exchange rate moves. We do not expect the SNB...

Read More »Swiss National Bank in wait-and-see mode

The SNB is unlikely to pre-empt the European Central Bank in hiking rates. Currency intervention will remain the SNB’s policy tool of choice in the case of renewed strengthening of the Swiss franc.At its June meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. The interest rate on sight deposits was maintained at a record low of -0.75% and the SNB reiterated its willingness to intervene in the foreign exchange market if needed. Our baseline scenario...

Read More »Swiss National Bank─Reactive rather than proactive

Macroview No change in base rates, but currency intervention on the cards as franc continues to strengthen Read full report hereThe Swiss National Bank (SNB) decided to leave its monetary policy unchanged at its quarterly meeting on 16 June. The main messages were unchanged from its March meeting. The target range for the three-month Libor was kept between -1.25% and -0.25%; the interest rate on sight deposits with the SNB was maintained at a record low of -0.75% and the SNB reiterated its...

Read More »Swiss monetary policy and the central bank’s options with regards to the CHF

At its quarterly policy assessment, the Swiss National Bank (SNB) decided to leave its monetary policy unchanged. The SNB could afford not to cut its reference rate after last week’s ECB stimulus failed to have much impact on the Swiss franc versus the euro. The target range for the 3-month Libor was kept between -1.25% and -0.25%; the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%; and the SNB reiterated its willingness to intervene on the foreign...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org